Invesco Ltd. lessened its position in AAON, Inc. (NASDAQ:AAON - Free Report) by 49.0% during the first quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 1,037,012 shares of the construction company's stock after selling 995,485 shares during the quarter. Invesco Ltd. owned approximately 1.27% of AAON worth $81,022,000 as of its most recent filing with the SEC.

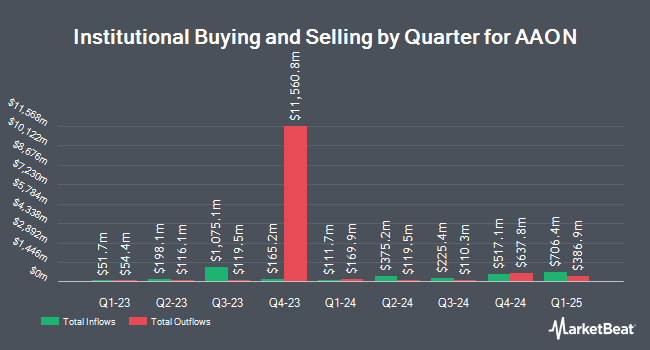

Other institutional investors have also recently bought and sold shares of the company. Curi RMB Capital LLC boosted its stake in shares of AAON by 0.5% during the 4th quarter. Curi RMB Capital LLC now owns 18,503 shares of the construction company's stock worth $2,177,000 after buying an additional 100 shares during the last quarter. Quarry LP raised its holdings in AAON by 49.0% during the fourth quarter. Quarry LP now owns 313 shares of the construction company's stock worth $37,000 after acquiring an additional 103 shares in the last quarter. Parallel Advisors LLC boosted its position in AAON by 26.3% during the first quarter. Parallel Advisors LLC now owns 716 shares of the construction company's stock valued at $56,000 after purchasing an additional 149 shares during the last quarter. CWM LLC boosted its position in AAON by 25.7% during the first quarter. CWM LLC now owns 938 shares of the construction company's stock valued at $73,000 after purchasing an additional 192 shares during the last quarter. Finally, Louisiana State Employees Retirement System grew its stake in AAON by 1.1% in the first quarter. Louisiana State Employees Retirement System now owns 18,900 shares of the construction company's stock valued at $1,477,000 after purchasing an additional 200 shares in the last quarter. Institutional investors own 70.81% of the company's stock.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on AAON. Sidoti upgraded AAON from a "neutral" rating to a "buy" rating and set a $95.00 price objective on the stock in a research note on Monday, June 16th. DA Davidson lowered their target price on shares of AAON from $125.00 to $105.00 and set a "buy" rating on the stock in a report on Tuesday, August 12th. Wall Street Zen cut shares of AAON from a "hold" rating to a "strong sell" rating in a research note on Sunday. Finally, Robert W. Baird decreased their price objective on shares of AAON from $102.00 to $98.00 and set a "buy" rating for the company in a research report on Tuesday, August 12th. One investment analyst has rated the stock with a Strong Buy rating and four have issued a Buy rating to the stock. According to data from MarketBeat.com, AAON presently has an average rating of "Buy" and an average target price of $102.00.

Check Out Our Latest Research Report on AAON

AAON Stock Performance

AAON stock traded up $0.61 during midday trading on Thursday, reaching $80.70. 81,104 shares of the company were exchanged, compared to its average volume of 1,016,693. AAON, Inc. has a one year low of $62.00 and a one year high of $144.07. The firm has a market capitalization of $6.58 billion, a price-to-earnings ratio of 54.82 and a beta of 0.94. The business has a 50-day moving average price of $77.46 and a two-hundred day moving average price of $86.90. The company has a debt-to-equity ratio of 0.38, a current ratio of 3.10 and a quick ratio of 1.99.

AAON (NASDAQ:AAON - Get Free Report) last issued its quarterly earnings data on Monday, August 11th. The construction company reported $0.22 earnings per share for the quarter, missing the consensus estimate of $0.31 by ($0.09). The company had revenue of $311.57 million during the quarter, compared to the consensus estimate of $326.15 million. AAON had a net margin of 9.70% and a return on equity of 15.45%. AAON's revenue for the quarter was down .6% compared to the same quarter last year. During the same period in the previous year, the company earned $0.62 earnings per share. Equities research analysts forecast that AAON, Inc. will post 2.26 EPS for the current year.

AAON Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Friday, September 26th. Stockholders of record on Friday, September 5th will be issued a dividend of $0.10 per share. This represents a $0.40 dividend on an annualized basis and a dividend yield of 0.5%. The ex-dividend date is Friday, September 5th. AAON's payout ratio is currently 27.21%.

About AAON

(

Free Report)

AAON, Inc, together with its subsidiaries, engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada. The company operates through three segments: AAON Oklahoma, AAON Coil Products, and BASX. It offers rooftop units, data center cooling solutions, cleanroom systems, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps, coils, and controls.

Read More

Before you consider AAON, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AAON wasn't on the list.

While AAON currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.