Aigen Investment Management LP bought a new position in Synovus Financial Corp. (NYSE:SNV - Free Report) during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The fund bought 5,406 shares of the bank's stock, valued at approximately $253,000.

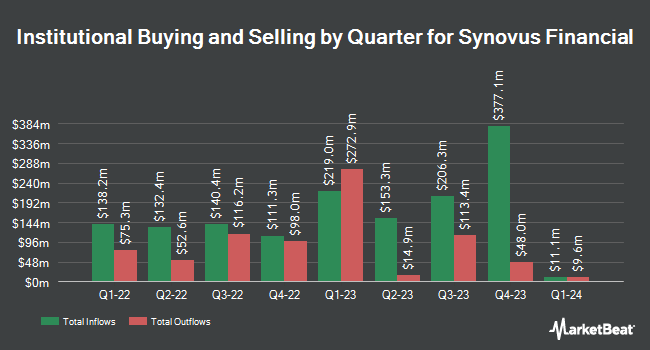

Several other large investors have also recently made changes to their positions in the company. Silvercrest Asset Management Group LLC increased its holdings in shares of Synovus Financial by 2.3% in the fourth quarter. Silvercrest Asset Management Group LLC now owns 2,370,521 shares of the bank's stock worth $121,442,000 after purchasing an additional 53,286 shares during the last quarter. First Trust Advisors LP boosted its holdings in shares of Synovus Financial by 4.5% in the fourth quarter. First Trust Advisors LP now owns 1,827,247 shares of the bank's stock valued at $93,610,000 after purchasing an additional 77,876 shares during the period. Bank of New York Mellon Corp boosted its holdings in shares of Synovus Financial by 5.8% in the first quarter. Bank of New York Mellon Corp now owns 1,577,840 shares of the bank's stock valued at $73,748,000 after purchasing an additional 86,694 shares during the period. Northern Trust Corp boosted its holdings in shares of Synovus Financial by 32.4% in the fourth quarter. Northern Trust Corp now owns 1,380,098 shares of the bank's stock valued at $70,702,000 after purchasing an additional 337,784 shares during the period. Finally, AQR Capital Management LLC boosted its holdings in shares of Synovus Financial by 226.5% in the fourth quarter. AQR Capital Management LLC now owns 1,065,249 shares of the bank's stock valued at $54,573,000 after purchasing an additional 738,983 shares during the period. 83.85% of the stock is owned by institutional investors.

Insider Activity at Synovus Financial

In other news, Director Diana M. Murphy acquired 1,000 shares of the business's stock in a transaction on Tuesday, July 29th. The stock was bought at an average cost of $48.80 per share, for a total transaction of $48,800.00. Following the purchase, the director owned 40,171 shares in the company, valued at approximately $1,960,344.80. This represents a 2.55% increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through this hyperlink. Also, CFO Andrew J. Jr. Gregory acquired 2,000 shares of the business's stock in a transaction on Tuesday, July 29th. The shares were purchased at an average price of $48.90 per share, with a total value of $97,800.00. Following the completion of the purchase, the chief financial officer owned 58,220 shares in the company, valued at $2,846,958. This represents a 3.56% increase in their position. The disclosure for this purchase can be found here. Insiders acquired 8,040 shares of company stock worth $392,916 over the last three months. Company insiders own 1.00% of the company's stock.

Synovus Financial Stock Performance

SNV traded down $0.0250 during midday trading on Tuesday, hitting $49.6750. 245,846 shares of the company were exchanged, compared to its average volume of 1,622,942. The company's 50 day simple moving average is $51.06 and its 200 day simple moving average is $48.60. The firm has a market capitalization of $6.89 billion, a price-to-earnings ratio of 9.53, a price-to-earnings-growth ratio of 0.84 and a beta of 1.21. The company has a current ratio of 0.92, a quick ratio of 0.92 and a debt-to-equity ratio of 0.77. Synovus Financial Corp. has a 1-year low of $35.94 and a 1-year high of $61.06.

Synovus Financial (NYSE:SNV - Get Free Report) last released its quarterly earnings results on Wednesday, July 16th. The bank reported $1.48 EPS for the quarter, beating the consensus estimate of $1.25 by $0.23. Synovus Financial had a net margin of 21.52% and a return on equity of 16.20%. The company had revenue of $592.08 million for the quarter, compared to analyst estimates of $584.89 million. During the same quarter last year, the business earned $1.16 earnings per share. Synovus Financial has set its FY 2025 guidance at EPS. As a group, sell-side analysts predict that Synovus Financial Corp. will post 4.89 earnings per share for the current year.

Synovus Financial Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, July 1st. Stockholders of record on Thursday, June 19th were paid a dividend of $0.39 per share. The ex-dividend date of this dividend was Wednesday, June 18th. This represents a $1.56 dividend on an annualized basis and a dividend yield of 3.1%. Synovus Financial's payout ratio is currently 29.94%.

Analysts Set New Price Targets

A number of analysts recently issued reports on the company. Barclays lowered their price target on Synovus Financial from $70.00 to $65.00 and set an "overweight" rating for the company in a report on Monday, July 28th. Jefferies Financial Group began coverage on Synovus Financial in a report on Wednesday, May 21st. They set a "hold" rating and a $55.00 target price for the company. Raymond James Financial lowered Synovus Financial from a "moderate buy" rating to a "hold" rating in a report on Monday, July 28th. Morgan Stanley upped their target price on Synovus Financial from $58.00 to $61.00 and gave the stock an "equal weight" rating in a report on Friday, July 18th. Finally, Truist Financial increased their price objective on Synovus Financial from $56.00 to $60.00 and gave the company a "buy" rating in a report on Friday, July 11th. Ten analysts have rated the stock with a Buy rating and eight have issued a Hold rating to the stock. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and a consensus price target of $59.94.

View Our Latest Research Report on Synovus Financial

Synovus Financial Profile

(

Free Report)

Synovus Financial Corp. operates as the bank holding company for Synovus Bank that provides commercial and consumer banking products and services. It operates through four segments: Community Banking, Wholesale Banking, Consumer Banking, and Financial Management Services. The company's commercial banking services include treasury and asset management, capital market, and institutional trust services, as well as commercial, financial, and real estate lending services.

Featured Articles

Before you consider Synovus Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synovus Financial wasn't on the list.

While Synovus Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report