Acadian Asset Management LLC lessened its holdings in Grand Canyon Education, Inc. (NASDAQ:LOPE - Free Report) by 8.1% during the 1st quarter, according to its most recent filing with the Securities & Exchange Commission. The fund owned 190,865 shares of the company's stock after selling 16,932 shares during the quarter. Acadian Asset Management LLC owned approximately 0.67% of Grand Canyon Education worth $33,011,000 as of its most recent filing with the Securities & Exchange Commission.

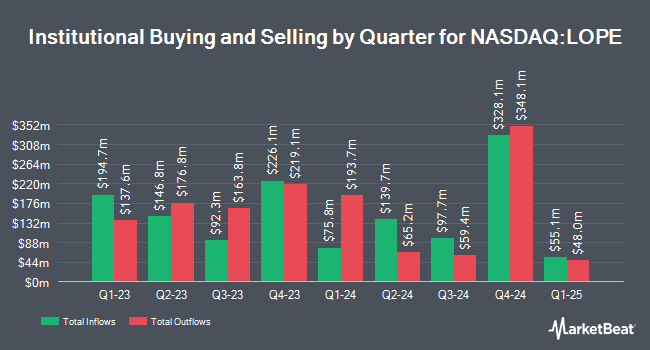

Several other hedge funds also recently bought and sold shares of the business. Pallas Capital Advisors LLC grew its position in Grand Canyon Education by 5.0% in the 1st quarter. Pallas Capital Advisors LLC now owns 1,355 shares of the company's stock valued at $234,000 after acquiring an additional 65 shares during the last quarter. Diversified Trust Co lifted its holdings in shares of Grand Canyon Education by 5.4% in the 1st quarter. Diversified Trust Co now owns 1,293 shares of the company's stock worth $224,000 after buying an additional 66 shares during the period. Synovus Financial Corp lifted its holdings in shares of Grand Canyon Education by 2.8% in the 1st quarter. Synovus Financial Corp now owns 2,476 shares of the company's stock worth $428,000 after buying an additional 68 shares during the period. Benjamin Edwards Inc. lifted its holdings in shares of Grand Canyon Education by 2.9% in the 1st quarter. Benjamin Edwards Inc. now owns 2,683 shares of the company's stock worth $464,000 after buying an additional 75 shares during the period. Finally, Migdal Insurance & Financial Holdings Ltd. lifted its holdings in shares of Grand Canyon Education by 58.2% in the 1st quarter. Migdal Insurance & Financial Holdings Ltd. now owns 261 shares of the company's stock worth $45,000 after buying an additional 96 shares during the period. Institutional investors own 94.17% of the company's stock.

Grand Canyon Education Price Performance

Shares of NASDAQ LOPE opened at $202.49 on Thursday. The stock has a market capitalization of $5.69 billion, a P/E ratio of 24.51, a price-to-earnings-growth ratio of 1.51 and a beta of 0.80. Grand Canyon Education, Inc. has a 1-year low of $130.69 and a 1-year high of $207.22. The business has a fifty day moving average price of $186.84 and a 200 day moving average price of $183.48.

Grand Canyon Education (NASDAQ:LOPE - Get Free Report) last issued its quarterly earnings data on Wednesday, August 6th. The company reported $1.53 earnings per share for the quarter, topping analysts' consensus estimates of $1.37 by $0.16. The firm had revenue of $247.50 million during the quarter, compared to analysts' expectations of $240.90 million. Grand Canyon Education had a return on equity of 31.50% and a net margin of 22.15%.The firm's quarterly revenue was up 8.8% on a year-over-year basis. During the same period in the prior year, the business posted $1.19 EPS. As a group, equities research analysts anticipate that Grand Canyon Education, Inc. will post 8.81 earnings per share for the current fiscal year.

Analyst Ratings Changes

LOPE has been the subject of several research reports. BMO Capital Markets lowered their target price on Grand Canyon Education from $222.00 to $210.00 and set an "outperform" rating for the company in a report on Monday, July 7th. Wall Street Zen upgraded Grand Canyon Education from a "hold" rating to a "buy" rating in a report on Saturday, August 9th. Finally, Barrington Research reiterated an "outperform" rating and issued a $215.00 target price on shares of Grand Canyon Education in a report on Thursday, August 7th. Three analysts have rated the stock with a Buy rating, Based on data from MarketBeat, the stock currently has a consensus rating of "Buy" and an average target price of $203.67.

View Our Latest Stock Analysis on LOPE

About Grand Canyon Education

(

Free Report)

Grand Canyon Education, Inc provides education services to colleges and universities in the United States. It offers technology services, including learning management system, internal administration, infrastructure, and support services; academic services, such as program and curriculum, faculty and related training and development, class scheduling, and skills and simulation lab sites; and counseling services and support services comprising admission, financial aid, and field experience and other counseling services.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Grand Canyon Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grand Canyon Education wasn't on the list.

While Grand Canyon Education currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.