Virtu Financial LLC purchased a new position in shares of Jazz Pharmaceuticals PLC (NASDAQ:JAZZ - Free Report) in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 9,362 shares of the specialty pharmaceutical company's stock, valued at approximately $1,162,000.

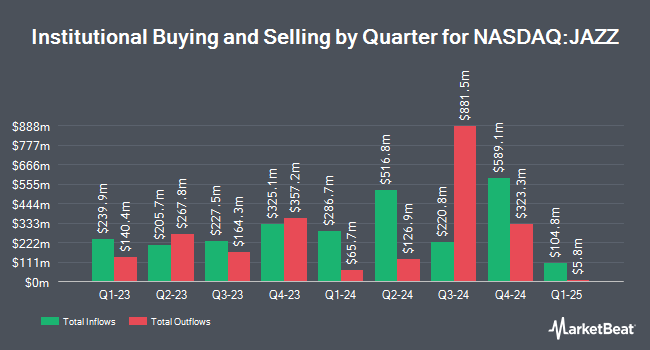

A number of other hedge funds have also made changes to their positions in JAZZ. Fuller & Thaler Asset Management Inc. grew its position in shares of Jazz Pharmaceuticals by 117.4% during the fourth quarter. Fuller & Thaler Asset Management Inc. now owns 939,351 shares of the specialty pharmaceutical company's stock worth $115,681,000 after buying an additional 507,234 shares in the last quarter. Darwin Global Management Ltd. acquired a new position in Jazz Pharmaceuticals in the fourth quarter worth $59,668,000. Perpetual Ltd boosted its holdings in Jazz Pharmaceuticals by 60.2% in the first quarter. Perpetual Ltd now owns 952,172 shares of the specialty pharmaceutical company's stock worth $118,212,000 after purchasing an additional 357,784 shares during the period. Dimensional Fund Advisors LP boosted its holdings in Jazz Pharmaceuticals by 18.7% in the fourth quarter. Dimensional Fund Advisors LP now owns 2,035,070 shares of the specialty pharmaceutical company's stock worth $250,619,000 after purchasing an additional 320,724 shares during the period. Finally, Ameriprise Financial Inc. boosted its holdings in Jazz Pharmaceuticals by 20.9% in the fourth quarter. Ameriprise Financial Inc. now owns 1,827,658 shares of the specialty pharmaceutical company's stock worth $225,076,000 after purchasing an additional 315,608 shares during the period. Institutional investors and hedge funds own 89.14% of the company's stock.

Jazz Pharmaceuticals Price Performance

JAZZ stock traded up $1.10 during trading on Friday, hitting $117.77. The company had a trading volume of 490,600 shares, compared to its average volume of 808,948. The firm has a market capitalization of $7.14 billion, a price-to-earnings ratio of -17.50, a P/E/G ratio of 7.89 and a beta of 0.34. The business has a 50 day moving average of $111.83 and a 200 day moving average of $117.27. Jazz Pharmaceuticals PLC has a fifty-two week low of $95.49 and a fifty-two week high of $148.06. The company has a current ratio of 1.62, a quick ratio of 1.37 and a debt-to-equity ratio of 1.17.

Jazz Pharmaceuticals (NASDAQ:JAZZ - Get Free Report) last posted its quarterly earnings data on Tuesday, August 5th. The specialty pharmaceutical company reported ($8.25) earnings per share for the quarter, missing the consensus estimate of ($5.61) by ($2.64). The company had revenue of $1.05 billion during the quarter, compared to analyst estimates of $1.05 billion. Jazz Pharmaceuticals had a positive return on equity of 5.02% and a negative net margin of 9.91%. The business's revenue for the quarter was up 2.1% compared to the same quarter last year. During the same period in the previous year, the company earned $5.30 EPS. As a group, research analysts predict that Jazz Pharmaceuticals PLC will post 16.96 earnings per share for the current year.

Insiders Place Their Bets

In related news, CEO Bruce C. Cozadd sold 1,000 shares of the company's stock in a transaction dated Tuesday, July 1st. The shares were sold at an average price of $107.63, for a total value of $107,630.00. Following the completion of the sale, the chief executive officer owned 436,973 shares of the company's stock, valued at $47,031,403.99. This represents a 0.23% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. 4.30% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

A number of research firms have commented on JAZZ. Robert W. Baird decreased their price objective on shares of Jazz Pharmaceuticals from $167.00 to $155.00 and set an "outperform" rating for the company in a report on Wednesday, May 7th. Wall Street Zen downgraded shares of Jazz Pharmaceuticals from a "buy" rating to a "hold" rating in a report on Thursday, May 15th. Piper Sandler reaffirmed an "overweight" rating and issued a $147.00 price objective (down previously from $176.00) on shares of Jazz Pharmaceuticals in a report on Wednesday, May 7th. Deutsche Bank Aktiengesellschaft assumed coverage on shares of Jazz Pharmaceuticals in a report on Tuesday, July 15th. They issued a "buy" rating and a $152.00 price objective for the company. Finally, Morgan Stanley reduced their price target on shares of Jazz Pharmaceuticals from $165.00 to $162.00 and set an "overweight" rating for the company in a report on Wednesday, August 6th. Two analysts have rated the stock with a hold rating and thirteen have given a buy rating to the company's stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $181.43.

View Our Latest Stock Report on Jazz Pharmaceuticals

Jazz Pharmaceuticals Company Profile

(

Free Report)

Jazz Pharmaceuticals plc identifies, develops, and commercializes pharmaceutical products for unmet medical needs in the United States, Europe, and internationally. The company offers Xywav for cataplexy or excessive daytime sleepiness (EDS) with narcolepsy and idiopathic hypersomnia; Xyrem to treat cataplexy or EDS with narcolepsy; Epidiolex for seizures associated with Lennox-Gastaut and Dravet syndromes, or tuberous sclerosis complex; Zepzelca to treat metastatic small cell lung cancer, or with disease progression on or after platinum-based chemotherapy; Rylaze for acute lymphoblastic leukemia or lymphoblastic lymphoma; Enrylaze to treat acute lymphoblastic leukemia and lymphoblastic lymphoma; Defitelio to treat severe hepatic veno-occlusive disease; and Vyxeos for newly-diagnosed therapy-related acute myeloid leukemia.

Read More

Before you consider Jazz Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Jazz Pharmaceuticals wasn't on the list.

While Jazz Pharmaceuticals currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.