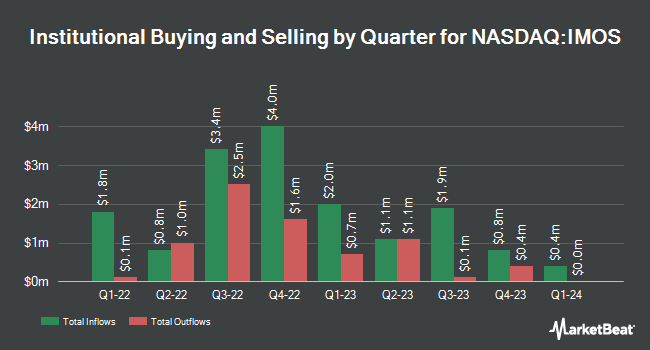

Acadian Asset Management LLC grew its position in shares of Chipmos Technologies (NASDAQ:IMOS - Free Report) by 14.5% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 250,695 shares of the semiconductor company's stock after buying an additional 31,768 shares during the quarter. Acadian Asset Management LLC owned 0.69% of Chipmos Technologies worth $4,206,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

Several other hedge funds and other institutional investors have also recently modified their holdings of IMOS. Wealthquest Corp purchased a new stake in shares of Chipmos Technologies in the 1st quarter worth $52,000. Bank of America Corp DE increased its stake in shares of Chipmos Technologies by 8.6% in the 4th quarter. Bank of America Corp DE now owns 8,613 shares of the semiconductor company's stock worth $162,000 after purchasing an additional 679 shares in the last quarter. Finally, Envestnet Asset Management Inc. increased its stake in shares of Chipmos Technologies by 35.4% in the 1st quarter. Envestnet Asset Management Inc. now owns 55,886 shares of the semiconductor company's stock worth $941,000 after purchasing an additional 14,620 shares in the last quarter. 7.39% of the stock is owned by institutional investors.

Chipmos Technologies Trading Up 0.1%

NASDAQ IMOS traded up $0.02 during trading on Friday, hitting $19.38. The stock had a trading volume of 19,327 shares, compared to its average volume of 16,137. The company has a debt-to-equity ratio of 0.39, a quick ratio of 1.97 and a current ratio of 2.29. The stock has a market capitalization of $694.97 million, a price-to-earnings ratio of 215.33 and a beta of 1.02. Chipmos Technologies has a one year low of $12.78 and a one year high of $23.85. The stock has a 50 day simple moving average of $17.19 and a 200 day simple moving average of $17.60.

Chipmos Technologies (NASDAQ:IMOS - Get Free Report) last announced its quarterly earnings data on Tuesday, August 12th. The semiconductor company reported ($0.51) earnings per share (EPS) for the quarter, missing the consensus estimate of $0.29 by ($0.80). The firm had revenue of $188.55 million during the quarter, compared to the consensus estimate of $5.82 billion. Chipmos Technologies had a return on equity of 0.47% and a net margin of 0.50%.The firm's revenue for the quarter was down 1.3% compared to the same quarter last year. During the same period last year, the company earned $0.38 EPS.

Chipmos Technologies declared that its board has initiated a stock buyback program on Tuesday, September 2nd that permits the company to repurchase $0.00 in outstanding shares. This repurchase authorization permits the semiconductor company to repurchase shares of its stock through open market purchases. Shares repurchase programs are usually a sign that the company's management believes its shares are undervalued.

Analyst Ratings Changes

Separately, Wall Street Zen upgraded Chipmos Technologies from a "sell" rating to a "hold" rating in a research note on Saturday, September 13th.

Read Our Latest Stock Report on Chipmos Technologies

Chipmos Technologies Profile

(

Free Report)

ChipMOS TECHNOLOGIES INC. engages in the research, development, manufacture, and sale of high-integration and high-precision integrated circuits, and related assembly and testing services in the People's Republic of China, Taiwan, Japan, Singapore, and internationally. It operates through Testing; Assembly; Testing and Assembly for LCD, OLED and Other Display Panel Driver Semiconductors; Bumping; and Others segments.

Read More

Before you consider Chipmos Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chipmos Technologies wasn't on the list.

While Chipmos Technologies currently has a Sell rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.