Acadian Asset Management LLC lessened its holdings in shares of Silver Standard Resources Inc. (NASDAQ:SSRM - Free Report) TSE: SSO by 48.9% in the 1st quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The fund owned 1,376,348 shares of the basic materials company's stock after selling 1,318,314 shares during the period. Acadian Asset Management LLC owned approximately 0.68% of Silver Standard Resources worth $13,791,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

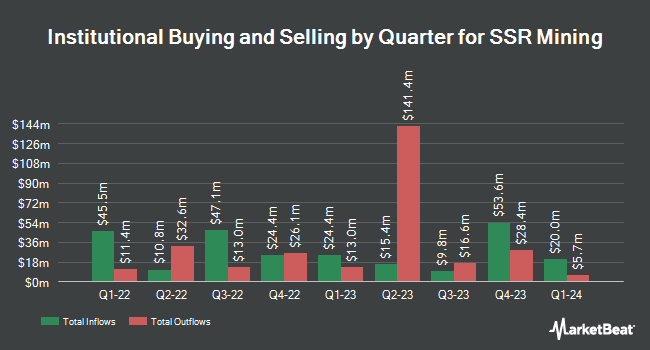

Several other institutional investors have also recently made changes to their positions in SSRM. Towarzystwo Funduszy Inwestycyjnych Allianz Polska S.A. acquired a new stake in Silver Standard Resources during the fourth quarter valued at $156,000. Northern Trust Corp grew its position in Silver Standard Resources by 7.1% during the fourth quarter. Northern Trust Corp now owns 1,342,744 shares of the basic materials company's stock valued at $9,345,000 after buying an additional 89,155 shares during the period. Deutsche Bank AG grew its position in shares of Silver Standard Resources by 23.5% in the fourth quarter. Deutsche Bank AG now owns 363,494 shares of the basic materials company's stock valued at $2,530,000 after purchasing an additional 69,124 shares during the period. OMERS ADMINISTRATION Corp acquired a new stake in shares of Silver Standard Resources in the fourth quarter valued at about $246,000. Finally, Quantinno Capital Management LP grew its position in shares of Silver Standard Resources by 59.0% in the fourth quarter. Quantinno Capital Management LP now owns 49,451 shares of the basic materials company's stock valued at $344,000 after purchasing an additional 18,344 shares during the period. Hedge funds and other institutional investors own 68.30% of the company's stock.

Silver Standard Resources Price Performance

SSRM traded up $0.44 on Wednesday, reaching $21.98. 1,280,651 shares of the company's stock were exchanged, compared to its average volume of 2,802,875. The company has a debt-to-equity ratio of 0.03, a current ratio of 2.39 and a quick ratio of 1.20. The stock's fifty day moving average price is $16.10 and its 200-day moving average price is $12.90. Silver Standard Resources Inc. has a twelve month low of $5.06 and a twelve month high of $23.07. The stock has a market cap of $4.46 billion, a PE ratio of 28.07 and a beta of -0.08.

Silver Standard Resources (NASDAQ:SSRM - Get Free Report) TSE: SSO last issued its earnings results on Tuesday, August 5th. The basic materials company reported $0.51 EPS for the quarter, topping analysts' consensus estimates of $0.23 by $0.28. Silver Standard Resources had a net margin of 12.66% and a return on equity of 4.99%. The company had revenue of $410.54 million for the quarter, compared to the consensus estimate of $381.08 million. Sell-side analysts expect that Silver Standard Resources Inc. will post 0.73 EPS for the current year.

Analyst Ratings Changes

Several analysts have recently issued reports on SSRM shares. Wall Street Zen upgraded shares of Silver Standard Resources from a "buy" rating to a "strong-buy" rating in a research report on Saturday, July 26th. BMO Capital Markets started coverage on shares of Silver Standard Resources in a research report on Friday, July 18th. They issued a "market perform" rating and a $13.50 target price on the stock. UBS Group upgraded shares of Silver Standard Resources from a "neutral" rating to a "buy" rating and lifted their target price for the company from $13.85 to $18.95 in a research report on Friday, August 15th. Finally, Zacks Research lowered shares of Silver Standard Resources from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, September 9th. One analyst has rated the stock with a Buy rating and six have assigned a Hold rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Hold" and an average target price of $12.55.

Check Out Our Latest Report on Silver Standard Resources

About Silver Standard Resources

(

Free Report)

SSR Mining Inc, together with its subsidiaries, engages in the operation, acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina. The company explores for gold doré, copper, silver, lead, and zinc deposits. Its mines include the Çöpler, located in Erzincan province, Turkey; the Marigold, located in Nevada, the United States; the Seabee, located in Saskatchewan, Canada; and the Puna, located in Jujuy province, Argentina.

See Also

Before you consider Silver Standard Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Silver Standard Resources wasn't on the list.

While Silver Standard Resources currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.