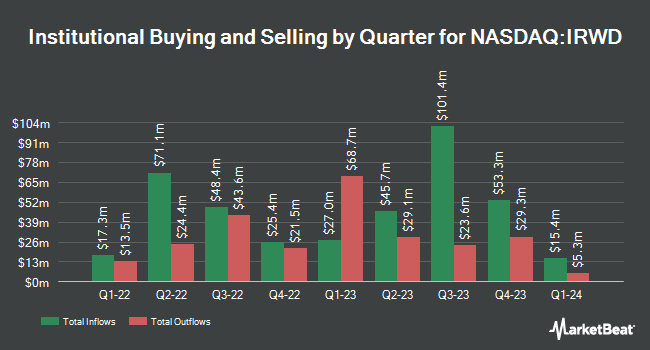

Acadian Asset Management LLC increased its position in shares of Ironwood Pharmaceuticals, Inc. (NASDAQ:IRWD - Free Report) by 160.7% in the first quarter, according to the company in its most recent disclosure with the SEC. The institutional investor owned 2,645,189 shares of the biotechnology company's stock after buying an additional 1,630,726 shares during the quarter. Acadian Asset Management LLC owned 1.63% of Ironwood Pharmaceuticals worth $3,878,000 as of its most recent SEC filing.

Other hedge funds have also modified their holdings of the company. Deutsche Bank AG grew its holdings in shares of Ironwood Pharmaceuticals by 47.4% during the fourth quarter. Deutsche Bank AG now owns 1,567,535 shares of the biotechnology company's stock worth $6,944,000 after buying an additional 504,336 shares in the last quarter. GSA Capital Partners LLP boosted its position in Ironwood Pharmaceuticals by 3,683.6% during the first quarter. GSA Capital Partners LLP now owns 524,676 shares of the biotechnology company's stock valued at $771,000 after purchasing an additional 510,809 shares during the last quarter. Voleon Capital Management LP boosted its position in Ironwood Pharmaceuticals by 952.4% during the first quarter. Voleon Capital Management LP now owns 870,629 shares of the biotechnology company's stock valued at $1,280,000 after purchasing an additional 787,901 shares during the last quarter. Armistice Capital LLC boosted its position in Ironwood Pharmaceuticals by 44.7% during the first quarter. Armistice Capital LLC now owns 13,700,000 shares of the biotechnology company's stock valued at $20,139,000 after purchasing an additional 4,232,000 shares during the last quarter. Finally, Universal Beteiligungs und Servicegesellschaft mbH acquired a new position in Ironwood Pharmaceuticals during the fourth quarter valued at approximately $1,888,000.

Wall Street Analyst Weigh In

Several brokerages recently commented on IRWD. Zacks Research cut Ironwood Pharmaceuticals from a "strong-buy" rating to a "hold" rating in a research report on Friday, September 5th. Wall Street Zen raised Ironwood Pharmaceuticals from a "hold" rating to a "strong-buy" rating in a research report on Saturday, August 9th. One analyst has rated the stock with a Buy rating and six have assigned a Hold rating to the company. According to data from MarketBeat, the company has an average rating of "Hold" and a consensus price target of $4.94.

Read Our Latest Stock Analysis on IRWD

Ironwood Pharmaceuticals Trading Down 3.4%

Shares of IRWD traded down $0.05 during mid-day trading on Friday, reaching $1.41. The company's stock had a trading volume of 2,969,741 shares, compared to its average volume of 1,262,749. Ironwood Pharmaceuticals, Inc. has a 1-year low of $0.53 and a 1-year high of $5.13. The stock has a market cap of $229.03 million, a P/E ratio of -28.19 and a beta of 0.33. The business has a 50-day simple moving average of $1.04 and a two-hundred day simple moving average of $0.96.

Ironwood Pharmaceuticals (NASDAQ:IRWD - Get Free Report) last released its quarterly earnings data on Thursday, August 7th. The biotechnology company reported $0.14 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of ($0.02) by $0.16. Ironwood Pharmaceuticals had a negative return on equity of 2.46% and a negative net margin of 2.25%.The company had revenue of $85.24 million during the quarter, compared to analysts' expectations of $62.02 million. Ironwood Pharmaceuticals has set its FY 2025 guidance at EPS. Research analysts anticipate that Ironwood Pharmaceuticals, Inc. will post 0.1 EPS for the current year.

Ironwood Pharmaceuticals Profile

(

Free Report)

Ironwood Pharmaceuticals, Inc, a healthcare company, focuses on the development and commercialization of gastrointestinal (GI) products. It markets linaclotide, a guanylate cyclase type-C (GC-C) agonist for the treatment of adults suffering from irritable bowel syndrome with constipation or chronic idiopathic constipation under the LINZESS name in the United States, Mexico, Japan, Saudi Arabia, and China, as well as under the CONSTELLA name in the Canada and European countries.

Further Reading

Before you consider Ironwood Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ironwood Pharmaceuticals wasn't on the list.

While Ironwood Pharmaceuticals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.