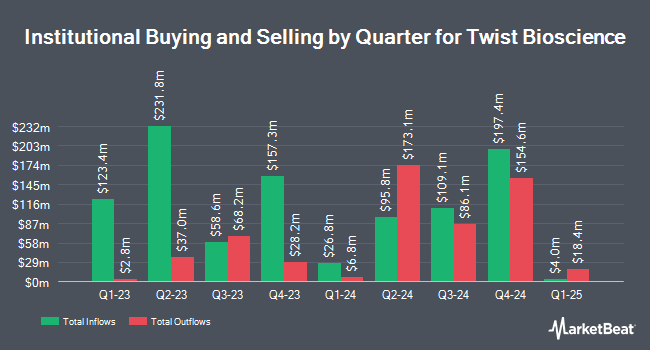

Aberdeen Group plc acquired a new stake in shares of Twist Bioscience Corporation (NASDAQ:TWST - Free Report) in the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund acquired 161,404 shares of the company's stock, valued at approximately $5,938,000. Aberdeen Group plc owned 0.27% of Twist Bioscience as of its most recent SEC filing.

Other institutional investors also recently made changes to their positions in the company. GAMMA Investing LLC grew its stake in shares of Twist Bioscience by 68.1% during the 1st quarter. GAMMA Investing LLC now owns 748 shares of the company's stock valued at $29,000 after buying an additional 303 shares during the period. Mirae Asset Global Investments Co. Ltd. grew its stake in shares of Twist Bioscience by 15.0% during the 2nd quarter. Mirae Asset Global Investments Co. Ltd. now owns 2,315 shares of the company's stock valued at $85,000 after buying an additional 302 shares during the period. Bayforest Capital Ltd grew its stake in shares of Twist Bioscience by 49.3% during the 1st quarter. Bayforest Capital Ltd now owns 4,860 shares of the company's stock valued at $191,000 after buying an additional 1,604 shares during the period. Hsbc Holdings PLC purchased a new stake in shares of Twist Bioscience during the 1st quarter valued at $228,000. Finally, Xponance Inc. grew its stake in shares of Twist Bioscience by 22.0% during the 1st quarter. Xponance Inc. now owns 5,953 shares of the company's stock valued at $234,000 after buying an additional 1,072 shares during the period.

Twist Bioscience Stock Performance

NASDAQ:TWST opened at $30.75 on Friday. The company has a debt-to-equity ratio of 0.03, a current ratio of 3.90 and a quick ratio of 3.60. The firm has a 50-day moving average of $27.93 and a two-hundred day moving average of $32.38. The stock has a market cap of $1.86 billion, a P/E ratio of -21.21 and a beta of 2.38. Twist Bioscience Corporation has a 1-year low of $24.07 and a 1-year high of $55.33.

Twist Bioscience (NASDAQ:TWST - Get Free Report) last posted its quarterly earnings data on Monday, August 4th. The company reported ($0.47) earnings per share for the quarter, beating analysts' consensus estimates of ($0.54) by $0.07. The company had revenue of $96.06 million during the quarter, compared to analysts' expectations of $95.52 million. Twist Bioscience had a negative net margin of 23.51% and a negative return on equity of 29.03%. Twist Bioscience has set its FY 2025 guidance at EPS. Q4 2025 guidance at EPS. On average, research analysts expect that Twist Bioscience Corporation will post -2.12 earnings per share for the current fiscal year.

Insider Buying and Selling

In other Twist Bioscience news, CAO Robert F. Werner sold 2,041 shares of the company's stock in a transaction dated Monday, October 6th. The shares were sold at an average price of $32.19, for a total value of $65,699.79. Following the completion of the transaction, the chief accounting officer directly owned 46,413 shares of the company's stock, valued at $1,494,034.47. This represents a 4.21% decrease in their position. The transaction was disclosed in a filing with the SEC, which is available at the SEC website. Also, SVP Paula Green sold 9,724 shares of the stock in a transaction dated Monday, October 6th. The stock was sold at an average price of $32.19, for a total transaction of $313,015.56. Following the transaction, the senior vice president directly owned 114,678 shares in the company, valued at $3,691,484.82. The trade was a 7.82% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 64,368 shares of company stock worth $2,036,204 over the last quarter. Company insiders own 3.01% of the company's stock.

Wall Street Analyst Weigh In

A number of analysts recently weighed in on TWST shares. Evercore ISI decreased their price target on shares of Twist Bioscience from $46.00 to $42.00 and set an "outperform" rating for the company in a research report on Tuesday, October 7th. Cowen reaffirmed a "buy" rating on shares of Twist Bioscience in a research report on Monday, August 4th. Barclays decreased their price target on shares of Twist Bioscience from $45.00 to $40.00 and set an "overweight" rating for the company in a research report on Thursday, October 2nd. Finally, Weiss Ratings reaffirmed a "sell (d-)" rating on shares of Twist Bioscience in a research report on Wednesday, October 8th. Nine equities research analysts have rated the stock with a Buy rating and two have issued a Sell rating to the company. According to data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $48.56.

Check Out Our Latest Report on Twist Bioscience

Twist Bioscience Profile

(

Free Report)

Twist Bioscience Corporation engages in the manufacture and sale of synthetic DNA-based products. The company offers synthetic genes and gene fragments used in product development for therapeutics, diagnostics, chemicals/materials, food/agriculture, data storage, and various applications within academic research by biotech, pharma, industrial chemical, and agricultural companies, as well as academic labs; Oligo pools used in targeted NGS, CRISPR gene editing, mutagenesis experiments, DNA origami, DNA computing, data storage in DNA, and other applications; and immunoglobulin G proteins for customers focused on the pursuit of drug discovery and development.

Featured Stories

Want to see what other hedge funds are holding TWST? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Twist Bioscience Corporation (NASDAQ:TWST - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Twist Bioscience, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Twist Bioscience wasn't on the list.

While Twist Bioscience currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.