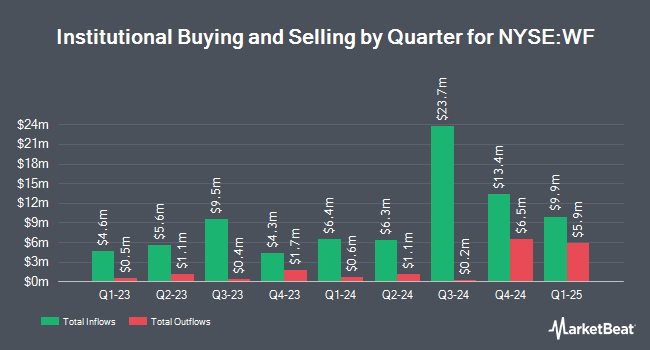

Aaron Wealth Advisors LLC acquired a new stake in shares of Woori Bank (NYSE:WF - Free Report) during the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund acquired 6,148 shares of the bank's stock, valued at approximately $306,000.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Canopy Partners LLC purchased a new stake in Woori Bank during the 1st quarter valued at about $201,000. Optas LLC purchased a new stake in Woori Bank in the first quarter valued at approximately $203,000. HighTower Advisors LLC purchased a new stake in Woori Bank in the first quarter valued at approximately $207,000. Compound Planning Inc. acquired a new position in Woori Bank in the 1st quarter worth approximately $215,000. Finally, Foster Group Inc. purchased a new position in Woori Bank during the 1st quarter worth approximately $221,000. Hedge funds and other institutional investors own 3.41% of the company's stock.

Woori Bank Stock Performance

NYSE WF traded down $0.33 on Monday, hitting $57.24. 32,855 shares of the company's stock traded hands, compared to its average volume of 47,751. The firm's 50-day moving average price is $54.46 and its two-hundred day moving average price is $44.92. The firm has a market capitalization of $14.17 billion, a PE ratio of 7.21, a P/E/G ratio of 1.03 and a beta of 1.11. The company has a current ratio of 1.09, a quick ratio of 1.09 and a debt-to-equity ratio of 0.88. Woori Bank has a 1-year low of $29.44 and a 1-year high of $57.97.

Woori Bank (NYSE:WF - Get Free Report) last released its quarterly earnings data on Friday, July 25th. The bank reported $2.63 earnings per share for the quarter, missing analysts' consensus estimates of $3,574.37 by ($3,571.74). The business had revenue of $2 billion during the quarter, compared to analyst estimates of $2,790.97 billion. Woori Bank had a return on equity of 8.30% and a net margin of 11.84%. As a group, analysts expect that Woori Bank will post 8.24 EPS for the current year.

About Woori Bank

(

Free Report)

Woori Financial Group Inc, a financial holding company, operates as a commercial bank that provides a range of financial products and services to individuals, corporations, and small- and medium-sized enterprises in Korea. It operates through Banking, Credit Card, Capital, Investment Banking, and Others segments.

Further Reading

Before you consider Woori Bank, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Woori Bank wasn't on the list.

While Woori Bank currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.