Prairie Sky Financial Group LLC raised its position in shares of Abbott Laboratories (NYSE:ABT - Free Report) by 6.2% in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 102,036 shares of the healthcare product maker's stock after acquiring an additional 5,931 shares during the quarter. Abbott Laboratories makes up about 7.6% of Prairie Sky Financial Group LLC's holdings, making the stock its 3rd largest holding. Prairie Sky Financial Group LLC's holdings in Abbott Laboratories were worth $13,878,000 at the end of the most recent reporting period.

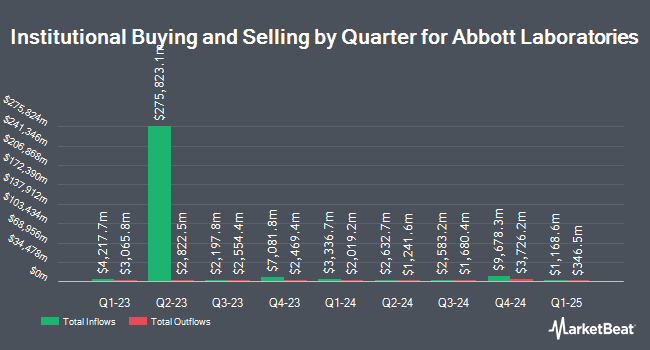

Other hedge funds have also made changes to their positions in the company. Edge Financial Advisors LLC raised its holdings in shares of Abbott Laboratories by 3.3% during the first quarter. Edge Financial Advisors LLC now owns 2,530 shares of the healthcare product maker's stock valued at $336,000 after acquiring an additional 81 shares during the last quarter. Avanza Fonder AB increased its holdings in shares of Abbott Laboratories by 0.4% in the second quarter. Avanza Fonder AB now owns 168,401 shares of the healthcare product maker's stock valued at $22,904,000 after purchasing an additional 655 shares during the last quarter. Madrona Financial Services LLC increased its holdings in shares of Abbott Laboratories by 9.7% in the second quarter. Madrona Financial Services LLC now owns 1,726 shares of the healthcare product maker's stock valued at $235,000 after purchasing an additional 152 shares during the last quarter. Janney Montgomery Scott LLC increased its holdings in shares of Abbott Laboratories by 12.4% in the second quarter. Janney Montgomery Scott LLC now owns 669,868 shares of the healthcare product maker's stock valued at $91,109,000 after purchasing an additional 73,780 shares during the last quarter. Finally, SageView Advisory Group LLC increased its holdings in shares of Abbott Laboratories by 18.6% in the first quarter. SageView Advisory Group LLC now owns 18,294 shares of the healthcare product maker's stock valued at $2,427,000 after purchasing an additional 2,873 shares during the last quarter. Institutional investors and hedge funds own 75.18% of the company's stock.

Insider Activity at Abbott Laboratories

In other news, CFO Philip P. Boudreau sold 5,550 shares of the firm's stock in a transaction on Friday, August 8th. The stock was sold at an average price of $134.55, for a total transaction of $746,752.50. Following the completion of the transaction, the chief financial officer directly owned 51,003 shares in the company, valued at $6,862,453.65. This trade represents a 9.81% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. 0.46% of the stock is currently owned by corporate insiders.

Analyst Upgrades and Downgrades

ABT has been the subject of several recent research reports. Jefferies Financial Group raised Abbott Laboratories from a "hold" rating to a "buy" rating and increased their price target for the company from $143.00 to $145.00 in a report on Friday, July 18th. Raymond James Financial cut their price target on Abbott Laboratories from $142.00 to $141.00 and set an "outperform" rating for the company in a report on Friday, July 18th. Wells Fargo & Company cut their price target on Abbott Laboratories from $147.00 to $142.00 and set an "overweight" rating for the company in a report on Friday, July 18th. Morgan Stanley increased their price objective on Abbott Laboratories from $127.00 to $137.00 and gave the stock an "equal weight" rating in a research report on Tuesday, July 15th. Finally, Weiss Ratings reiterated a "buy (b)" rating on shares of Abbott Laboratories in a research report on Wednesday, October 8th. Two equities research analysts have rated the stock with a Strong Buy rating, sixteen have issued a Buy rating and four have given a Hold rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $146.17.

Get Our Latest Stock Analysis on Abbott Laboratories

Abbott Laboratories Trading Up 1.4%

Shares of Abbott Laboratories stock opened at $133.17 on Wednesday. Abbott Laboratories has a fifty-two week low of $110.86 and a fifty-two week high of $141.23. The stock has a 50 day moving average of $132.62 and a 200 day moving average of $131.61. The firm has a market capitalization of $231.77 billion, a price-to-earnings ratio of 16.69, a PEG ratio of 2.49 and a beta of 0.69. The company has a debt-to-equity ratio of 0.25, a quick ratio of 1.30 and a current ratio of 1.82.

Abbott Laboratories (NYSE:ABT - Get Free Report) last released its quarterly earnings results on Thursday, July 17th. The healthcare product maker reported $1.26 EPS for the quarter, hitting the consensus estimate of $1.26. Abbott Laboratories had a return on equity of 18.32% and a net margin of 32.43%.The business had revenue of $11.14 billion during the quarter, compared to analyst estimates of $11.01 billion. During the same period last year, the business posted $1.14 earnings per share. The company's quarterly revenue was up 7.4% on a year-over-year basis. Abbott Laboratories has set its FY 2025 guidance at 5.100-5.200 EPS. Q3 2025 guidance at 1.280-1.320 EPS. As a group, research analysts predict that Abbott Laboratories will post 5.14 earnings per share for the current year.

Abbott Laboratories Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Monday, November 17th. Stockholders of record on Wednesday, October 15th will be given a dividend of $0.59 per share. This represents a $2.36 annualized dividend and a dividend yield of 1.8%. The ex-dividend date is Wednesday, October 15th. Abbott Laboratories's dividend payout ratio (DPR) is currently 29.57%.

About Abbott Laboratories

(

Free Report)

Abbott Laboratories, together with its subsidiaries, discovers, develops, manufactures, and sells health care products worldwide. It operates in four segments: Established Pharmaceutical Products, Diagnostic Products, Nutritional Products, and Medical Devices. The company provides generic pharmaceuticals for the treatment of pancreatic exocrine insufficiency, irritable bowel syndrome or biliary spasm, intrahepatic cholestasis or depressive symptoms, gynecological disorder, hormone replacement therapy, dyslipidemia, hypertension, hypothyroidism, Ménière's disease and vestibular vertigo, pain, fever, inflammation, and migraine, as well as provides anti-infective clarithromycin, influenza vaccine, and products to regulate physiological rhythm of the colon.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Abbott Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Abbott Laboratories wasn't on the list.

While Abbott Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report