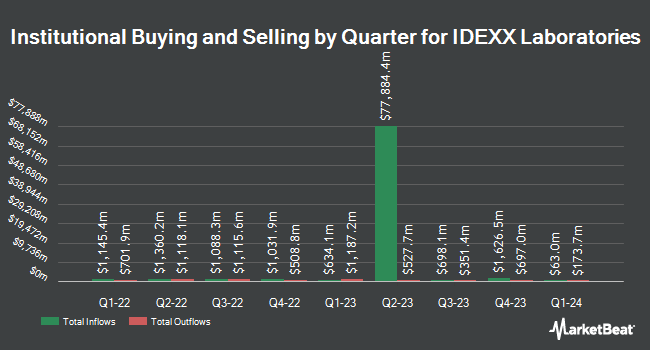

Aberdeen Group plc grew its holdings in IDEXX Laboratories, Inc. (NASDAQ:IDXX - Free Report) by 2.8% during the 2nd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 92,637 shares of the company's stock after purchasing an additional 2,506 shares during the period. Aberdeen Group plc owned approximately 0.12% of IDEXX Laboratories worth $49,685,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently modified their holdings of the business. Red Spruce Capital LLC raised its position in shares of IDEXX Laboratories by 1.1% in the second quarter. Red Spruce Capital LLC now owns 1,701 shares of the company's stock valued at $912,000 after purchasing an additional 19 shares during the period. Rise Advisors LLC grew its stake in IDEXX Laboratories by 3.9% during the second quarter. Rise Advisors LLC now owns 562 shares of the company's stock valued at $301,000 after acquiring an additional 21 shares in the last quarter. Blue Trust Inc. grew its stake in IDEXX Laboratories by 14.2% during the second quarter. Blue Trust Inc. now owns 177 shares of the company's stock valued at $95,000 after acquiring an additional 22 shares in the last quarter. Sage Mountain Advisors LLC grew its stake in IDEXX Laboratories by 3.8% during the first quarter. Sage Mountain Advisors LLC now owns 635 shares of the company's stock valued at $267,000 after acquiring an additional 23 shares in the last quarter. Finally, Great Lakes Advisors LLC grew its stake in IDEXX Laboratories by 0.9% during the first quarter. Great Lakes Advisors LLC now owns 2,567 shares of the company's stock valued at $1,078,000 after acquiring an additional 23 shares in the last quarter. Institutional investors own 87.84% of the company's stock.

IDEXX Laboratories Price Performance

Shares of NASDAQ:IDXX opened at $616.15 on Friday. The company's fifty day moving average price is $641.49 and its 200-day moving average price is $542.72. The firm has a market capitalization of $49.30 billion, a price-to-earnings ratio of 51.30, a PEG ratio of 3.99 and a beta of 1.58. IDEXX Laboratories, Inc. has a one year low of $356.14 and a one year high of $688.12. The company has a debt-to-equity ratio of 0.31, a current ratio of 1.11 and a quick ratio of 0.79.

IDEXX Laboratories (NASDAQ:IDXX - Get Free Report) last issued its quarterly earnings results on Monday, August 4th. The company reported $3.63 EPS for the quarter, topping analysts' consensus estimates of $3.28 by $0.35. The firm had revenue of $1.11 billion for the quarter, compared to analyst estimates of $1.06 billion. IDEXX Laboratories had a net margin of 24.41% and a return on equity of 64.42%. The business's revenue for the quarter was up 10.6% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $2.44 EPS. IDEXX Laboratories has set its FY 2025 guidance at 12.400-12.760 EPS. On average, equities research analysts anticipate that IDEXX Laboratories, Inc. will post 11.93 earnings per share for the current fiscal year.

Insider Activity at IDEXX Laboratories

In related news, EVP Sharon E. Underberg sold 5,450 shares of the stock in a transaction on Friday, August 8th. The shares were sold at an average price of $651.60, for a total transaction of $3,551,220.00. Following the transaction, the executive vice president owned 6,156 shares of the company's stock, valued at approximately $4,011,249.60. This trade represents a 46.96% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Michael Lane sold 8,411 shares of the stock in a transaction on Wednesday, August 6th. The shares were sold at an average price of $627.74, for a total transaction of $5,279,921.14. Following the transaction, the executive vice president directly owned 7,132 shares in the company, valued at approximately $4,477,041.68. This represents a 54.11% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 54,057 shares of company stock worth $34,293,468 in the last 90 days. Corporate insiders own 0.98% of the company's stock.

Analysts Set New Price Targets

Several equities analysts recently commented on IDXX shares. Jefferies Financial Group started coverage on shares of IDEXX Laboratories in a research note on Tuesday, July 1st. They set a "buy" rating and a $625.00 price objective for the company. BTIG Research boosted their price objective on shares of IDEXX Laboratories from $545.00 to $785.00 and gave the company a "buy" rating in a research note on Tuesday, August 5th. Wall Street Zen cut shares of IDEXX Laboratories from a "strong-buy" rating to a "buy" rating in a research note on Sunday, September 28th. Piper Sandler reaffirmed a "neutral" rating and set a $700.00 price objective (up previously from $510.00) on shares of IDEXX Laboratories in a research note on Monday, August 11th. Finally, Weiss Ratings reissued a "buy (b-)" rating on shares of IDEXX Laboratories in a research note on Wednesday. One investment analyst has rated the stock with a Strong Buy rating, seven have issued a Buy rating and four have issued a Hold rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $656.50.

Check Out Our Latest Stock Report on IDXX

IDEXX Laboratories Profile

(

Free Report)

IDEXX Laboratories, Inc develops, manufactures, and distributes products primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets in Africa, the Asia Pacific, Canada, Europe, Latin America, and internationally. The company operates through three segments: Companion Animal Group; Water Quality Products; and Livestock, Poultry and Dairy.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider IDEXX Laboratories, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IDEXX Laboratories wasn't on the list.

While IDEXX Laboratories currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.