Advance Capital Management Inc. trimmed its position in shares of Invesco QQQ (NASDAQ:QQQ - Free Report) by 13.6% in the 2nd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 7,259 shares of the exchange traded fund's stock after selling 1,139 shares during the quarter. Advance Capital Management Inc.'s holdings in Invesco QQQ were worth $4,004,000 at the end of the most recent reporting period.

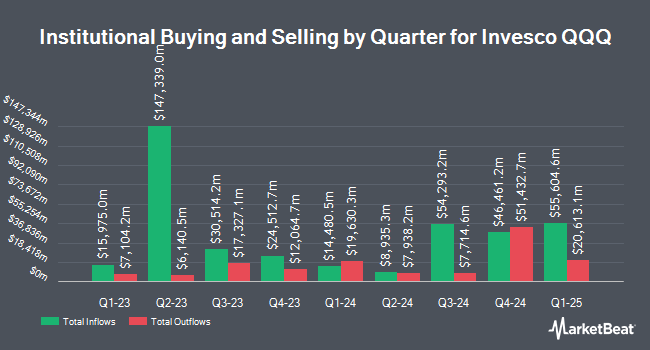

Other institutional investors and hedge funds have also recently modified their holdings of the company. Compass Financial Services Inc grew its holdings in Invesco QQQ by 0.4% in the first quarter. Compass Financial Services Inc now owns 5,001 shares of the exchange traded fund's stock worth $2,345,000 after purchasing an additional 19 shares during the last quarter. Willis Johnson & Associates Inc. lifted its holdings in shares of Invesco QQQ by 2.6% during the 4th quarter. Willis Johnson & Associates Inc. now owns 814 shares of the exchange traded fund's stock valued at $416,000 after purchasing an additional 21 shares during the last quarter. MTM Investment Management LLC lifted its holdings in shares of Invesco QQQ by 1.6% during the 1st quarter. MTM Investment Management LLC now owns 1,297 shares of the exchange traded fund's stock valued at $613,000 after purchasing an additional 21 shares during the last quarter. Cutler Investment Counsel LLC boosted its position in shares of Invesco QQQ by 1.4% in the 1st quarter. Cutler Investment Counsel LLC now owns 1,513 shares of the exchange traded fund's stock worth $710,000 after purchasing an additional 21 shares in the last quarter. Finally, Mosaic Family Wealth Partners LLC raised its stake in Invesco QQQ by 1.6% in the fourth quarter. Mosaic Family Wealth Partners LLC now owns 1,382 shares of the exchange traded fund's stock valued at $707,000 after buying an additional 22 shares during the last quarter. Hedge funds and other institutional investors own 44.58% of the company's stock.

Invesco QQQ Stock Performance

QQQ opened at $586.66 on Monday. The firm's 50-day moving average price is $568.24 and its 200-day moving average price is $520.68. Invesco QQQ has a 52-week low of $402.39 and a 52-week high of $587.86.

Invesco QQQ Cuts Dividend

The firm also recently announced a quarterly dividend, which was paid on Thursday, July 31st. Investors of record on Monday, June 23rd were issued a dividend of $0.5911 per share. This represents a $2.36 annualized dividend and a dividend yield of 0.4%. The ex-dividend date of this dividend was Monday, June 23rd.

Invesco QQQ Profile

(

Free Report)

PowerShares QQQ Trust, Series 1 is a unit investment trust that issues securities called Nasdaq-100 Index Tracking Stock. The Trust's investment objective is to provide investment results that generally correspond to the price and yield performance of the Nasdaq-100 Index. The Trust provides investors with the opportunity to purchase units of beneficial interest in the Trust representing proportionate undivided interests in the portfolio of securities held by the Trust, which consists of substantially all of the securities, in substantially the same weighting, as the component securities of the Nasdaq-100 Index.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Invesco QQQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Invesco QQQ wasn't on the list.

While Invesco QQQ currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.