Aigen Investment Management LP bought a new position in shares of Stellantis N.V. (NYSE:STLA - Free Report) during the 1st quarter, according to its most recent 13F filing with the SEC. The fund bought 96,311 shares of the company's stock, valued at approximately $1,080,000.

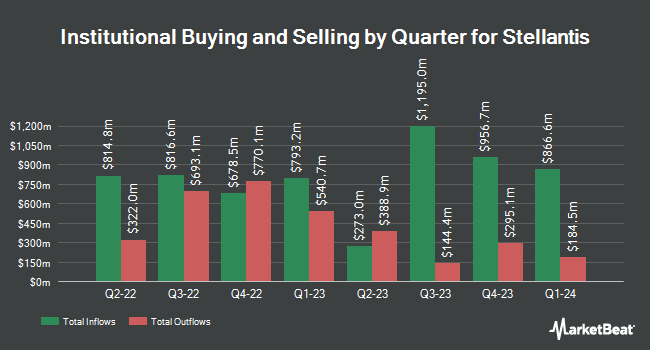

Other institutional investors also recently made changes to their positions in the company. Mpwm Advisory Solutions LLC purchased a new stake in shares of Stellantis during the 4th quarter worth $29,000. GAMMA Investing LLC raised its stake in shares of Stellantis by 422.3% during the 1st quarter. GAMMA Investing LLC now owns 3,139 shares of the company's stock worth $35,000 after buying an additional 2,538 shares during the last quarter. Farther Finance Advisors LLC raised its stake in shares of Stellantis by 54.5% during the 1st quarter. Farther Finance Advisors LLC now owns 3,309 shares of the company's stock worth $37,000 after buying an additional 1,167 shares during the last quarter. Harbour Investments Inc. raised its stake in shares of Stellantis by 136.5% during the 1st quarter. Harbour Investments Inc. now owns 3,812 shares of the company's stock worth $43,000 after buying an additional 2,200 shares during the last quarter. Finally, WealthCollab LLC raised its stake in shares of Stellantis by 96.5% during the 4th quarter. WealthCollab LLC now owns 4,594 shares of the company's stock worth $60,000 after buying an additional 2,256 shares during the last quarter. 59.48% of the stock is currently owned by hedge funds and other institutional investors.

Stellantis Price Performance

STLA stock traded up $0.30 during trading on Tuesday, hitting $9.65. The stock had a trading volume of 12,663,230 shares, compared to its average volume of 25,616,586. The company's 50 day moving average price is $9.70 and its two-hundred day moving average price is $10.76. Stellantis N.V. has a 1-year low of $8.39 and a 1-year high of $16.92. The stock has a market cap of $29.17 billion, a price-to-earnings ratio of 2.83, a price-to-earnings-growth ratio of 0.56 and a beta of 1.45. The company has a debt-to-equity ratio of 0.37, a quick ratio of 0.77 and a current ratio of 1.06.

Wall Street Analyst Weigh In

Several research analysts have recently issued reports on STLA shares. Jefferies Financial Group raised Stellantis from a "hold" rating to a "buy" rating and lifted their price target for the stock from $10.25 to $13.20 in a research note on Wednesday, June 25th. UBS Group downgraded Stellantis from a "buy" rating to a "neutral" rating in a research note on Monday, April 14th. Bank of America downgraded Stellantis from a "buy" rating to a "neutral" rating and cut their price target for the stock from $16.50 to $11.75 in a research note on Monday, July 7th. DZ Bank raised Stellantis from a "strong sell" rating to a "hold" rating in a research note on Tuesday, April 22nd. Finally, Redburn Atlantic downgraded Stellantis from a "buy" rating to a "neutral" rating in a research note on Tuesday, April 22nd. One investment analyst has rated the stock with a sell rating, nine have issued a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus target price of $12.74.

Get Our Latest Stock Report on Stellantis

Stellantis Company Profile

(

Free Report)

Stellantis N.V. engages in the design, engineering, manufacturing, distribution, and sale of automobiles and light commercial vehicles, engines, transmission systems, metallurgical products, mobility services, and production systems worldwide. It provides luxury and premium vehicles; sport utility vehicles; American and European brand vehicles; and parts and services, as well as retail and dealer financing, leasing, and rental services.

Further Reading

Before you consider Stellantis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stellantis wasn't on the list.

While Stellantis currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.