Kestra Private Wealth Services LLC acquired a new stake in Li Auto Inc. Sponsored ADR (NASDAQ:LI - Free Report) in the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund acquired 8,949 shares of the company's stock, valued at approximately $226,000.

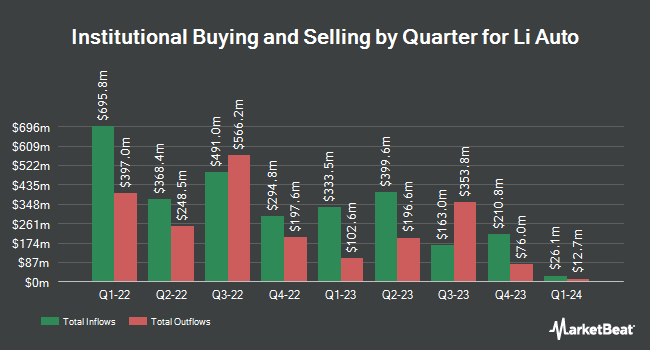

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in LI. Mirae Asset Global Investments Co. Ltd. increased its stake in shares of Li Auto by 459.3% during the first quarter. Mirae Asset Global Investments Co. Ltd. now owns 16,923,620 shares of the company's stock worth $426,475,000 after purchasing an additional 13,897,555 shares in the last quarter. LMR Partners LLP purchased a new stake in shares of Li Auto during the fourth quarter worth about $16,266,000. OLD Mission Capital LLC purchased a new stake in shares of Li Auto during the fourth quarter worth about $14,704,000. Myriad Asset Management US LP purchased a new stake in Li Auto during the 1st quarter valued at about $9,913,000. Finally, OCONNOR A Distinct Business Unit of UBS ASSET MANAGEMENT AMERICAS LLC purchased a new stake in Li Auto during the 4th quarter valued at about $8,923,000. Hedge funds and other institutional investors own 9.88% of the company's stock.

Analyst Ratings Changes

Separately, Cfra Research upgraded shares of Li Auto from a "strong sell" rating to a "hold" rating in a report on Tuesday, June 10th. Five analysts have rated the stock with a hold rating and three have issued a buy rating to the stock. According to MarketBeat.com, the stock currently has an average rating of "Hold" and a consensus price target of $32.85.

Read Our Latest Stock Analysis on LI

Li Auto Stock Performance

Shares of LI stock traded down $0.91 during mid-day trading on Friday, hitting $25.19. The stock had a trading volume of 2,688,826 shares, compared to its average volume of 5,467,656. Li Auto Inc. Sponsored ADR has a fifty-two week low of $17.44 and a fifty-two week high of $33.12. The firm has a market cap of $26.38 billion, a PE ratio of 24.03, a PEG ratio of 1.11 and a beta of 0.95. The company has a debt-to-equity ratio of 0.12, a current ratio of 1.87 and a quick ratio of 1.72. The company's 50-day simple moving average is $28.28 and its 200-day simple moving average is $26.46.

Li Auto (NASDAQ:LI - Get Free Report) last announced its quarterly earnings data on Thursday, May 29th. The company reported $0.08 EPS for the quarter, missing the consensus estimate of $0.09 by ($0.01). Li Auto had a net margin of 5.60% and a return on equity of 11.83%. The company had revenue of $3.53 billion during the quarter, compared to analyst estimates of $3.45 billion. During the same quarter last year, the business earned $1.21 EPS. The firm's revenue for the quarter was up 1.1% on a year-over-year basis. Sell-side analysts anticipate that Li Auto Inc. Sponsored ADR will post 0.96 earnings per share for the current year.

About Li Auto

(

Free Report)

Li Auto Inc operates in the energy vehicle market in the People's Republic of China. It designs, develops, manufactures, and sells premium smart electric vehicles. The company's product line comprises MPVs and sport utility vehicles. It offers sales and after sales management, and technology development and corporate management services, as well as purchases manufacturing equipment.

Featured Stories

Before you consider Li Auto, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Li Auto wasn't on the list.

While Li Auto currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.