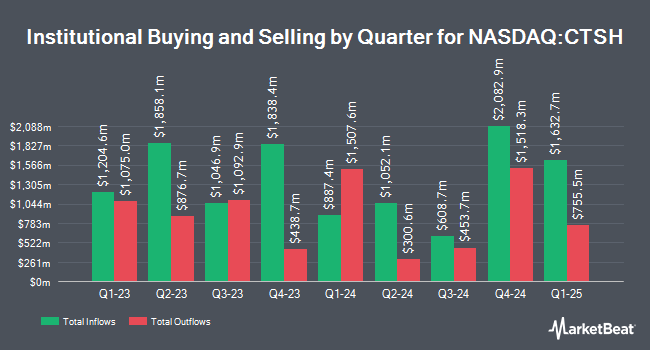

Aberdeen Group plc raised its holdings in shares of Cognizant Technology Solutions Corporation (NASDAQ:CTSH - Free Report) by 6.4% in the 2nd quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 438,507 shares of the information technology service provider's stock after acquiring an additional 26,241 shares during the quarter. Aberdeen Group plc owned approximately 0.09% of Cognizant Technology Solutions worth $34,111,000 as of its most recent filing with the SEC.

A number of other large investors have also recently made changes to their positions in the company. Mirae Asset Global Investments Co. Ltd. increased its position in Cognizant Technology Solutions by 6.8% during the second quarter. Mirae Asset Global Investments Co. Ltd. now owns 174,287 shares of the information technology service provider's stock worth $13,600,000 after buying an additional 11,037 shares in the last quarter. LBP AM SA purchased a new stake in shares of Cognizant Technology Solutions during the second quarter worth about $8,541,000. Ritholtz Wealth Management increased its position in shares of Cognizant Technology Solutions by 21.0% during the first quarter. Ritholtz Wealth Management now owns 10,531 shares of the information technology service provider's stock worth $806,000 after acquiring an additional 1,827 shares during the last quarter. Envestnet Asset Management Inc. increased its holdings in Cognizant Technology Solutions by 1.4% in the first quarter. Envestnet Asset Management Inc. now owns 500,039 shares of the information technology service provider's stock valued at $38,253,000 after buying an additional 7,105 shares during the last quarter. Finally, Leo Wealth LLC bought a new stake in Cognizant Technology Solutions in the second quarter valued at about $912,000. 92.44% of the stock is owned by institutional investors and hedge funds.

Cognizant Technology Solutions Trading Down 4.1%

Cognizant Technology Solutions stock opened at $65.80 on Monday. The company has a market cap of $32.14 billion, a price-to-earnings ratio of 13.37, a P/E/G ratio of 1.37 and a beta of 0.95. The firm has a 50-day moving average of $69.60 and a 200-day moving average of $74.03. Cognizant Technology Solutions Corporation has a one year low of $65.17 and a one year high of $90.82. The company has a debt-to-equity ratio of 0.04, a current ratio of 2.41 and a quick ratio of 2.41.

Cognizant Technology Solutions (NASDAQ:CTSH - Get Free Report) last released its quarterly earnings results on Wednesday, July 30th. The information technology service provider reported $1.31 earnings per share for the quarter, beating the consensus estimate of $1.26 by $0.05. Cognizant Technology Solutions had a net margin of 11.89% and a return on equity of 16.77%. The firm had revenue of $5.25 billion for the quarter, compared to analysts' expectations of $5.17 billion. During the same period in the prior year, the firm earned $1.17 EPS. The business's revenue was up 8.1% on a year-over-year basis. Cognizant Technology Solutions has set its FY 2025 guidance at 5.080-5.220 EPS. Q3 2025 guidance at EPS. On average, equities analysts expect that Cognizant Technology Solutions Corporation will post 4.98 earnings per share for the current fiscal year.

Cognizant Technology Solutions Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, August 26th. Investors of record on Monday, August 18th were paid a $0.31 dividend. The ex-dividend date of this dividend was Monday, August 18th. This represents a $1.24 annualized dividend and a dividend yield of 1.9%. Cognizant Technology Solutions's payout ratio is currently 25.20%.

Analysts Set New Price Targets

A number of equities analysts recently issued reports on the company. Guggenheim raised Cognizant Technology Solutions from a "neutral" rating to a "buy" rating and set a $90.00 price objective for the company in a report on Friday, July 18th. Weiss Ratings reiterated a "hold (c+)" rating on shares of Cognizant Technology Solutions in a report on Wednesday, October 8th. Deutsche Bank Aktiengesellschaft assumed coverage on Cognizant Technology Solutions in a report on Thursday, July 17th. They set a "hold" rating and a $80.00 target price on the stock. JPMorgan Chase & Co. lowered their price target on Cognizant Technology Solutions from $101.00 to $89.00 and set an "overweight" rating on the stock in a research report on Wednesday, August 20th. Finally, Evercore ISI started coverage on Cognizant Technology Solutions in a report on Thursday, July 17th. They set an "outperform" rating and a $100.00 price objective on the stock. Five analysts have rated the stock with a Buy rating and eleven have issued a Hold rating to the stock. According to MarketBeat.com, Cognizant Technology Solutions presently has an average rating of "Hold" and an average price target of $86.79.

Check Out Our Latest Analysis on CTSH

About Cognizant Technology Solutions

(

Free Report)

Cognizant Technology Solutions Corporation, a professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally. It operates through four segments: Financial Services, Health Sciences, Products and Resources, and Communications, Media and Technology.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cognizant Technology Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cognizant Technology Solutions wasn't on the list.

While Cognizant Technology Solutions currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.