Strs Ohio acquired a new position in Matson, Inc. (NYSE:MATX - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 9,500 shares of the shipping company's stock, valued at approximately $1,218,000.

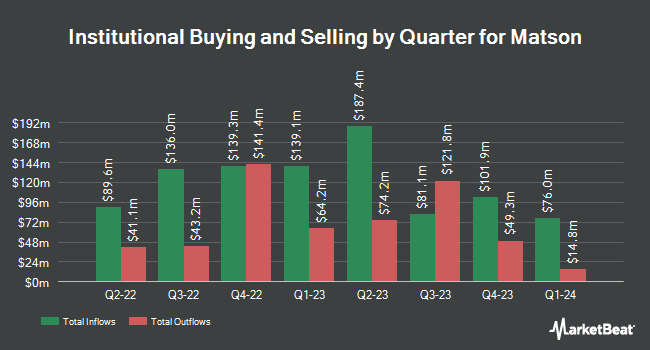

Other institutional investors have also recently made changes to their positions in the company. GAMMA Investing LLC raised its stake in shares of Matson by 11.7% in the first quarter. GAMMA Investing LLC now owns 1,373 shares of the shipping company's stock worth $176,000 after buying an additional 144 shares during the period. SG Americas Securities LLC bought a new stake in Matson during the 1st quarter valued at approximately $507,000. Raymond James Financial Inc. raised its stake in Matson by 91.6% during the 1st quarter. Raymond James Financial Inc. now owns 61,500 shares of the shipping company's stock valued at $7,883,000 after purchasing an additional 29,400 shares during the period. Envestnet Asset Management Inc. raised its stake in Matson by 8.9% during the 1st quarter. Envestnet Asset Management Inc. now owns 96,669 shares of the shipping company's stock valued at $12,390,000 after purchasing an additional 7,920 shares during the period. Finally, Ameriprise Financial Inc. raised its stake in Matson by 10.9% during the 1st quarter. Ameriprise Financial Inc. now owns 461,769 shares of the shipping company's stock valued at $59,188,000 after purchasing an additional 45,296 shares during the period. Institutional investors own 84.76% of the company's stock.

Wall Street Analyst Weigh In

Several analysts recently issued reports on the company. Jefferies Financial Group reissued a "hold" rating and set a $115.00 target price on shares of Matson in a research note on Friday, August 1st. Zacks Research raised Matson from a "strong sell" rating to a "hold" rating in a research note on Tuesday, September 16th. One investment analyst has rated the stock with a Buy rating and four have given a Hold rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus price target of $131.67.

Read Our Latest Analysis on Matson

Matson Price Performance

NYSE:MATX traded down $3.86 during trading hours on Friday, reaching $103.66. The stock had a trading volume of 1,182,150 shares, compared to its average volume of 319,408. The company has a debt-to-equity ratio of 0.13, a quick ratio of 0.78 and a current ratio of 0.78. Matson, Inc. has a 52 week low of $91.75 and a 52 week high of $169.12. The company has a 50 day moving average price of $106.40 and a two-hundred day moving average price of $110.94. The stock has a market capitalization of $3.30 billion, a PE ratio of 7.01 and a beta of 1.21.

Matson (NYSE:MATX - Get Free Report) last released its quarterly earnings data on Thursday, July 31st. The shipping company reported $2.92 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.18 by $0.74. Matson had a return on equity of 18.90% and a net margin of 14.26%.The business had revenue of $830.50 million for the quarter, compared to the consensus estimate of $727.30 million. During the same quarter in the previous year, the company posted $3.31 EPS. The company's revenue was down 2.0% compared to the same quarter last year. As a group, sell-side analysts anticipate that Matson, Inc. will post 13.27 earnings per share for the current fiscal year.

Matson Increases Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, September 4th. Stockholders of record on Thursday, August 7th were issued a $0.36 dividend. This is a positive change from Matson's previous quarterly dividend of $0.34. The ex-dividend date was Thursday, August 7th. This represents a $1.44 dividend on an annualized basis and a dividend yield of 1.4%. Matson's dividend payout ratio (DPR) is presently 9.74%.

Insider Activity at Matson

In other news, SVP Christopher A. Scott sold 1,044 shares of Matson stock in a transaction that occurred on Thursday, August 7th. The stock was sold at an average price of $109.94, for a total value of $114,777.36. Following the completion of the transaction, the senior vice president owned 13,441 shares in the company, valued at approximately $1,477,703.54. The trade was a 7.21% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Company insiders own 2.05% of the company's stock.

About Matson

(

Free Report)

Matson, Inc, together with its subsidiaries, engages in the provision of ocean transportation and logistics services. It operates through two segments, Ocean Transportation and Logistics. The Ocean Transportation segment offers ocean freight transportation services to the domestic non-contiguous economies of Hawaii, Japan, Alaska, and Guam, as well as to other island economies in Micronesia.

Recommended Stories

Before you consider Matson, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Matson wasn't on the list.

While Matson currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.