Aberdeen Group plc increased its position in shares of Halliburton Company (NYSE:HAL - Free Report) by 130.9% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 591,289 shares of the oilfield services company's stock after buying an additional 335,218 shares during the period. Aberdeen Group plc owned 0.07% of Halliburton worth $14,957,000 as of its most recent filing with the Securities and Exchange Commission.

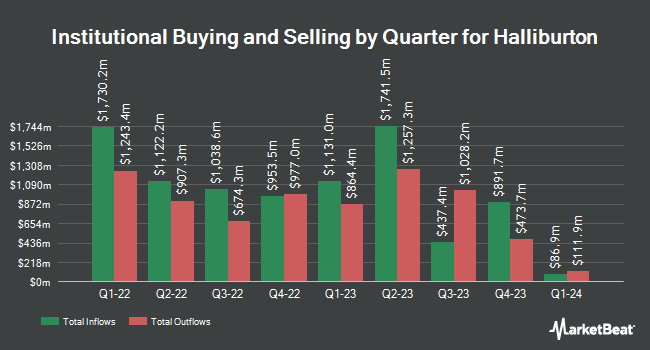

Other institutional investors have also added to or reduced their stakes in the company. Mascagni Wealth Management Inc. acquired a new position in shares of Halliburton in the fourth quarter valued at $28,000. Stone House Investment Management LLC acquired a new position in shares of Halliburton in the first quarter valued at $30,000. Hexagon Capital Partners LLC increased its holdings in shares of Halliburton by 87.4% in the first quarter. Hexagon Capital Partners LLC now owns 1,407 shares of the oilfield services company's stock valued at $36,000 after purchasing an additional 656 shares during the last quarter. Vermillion Wealth Management Inc. acquired a new position in shares of Halliburton in the fourth quarter valued at $39,000. Finally, Zions Bancorporation National Association UT acquired a new position in shares of Halliburton in the first quarter valued at $37,000. 85.23% of the stock is currently owned by institutional investors and hedge funds.

Halliburton Price Performance

HAL traded up $0.9750 on Friday, hitting $22.2550. 12,617,447 shares of the stock were exchanged, compared to its average volume of 12,239,343. Halliburton Company has a 12 month low of $18.72 and a 12 month high of $32.57. The business has a 50-day moving average of $21.61 and a two-hundred day moving average of $22.39. The company has a debt-to-equity ratio of 0.68, a current ratio of 2.00 and a quick ratio of 1.47. The firm has a market capitalization of $18.97 billion, a price-to-earnings ratio of 10.40, a PEG ratio of 3.72 and a beta of 1.12.

Halliburton (NYSE:HAL - Get Free Report) last posted its quarterly earnings data on Tuesday, July 22nd. The oilfield services company reported $0.55 earnings per share for the quarter, hitting the consensus estimate of $0.55. Halliburton had a net margin of 8.37% and a return on equity of 21.45%. The business had revenue of $5.51 billion during the quarter, compared to analysts' expectations of $5.43 billion. During the same quarter in the prior year, the business posted $0.80 earnings per share. Halliburton's revenue was down 5.5% compared to the same quarter last year. Sell-side analysts forecast that Halliburton Company will post 2.64 EPS for the current fiscal year.

Halliburton Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Wednesday, September 24th. Investors of record on Wednesday, September 3rd will be given a dividend of $0.17 per share. The ex-dividend date of this dividend is Wednesday, September 3rd. This represents a $0.68 annualized dividend and a yield of 3.1%. Halliburton's dividend payout ratio is currently 31.78%.

Wall Street Analyst Weigh In

Several equities analysts have commented on the stock. The Goldman Sachs Group decreased their price objective on shares of Halliburton from $27.00 to $24.00 and set a "buy" rating on the stock in a report on Friday, May 2nd. Piper Sandler downgraded shares of Halliburton from an "overweight" rating to a "neutral" rating and set a $25.00 price objective on the stock. in a report on Monday, July 28th. Melius Research assumed coverage on shares of Halliburton in a report on Wednesday. They issued a "buy" rating and a $41.00 price objective on the stock. Stifel Nicolaus decreased their price objective on shares of Halliburton from $31.00 to $29.00 and set a "buy" rating on the stock in a report on Wednesday, July 23rd. Finally, Wells Fargo & Company decreased their price objective on shares of Halliburton from $28.00 to $26.00 and set an "overweight" rating on the stock in a report on Wednesday, July 23rd. Fourteen analysts have rated the stock with a Buy rating and eight have assigned a Hold rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $32.05.

View Our Latest Report on Halliburton

Halliburton Company Profile

(

Free Report)

Halliburton Company provides products and services to the energy industry worldwide. It operates through two segments, Completion and Production, and Drilling and Evaluation. The Completion and Production segment offers production enhancement services that include stimulation and sand control services; cementing services, such as well bonding and casing, and casing equipment; and completion tools that offer downhole solutions and services, including well completion products and services, intelligent well completions, and service tools, as well as liner hanger, sand control, and multilateral systems.

Recommended Stories

Before you consider Halliburton, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Halliburton wasn't on the list.

While Halliburton currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.