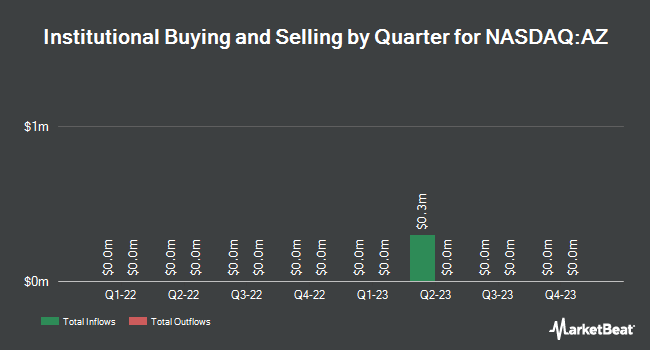

Fortitude Advisory Group L.L.C. increased its stake in shares of A2Z Cust2Mate Solutions Corp. (NASDAQ:AZ - Free Report) by 151.4% in the 2nd quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund owned 301,680 shares of the company's stock after purchasing an additional 181,680 shares during the period. A2Z Cust2Mate Solutions makes up 1.8% of Fortitude Advisory Group L.L.C.'s investment portfolio, making the stock its 9th largest holding. Fortitude Advisory Group L.L.C. owned 1.02% of A2Z Cust2Mate Solutions worth $3,189,000 as of its most recent filing with the Securities & Exchange Commission.

Several other hedge funds have also recently made changes to their positions in AZ. FNY Investment Advisers LLC purchased a new position in shares of A2Z Cust2Mate Solutions during the first quarter valued at approximately $35,000. Hohimer Wealth Management LLC purchased a new position in shares of A2Z Cust2Mate Solutions during the first quarter valued at approximately $141,000. Woodward Diversified Capital LLC purchased a new position in shares of A2Z Cust2Mate Solutions during the first quarter valued at approximately $143,000. Corsair Capital Management L.P. purchased a new position in shares of A2Z Cust2Mate Solutions during the first quarter valued at approximately $157,000. Finally, Alyeska Investment Group L.P. purchased a new position in shares of A2Z Cust2Mate Solutions during the first quarter valued at approximately $8,514,000. 12.64% of the stock is owned by hedge funds and other institutional investors.

A2Z Cust2Mate Solutions Trading Up 4.8%

Shares of NASDAQ AZ opened at $7.85 on Friday. The firm has a 50 day moving average of $8.90 and a 200 day moving average of $8.88. The firm has a market capitalization of $328.52 million, a price-to-earnings ratio of -6.54 and a beta of 1.39. A2Z Cust2Mate Solutions Corp. has a 12-month low of $1.76 and a 12-month high of $12.36.

A2Z Cust2Mate Solutions (NASDAQ:AZ - Get Free Report) last announced its earnings results on Wednesday, August 13th. The company reported ($0.31) earnings per share (EPS) for the quarter. The business had revenue of $1.16 million for the quarter. A2Z Cust2Mate Solutions had a negative net margin of 479.28% and a negative return on equity of 187.41%.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on the stock. Weiss Ratings reissued a "sell (d-)" rating on shares of A2Z Cust2Mate Solutions in a report on Saturday, September 27th. Wall Street Zen cut shares of A2Z Cust2Mate Solutions from a "hold" rating to a "strong sell" rating in a report on Saturday, August 16th. One analyst has rated the stock with a Buy rating and one has given a Sell rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and a consensus price target of $20.00.

Read Our Latest Analysis on A2Z Cust2Mate Solutions

A2Z Cust2Mate Solutions Profile

(

Free Report)

A2Z Smart Technologies Corp., a technology company, focuses on the development and commercialization of retail smart cart solutions for grocery stores and supermarkets in Israel and internationally. The company operates through three segments: Precision Metal Parts, Advanced Engineering, and Smart Carts.

Featured Articles

Want to see what other hedge funds are holding AZ? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for A2Z Cust2Mate Solutions Corp. (NASDAQ:AZ - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider A2Z Cust2Mate Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and A2Z Cust2Mate Solutions wasn't on the list.

While A2Z Cust2Mate Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.