Dimensional Fund Advisors LP grew its stake in shares of AGCO Corporation (NYSE:AGCO - Free Report) by 12.1% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 3,346,046 shares of the industrial products company's stock after purchasing an additional 361,965 shares during the period. Dimensional Fund Advisors LP owned approximately 4.49% of AGCO worth $309,745,000 as of its most recent filing with the Securities and Exchange Commission.

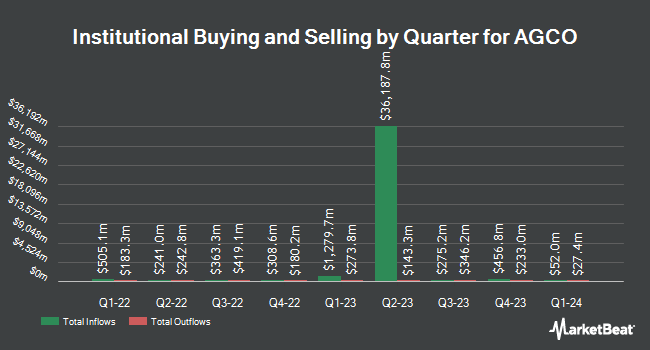

Other institutional investors have also recently made changes to their positions in the company. Teacher Retirement System of Texas acquired a new position in shares of AGCO during the first quarter valued at about $1,212,000. GAMMA Investing LLC raised its holdings in shares of AGCO by 66.9% during the first quarter. GAMMA Investing LLC now owns 908 shares of the industrial products company's stock valued at $84,000 after purchasing an additional 364 shares during the period. Envestnet Asset Management Inc. increased its position in shares of AGCO by 9.0% during the first quarter. Envestnet Asset Management Inc. now owns 99,951 shares of the industrial products company's stock worth $9,252,000 after acquiring an additional 8,293 shares in the last quarter. UMB Bank n.a. increased its position in shares of AGCO by 140.7% during the first quarter. UMB Bank n.a. now owns 811 shares of the industrial products company's stock worth $75,000 after acquiring an additional 474 shares in the last quarter. Finally, Baker Ellis Asset Management LLC increased its position in shares of AGCO by 9.0% during the first quarter. Baker Ellis Asset Management LLC now owns 29,934 shares of the industrial products company's stock worth $2,771,000 after acquiring an additional 2,480 shares in the last quarter. Institutional investors and hedge funds own 78.80% of the company's stock.

Insider Buying and Selling at AGCO

In other news, SVP Luis Fernando Sartini Felli sold 10,000 shares of the stock in a transaction that occurred on Monday, August 11th. The shares were sold at an average price of $109.40, for a total transaction of $1,094,000.00. Following the completion of the transaction, the senior vice president directly owned 16,189 shares of the company's stock, valued at $1,771,076.60. This represents a 38.18% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. 16.90% of the stock is owned by corporate insiders.

Wall Street Analyst Weigh In

AGCO has been the subject of several recent research reports. Wall Street Zen raised shares of AGCO from a "hold" rating to a "buy" rating in a research report on Saturday, August 2nd. JPMorgan Chase & Co. boosted their target price on shares of AGCO from $130.00 to $137.00 and gave the stock an "overweight" rating in a research report on Friday, August 1st. UBS Group reissued a "neutral" rating and set a $119.00 target price (up from $100.00) on shares of AGCO in a research report on Friday, August 8th. Morgan Stanley boosted their target price on shares of AGCO from $75.00 to $84.00 and gave the stock an "underweight" rating in a research report on Monday, May 12th. Finally, Oppenheimer boosted their target price on shares of AGCO from $108.00 to $115.00 and gave the stock an "outperform" rating in a research report on Tuesday, July 15th. Three equities research analysts have rated the stock with a Buy rating, five have assigned a Hold rating and one has issued a Sell rating to the stock. According to data from MarketBeat, the stock has an average rating of "Hold" and an average target price of $109.63.

View Our Latest Report on AGCO

AGCO Stock Up 0.3%

NYSE:AGCO traded up $0.3160 on Tuesday, hitting $113.4960. The stock had a trading volume of 630,746 shares, compared to its average volume of 958,904. The company has a debt-to-equity ratio of 0.66, a quick ratio of 0.67 and a current ratio of 1.48. The stock has a market cap of $8.47 billion, a P/E ratio of 84.70, a price-to-earnings-growth ratio of 1.78 and a beta of 1.21. AGCO Corporation has a 1 year low of $73.79 and a 1 year high of $121.16. The firm's fifty day simple moving average is $108.24 and its two-hundred day simple moving average is $99.40.

AGCO (NYSE:AGCO - Get Free Report) last posted its quarterly earnings data on Thursday, July 31st. The industrial products company reported $1.35 EPS for the quarter, beating the consensus estimate of $1.06 by $0.29. The firm had revenue of $2.64 billion during the quarter, compared to analyst estimates of $2.52 billion. AGCO had a net margin of 0.98% and a return on equity of 8.27%. The company's revenue for the quarter was down 18.8% on a year-over-year basis. During the same quarter last year, the business posted $2.53 EPS. AGCO has set its FY 2025 guidance at 4.750-5.00 EPS. Analysts predict that AGCO Corporation will post 4.2 earnings per share for the current year.

AGCO declared that its board has authorized a share buyback plan on Wednesday, July 9th that authorizes the company to buyback $1.00 billion in shares. This buyback authorization authorizes the industrial products company to repurchase up to 12.2% of its shares through open market purchases. Shares buyback plans are often a sign that the company's leadership believes its shares are undervalued.

AGCO Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Monday, September 15th. Stockholders of record on Friday, August 15th will be given a dividend of $0.29 per share. This represents a $1.16 dividend on an annualized basis and a dividend yield of 1.0%. The ex-dividend date of this dividend is Friday, August 15th. AGCO's dividend payout ratio is currently 86.57%.

About AGCO

(

Free Report)

AGCO Corporation manufactures and distributes agricultural equipment and related replacement parts worldwide. It offers horsepower tractors for row crop production, soil cultivation, planting, land leveling, seeding, and commercial hay operations; utility tractors for small- and medium-sized farms, as well as for dairy, livestock, orchards, and vineyards; and compact tractors for small farms, specialty agricultural industries, landscaping, equestrian, and residential uses.

Featured Articles

Before you consider AGCO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AGCO wasn't on the list.

While AGCO currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.