Advisors Asset Management Inc. acquired a new stake in Cable One, Inc. (NYSE:CABO - Free Report) in the 1st quarter, according to its most recent Form 13F filing with the SEC. The institutional investor acquired 5,854 shares of the company's stock, valued at approximately $1,556,000. Advisors Asset Management Inc. owned about 0.10% of Cable One as of its most recent filing with the SEC.

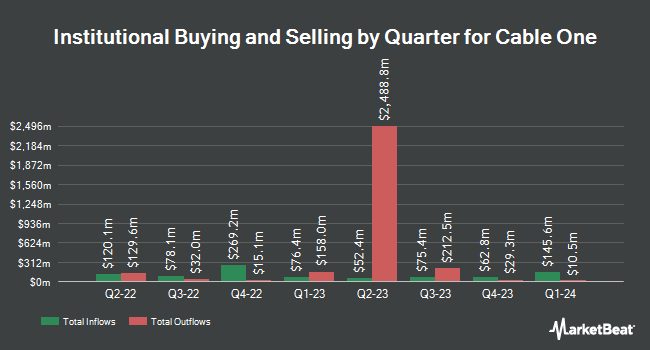

Other hedge funds have also recently added to or reduced their stakes in the company. Meeder Asset Management Inc. acquired a new position in Cable One in the 1st quarter valued at $30,000. Brooklyn Investment Group increased its stake in shares of Cable One by 5,233.3% in the 1st quarter. Brooklyn Investment Group now owns 160 shares of the company's stock worth $43,000 after acquiring an additional 157 shares during the last quarter. Farther Finance Advisors LLC increased its stake in shares of Cable One by 1,435.7% in the 1st quarter. Farther Finance Advisors LLC now owns 215 shares of the company's stock worth $58,000 after acquiring an additional 201 shares during the last quarter. Spire Wealth Management increased its stake in shares of Cable One by 21.3% in the 1st quarter. Spire Wealth Management now owns 382 shares of the company's stock worth $102,000 after acquiring an additional 67 shares during the last quarter. Finally, Ancora Advisors LLC increased its stake in shares of Cable One by 26.9% in the 1st quarter. Ancora Advisors LLC now owns 825 shares of the company's stock worth $219,000 after acquiring an additional 175 shares during the last quarter. 89.92% of the stock is owned by institutional investors and hedge funds.

Cable One Trading Down 2.9%

Shares of NYSE:CABO traded down $5.21 during midday trading on Friday, reaching $172.47. 189,097 shares of the company's stock were exchanged, compared to its average volume of 115,560. The firm's 50 day simple moving average is $146.99 and its two-hundred day simple moving average is $184.49. The company has a debt-to-equity ratio of 2.16, a current ratio of 0.37 and a quick ratio of 0.37. The stock has a market cap of $970.99 million, a price-to-earnings ratio of -1.95 and a beta of 0.81. Cable One, Inc. has a fifty-two week low of $117.54 and a fifty-two week high of $436.99.

Cable One (NYSE:CABO - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The company reported $3.23 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $8.23 by ($5.00). The business had revenue of $381.07 million for the quarter, compared to analyst estimates of $379.81 million. Cable One had a positive return on equity of 8.40% and a negative net margin of 32.18%.During the same period in the previous year, the business posted $10.29 earnings per share. As a group, sell-side analysts forecast that Cable One, Inc. will post 32.08 EPS for the current fiscal year.

Analysts Set New Price Targets

CABO has been the subject of a number of recent research reports. BNP Paribas Exane raised Cable One from an "underperform" rating to a "neutral" rating and set a $125.00 target price for the company in a research note on Monday, June 16th. BNP Paribas raised Cable One from a "strong sell" rating to a "hold" rating in a research note on Monday, June 16th. Finally, Wells Fargo & Company cut their target price on Cable One from $210.00 to $120.00 and set an "underweight" rating for the company in a research note on Friday, August 1st. Five research analysts have rated the stock with a Hold rating and one has issued a Sell rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Reduce" and a consensus target price of $279.25.

Read Our Latest Research Report on CABO

About Cable One

(

Free Report)

Cable One, Inc, together with its subsidiaries, provides data, video, and voice services in the United States. The company offers residential data services, a service to enhance Wi-Fi signal throughout the home. It also provides various residential video services from basic video service to digital services with access to hundreds of channels; and provides a cloud-based DVR feature that does not require the use of a set-top boxes.

Featured Stories

Before you consider Cable One, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cable One wasn't on the list.

While Cable One currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.