Astoria Portfolio Advisors LLC. bought a new position in GE Aerospace (NYSE:GE - Free Report) during the second quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor bought 928 shares of the company's stock, valued at approximately $249,000.

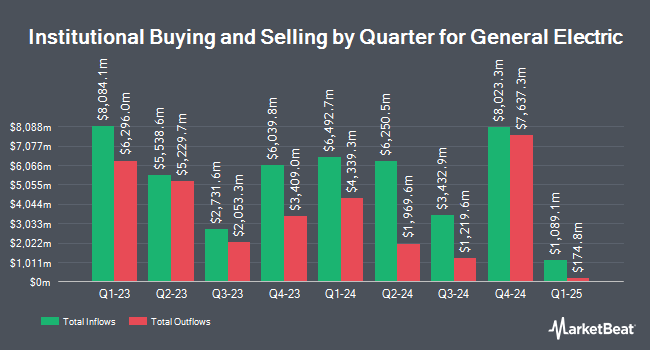

A number of other institutional investors and hedge funds also recently made changes to their positions in the business. Concord Asset Management LLC VA acquired a new stake in shares of GE Aerospace in the 2nd quarter worth about $217,000. Sequoia Financial Advisors LLC raised its holdings in shares of GE Aerospace by 3.7% in the 2nd quarter. Sequoia Financial Advisors LLC now owns 76,260 shares of the company's stock worth $19,629,000 after acquiring an additional 2,700 shares during the last quarter. Total Clarity Wealth Management Inc. raised its holdings in shares of GE Aerospace by 52.1% in the 2nd quarter. Total Clarity Wealth Management Inc. now owns 2,410 shares of the company's stock worth $621,000 after acquiring an additional 826 shares during the last quarter. Vest Financial LLC raised its holdings in shares of GE Aerospace by 79.0% in the 2nd quarter. Vest Financial LLC now owns 112,750 shares of the company's stock worth $29,021,000 after acquiring an additional 49,758 shares during the last quarter. Finally, St. Louis Trust Co acquired a new stake in shares of GE Aerospace in the 2nd quarter worth about $202,000. Institutional investors and hedge funds own 74.77% of the company's stock.

Analysts Set New Price Targets

A number of brokerages have issued reports on GE. TD Cowen upped their price objective on shares of GE Aerospace from $300.00 to $330.00 and gave the stock a "buy" rating in a research report on Tuesday, October 7th. Wells Fargo & Company upped their price objective on shares of GE Aerospace from $34.00 to $38.00 in a research report on Wednesday, July 23rd. Weiss Ratings reaffirmed a "buy (b)" rating on shares of GE Aerospace in a research report on Wednesday, October 8th. The Goldman Sachs Group upped their price objective on shares of GE Aerospace from $271.00 to $305.00 and gave the stock a "buy" rating in a research report on Friday. Finally, Sanford C. Bernstein reaffirmed an "outperform" rating on shares of GE Aerospace in a research report on Friday, August 15th. Fifteen research analysts have rated the stock with a Buy rating and two have issued a Hold rating to the stock. Based on data from MarketBeat.com, GE Aerospace presently has a consensus rating of "Moderate Buy" and a consensus price target of $267.13.

Get Our Latest Report on GE

GE Aerospace Stock Up 2.1%

GE Aerospace stock opened at $297.47 on Tuesday. GE Aerospace has a twelve month low of $159.36 and a twelve month high of $307.25. The firm has a 50 day moving average price of $283.87 and a 200-day moving average price of $248.35. The company has a market capitalization of $315.45 billion, a P/E ratio of 41.49, a P/E/G ratio of 3.14 and a beta of 1.49. The company has a quick ratio of 0.73, a current ratio of 1.04 and a debt-to-equity ratio of 0.88.

GE Aerospace (NYSE:GE - Get Free Report) last released its earnings results on Thursday, July 17th. The company reported $1.66 earnings per share for the quarter, beating analysts' consensus estimates of $1.43 by $0.23. GE Aerospace had a net margin of 18.64% and a return on equity of 31.32%. The firm had revenue of $10.15 billion during the quarter, compared to the consensus estimate of $9.49 billion. During the same period in the prior year, the firm earned $1.20 EPS. The company's revenue was up 21.2% compared to the same quarter last year. GE Aerospace has set its FY 2025 guidance at 5.600-5.800 EPS. As a group, equities analysts predict that GE Aerospace will post 5.4 EPS for the current year.

GE Aerospace Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, October 27th. Stockholders of record on Monday, September 29th will be given a dividend of $0.36 per share. This represents a $1.44 dividend on an annualized basis and a dividend yield of 0.5%. The ex-dividend date of this dividend is Monday, September 29th. GE Aerospace's dividend payout ratio is currently 20.08%.

About GE Aerospace

(

Free Report)

GE Aerospace (also known as General Electric) is a company that specializes in providing aerospace products and services. It operates through two reportable segments: Commercial Engines and Services and Defense and Propulsion Technologies. It offers jet and turboprop engines, as well as integrated systems for commercial, military, business, and general aviation aircraft.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider GE Aerospace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE Aerospace wasn't on the list.

While GE Aerospace currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.