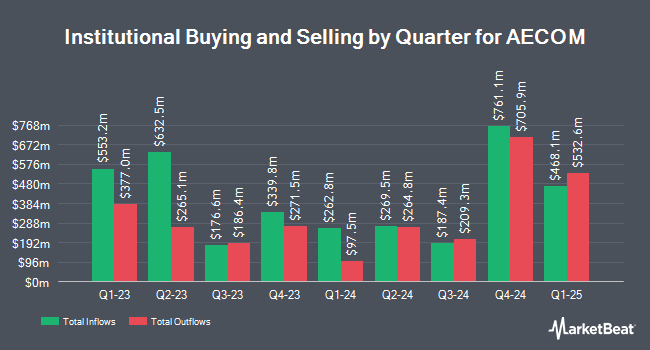

Edgestream Partners L.P. grew its stake in shares of AECOM (NYSE:ACM - Free Report) by 52.9% in the first quarter, according to its most recent filing with the SEC. The institutional investor owned 57,724 shares of the construction company's stock after purchasing an additional 19,975 shares during the period. Edgestream Partners L.P.'s holdings in AECOM were worth $5,353,000 as of its most recent filing with the SEC.

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in ACM. Norges Bank bought a new stake in AECOM during the 4th quarter worth approximately $190,495,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC increased its holdings in AECOM by 34.7% during the 4th quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 2,680,258 shares of the construction company's stock worth $286,305,000 after purchasing an additional 691,020 shares in the last quarter. Northern Trust Corp increased its holdings in AECOM by 53.5% during the 4th quarter. Northern Trust Corp now owns 1,664,893 shares of the construction company's stock worth $177,844,000 after purchasing an additional 580,078 shares in the last quarter. Alliancebernstein L.P. increased its holdings in AECOM by 11.2% during the 4th quarter. Alliancebernstein L.P. now owns 3,718,371 shares of the construction company's stock worth $397,196,000 after purchasing an additional 373,991 shares in the last quarter. Finally, Sandhill Capital Partners LLC bought a new stake in AECOM during the 4th quarter worth approximately $36,933,000. 85.41% of the stock is owned by institutional investors.

AECOM Stock Performance

Shares of NYSE ACM traded up $0.15 during trading on Wednesday, reaching $113.20. 886,916 shares of the stock traded hands, compared to its average volume of 921,749. AECOM has a 52-week low of $84.75 and a 52-week high of $118.56. The company has a debt-to-equity ratio of 1.00, a current ratio of 1.15 and a quick ratio of 1.15. The company has a 50-day moving average of $110.95 and a 200-day moving average of $103.66. The stock has a market capitalization of $14.98 billion, a P/E ratio of 24.66, a price-to-earnings-growth ratio of 1.83 and a beta of 0.96.

AECOM (NYSE:ACM - Get Free Report) last posted its quarterly earnings results on Monday, May 5th. The construction company reported $1.25 EPS for the quarter, topping analysts' consensus estimates of $1.15 by $0.10. AECOM had a return on equity of 27.67% and a net margin of 3.85%. The firm had revenue of $3.77 billion during the quarter, compared to analyst estimates of $4.18 billion. During the same period last year, the company earned $1.04 earnings per share. The business's revenue for the quarter was up 2.6% on a year-over-year basis. Analysts forecast that AECOM will post 5.1 EPS for the current fiscal year.

AECOM Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Friday, July 18th. Stockholders of record on Wednesday, July 2nd will be issued a $0.26 dividend. This represents a $1.04 dividend on an annualized basis and a dividend yield of 0.92%. The ex-dividend date of this dividend is Wednesday, July 2nd. AECOM's payout ratio is currently 22.66%.

Wall Street Analysts Forecast Growth

Several research firms have recently issued reports on ACM. Truist Financial reduced their target price on AECOM from $129.00 to $121.00 and set a "buy" rating for the company in a report on Tuesday, April 8th. KeyCorp upped their target price on AECOM from $120.00 to $129.00 and gave the company an "overweight" rating in a report on Wednesday. Royal Bank Of Canada upped their target price on AECOM from $123.00 to $126.00 and gave the company an "outperform" rating in a report on Wednesday, May 7th. Citigroup increased their price objective on AECOM from $116.00 to $122.00 and gave the company a "buy" rating in a report on Wednesday, May 7th. Finally, Robert W. Baird boosted their target price on AECOM from $108.00 to $118.00 and gave the company an "outperform" rating in a research note on Tuesday, May 6th. Eight equities research analysts have rated the stock with a buy rating, According to MarketBeat, the stock has a consensus rating of "Buy" and a consensus price target of $123.71.

Get Our Latest Stock Report on ACM

AECOM Company Profile

(

Free Report)

AECOM, together with its subsidiaries, provides professional infrastructure consulting services worldwide. It operates in three segments: Americas, International, and AECOM Capital. The company offers planning, consulting, architectural and engineering design, construction and program management, and investment and development services to public and private clients.

Further Reading

Before you consider AECOM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AECOM wasn't on the list.

While AECOM currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.