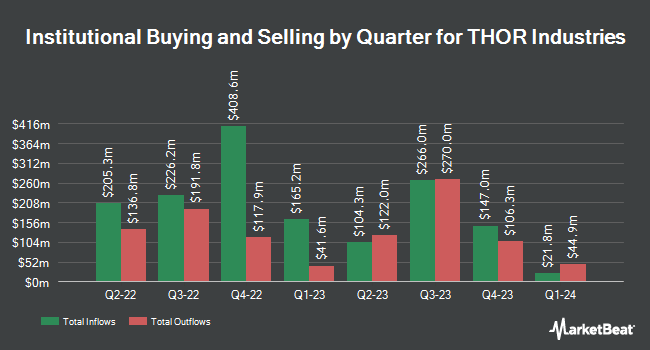

Hotchkis & Wiley Capital Management LLC bought a new position in shares of Thor Industries, Inc. (NYSE:THO - Free Report) during the 1st quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor bought 98,330 shares of the construction company's stock, valued at approximately $7,454,000. Hotchkis & Wiley Capital Management LLC owned about 0.18% of Thor Industries at the end of the most recent reporting period.

Other hedge funds have also recently bought and sold shares of the company. UMB Bank n.a. increased its position in Thor Industries by 135.6% during the first quarter. UMB Bank n.a. now owns 483 shares of the construction company's stock worth $37,000 after buying an additional 278 shares during the last quarter. Whittier Trust Co. of Nevada Inc. increased its position in Thor Industries by 96.3% during the first quarter. Whittier Trust Co. of Nevada Inc. now owns 805 shares of the construction company's stock worth $61,000 after buying an additional 395 shares during the last quarter. Smartleaf Asset Management LLC increased its position in Thor Industries by 336.1% during the first quarter. Smartleaf Asset Management LLC now owns 785 shares of the construction company's stock worth $61,000 after buying an additional 605 shares during the last quarter. NBC Securities Inc. increased its position in Thor Industries by 135,500.0% during the first quarter. NBC Securities Inc. now owns 2,712 shares of the construction company's stock worth $205,000 after buying an additional 2,710 shares during the last quarter. Finally, Oxford Asset Management LLP bought a new position in Thor Industries in the 4th quarter worth $217,000. 96.71% of the stock is owned by institutional investors and hedge funds.

Analysts Set New Price Targets

Several brokerages recently commented on THO. Citigroup reiterated a "neutral" rating and issued a $100.00 target price (up previously from $88.00) on shares of Thor Industries in a report on Tuesday, August 12th. Roth Capital set a $77.00 target price on shares of Thor Industries and gave the stock a "neutral" rating in a report on Monday, June 9th. KeyCorp upgraded shares of Thor Industries from an "underweight" rating to a "sector weight" rating in a report on Friday, August 1st. Wall Street Zen upgraded shares of Thor Industries from a "sell" rating to a "hold" rating in a report on Friday, June 6th. Finally, Truist Financial lifted their target price on shares of Thor Industries from $72.00 to $78.00 and gave the stock a "hold" rating in a report on Tuesday, June 3rd. Two investment analysts have rated the stock with a Buy rating and eight have given a Hold rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus price target of $89.38.

Get Our Latest Report on THO

Insider Buying and Selling at Thor Industries

In other Thor Industries news, Director Peter Busch Orthwein bought 3,000 shares of the firm's stock in a transaction dated Friday, June 20th. The shares were acquired at an average cost of $85.40 per share, for a total transaction of $256,200.00. Following the transaction, the director owned 136,400 shares in the company, valued at approximately $11,648,560. The trade was a 2.25% increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the SEC, which is available through the SEC website. Company insiders own 4.50% of the company's stock.

Thor Industries Stock Performance

Shares of NYSE:THO traded down $0.01 on Friday, hitting $109.71. 454,695 shares of the company were exchanged, compared to its average volume of 792,051. The company has a debt-to-equity ratio of 0.24, a quick ratio of 0.90 and a current ratio of 1.71. The company's 50 day moving average price is $96.60 and its two-hundred day moving average price is $86.90. Thor Industries, Inc. has a one year low of $63.15 and a one year high of $118.85. The firm has a market capitalization of $5.84 billion, a price-to-earnings ratio of 26.31, a PEG ratio of 2.20 and a beta of 1.21.

Thor Industries (NYSE:THO - Get Free Report) last issued its earnings results on Wednesday, June 4th. The construction company reported $2.53 earnings per share for the quarter, beating the consensus estimate of $1.79 by $0.74. Thor Industries had a net margin of 2.32% and a return on equity of 6.15%. The business had revenue of $2.89 billion for the quarter, compared to analyst estimates of $2.60 billion. During the same period in the previous year, the business earned $2.13 EPS. The firm's revenue was up 3.3% on a year-over-year basis. Thor Industries has set its FY 2025 guidance at 3.300-4.000 EPS. Research analysts expect that Thor Industries, Inc. will post 4.64 earnings per share for the current year.

Thor Industries Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Tuesday, July 15th. Stockholders of record on Tuesday, July 1st were given a dividend of $0.50 per share. This represents a $2.00 annualized dividend and a dividend yield of 1.8%. The ex-dividend date was Tuesday, July 1st. Thor Industries's payout ratio is 47.96%.

Thor Industries declared that its board has approved a share buyback plan on Monday, June 23rd that permits the company to repurchase $400.00 million in outstanding shares. This repurchase authorization permits the construction company to purchase up to 8.8% of its stock through open market purchases. Stock repurchase plans are typically an indication that the company's leadership believes its shares are undervalued.

About Thor Industries

(

Free Report)

THOR Industries, Inc designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Canada, and Europe. The company offers travel trailers; gasoline and diesel Class A, Class B, and Class C motorhomes; conventional travel trailers and fifth wheels; luxury fifth wheels; and motorcaravans, caravans, campervans, and urban vehicles.

Read More

Before you consider Thor Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Thor Industries wasn't on the list.

While Thor Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.