AGF Management Ltd. raised its position in Wyndham Hotels & Resorts (NYSE:WH - Free Report) by 520.3% during the first quarter, according to the company in its most recent disclosure with the SEC. The firm owned 164,733 shares of the company's stock after acquiring an additional 138,177 shares during the quarter. AGF Management Ltd. owned approximately 0.21% of Wyndham Hotels & Resorts worth $14,910,000 at the end of the most recent quarter.

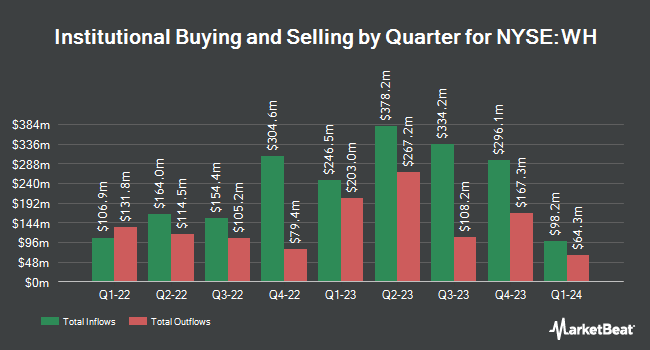

Other institutional investors also recently bought and sold shares of the company. Quarry LP bought a new stake in Wyndham Hotels & Resorts during the 4th quarter valued at approximately $41,000. FIL Ltd increased its holdings in shares of Wyndham Hotels & Resorts by 226.6% in the 4th quarter. FIL Ltd now owns 454 shares of the company's stock worth $46,000 after buying an additional 315 shares during the last quarter. Versant Capital Management Inc raised its position in Wyndham Hotels & Resorts by 139.2% during the first quarter. Versant Capital Management Inc now owns 531 shares of the company's stock valued at $48,000 after purchasing an additional 309 shares during the period. First Horizon Advisors Inc. boosted its holdings in shares of Wyndham Hotels & Resorts by 36.1% in the 1st quarter. First Horizon Advisors Inc. now owns 626 shares of the company's stock worth $57,000 after purchasing an additional 166 shares during the period. Finally, State of Wyoming purchased a new position in shares of Wyndham Hotels & Resorts in the 4th quarter worth approximately $69,000. Institutional investors own 93.46% of the company's stock.

Wyndham Hotels & Resorts Price Performance

Shares of NYSE:WH traded down $0.84 during trading on Friday, reaching $87.93. The stock had a trading volume of 868,534 shares, compared to its average volume of 1,041,762. The company has a debt-to-equity ratio of 4.44, a quick ratio of 1.03 and a current ratio of 1.03. The business has a fifty day moving average price of $84.78 and a 200-day moving average price of $89.79. The stock has a market cap of $6.71 billion, a PE ratio of 20.54, a PEG ratio of 1.60 and a beta of 0.99. Wyndham Hotels & Resorts has a 1-year low of $74.65 and a 1-year high of $113.07.

Wyndham Hotels & Resorts (NYSE:WH - Get Free Report) last posted its quarterly earnings results on Wednesday, July 23rd. The company reported $1.33 EPS for the quarter, beating the consensus estimate of $1.16 by $0.17. Wyndham Hotels & Resorts had a return on equity of 60.79% and a net margin of 23.10%. The firm had revenue of $397.00 million during the quarter, compared to analysts' expectations of $384.69 million. During the same quarter last year, the firm earned $1.13 earnings per share. The business's revenue for the quarter was up 8.2% on a year-over-year basis. On average, equities analysts forecast that Wyndham Hotels & Resorts will post 4.79 earnings per share for the current fiscal year.

Wyndham Hotels & Resorts Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Shareholders of record on Monday, September 15th will be paid a dividend of $0.41 per share. This represents a $1.64 annualized dividend and a yield of 1.9%. Wyndham Hotels & Resorts's dividend payout ratio (DPR) is 38.32%.

Wall Street Analysts Forecast Growth

A number of research analysts have recently weighed in on the company. Stifel Nicolaus cut their price objective on Wyndham Hotels & Resorts from $121.00 to $102.75 and set a "buy" rating on the stock in a report on Thursday, May 1st. Barclays lifted their price target on Wyndham Hotels & Resorts from $100.00 to $101.00 and gave the company an "overweight" rating in a research report on Friday, July 25th. Morgan Stanley reiterated an "overweight" rating and set a $105.00 price target on shares of Wyndham Hotels & Resorts in a research report on Tuesday, July 15th. JPMorgan Chase & Co. began coverage on Wyndham Hotels & Resorts in a research report on Monday, June 23rd. They set an "overweight" rating and a $101.00 price target for the company. Finally, Robert W. Baird lifted their price target on Wyndham Hotels & Resorts from $98.00 to $99.00 and gave the company an "outperform" rating in a research report on Friday, July 25th. Two research analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $106.98.

Read Our Latest Stock Report on WH

Wyndham Hotels & Resorts Profile

(

Free Report)

Wyndham Hotels & Resorts, Inc engages in the franchise and operation of hotels under the Wyndham brand. It operates through the Hotel Franchising and Hotel Management segments. The Hotel Franchising segment focuses on licensing the company's lodging brands and providing related services to third-party hotel owners and others.

See Also

Before you consider Wyndham Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wyndham Hotels & Resorts wasn't on the list.

While Wyndham Hotels & Resorts currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.