Aigen Investment Management LP purchased a new stake in shares of Viking Therapeutics, Inc. (NASDAQ:VKTX - Free Report) during the 1st quarter, according to the company in its most recent Form 13F filing with the SEC. The fund purchased 13,780 shares of the biotechnology company's stock, valued at approximately $333,000.

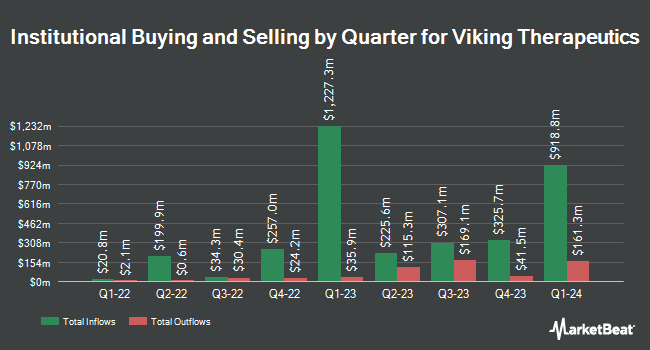

Several other institutional investors and hedge funds have also recently modified their holdings of the company. HighMark Wealth Management LLC boosted its stake in Viking Therapeutics by 9.4% during the first quarter. HighMark Wealth Management LLC now owns 4,660 shares of the biotechnology company's stock worth $113,000 after buying an additional 400 shares during the period. Xponance Inc. boosted its stake in Viking Therapeutics by 3.2% during the first quarter. Xponance Inc. now owns 14,470 shares of the biotechnology company's stock worth $349,000 after buying an additional 446 shares during the period. Deutsche Bank AG boosted its stake in Viking Therapeutics by 7.5% during the first quarter. Deutsche Bank AG now owns 6,911 shares of the biotechnology company's stock worth $167,000 after buying an additional 484 shares during the period. Knights of Columbus Asset Advisors LLC boosted its stake in Viking Therapeutics by 2.7% during the first quarter. Knights of Columbus Asset Advisors LLC now owns 18,729 shares of the biotechnology company's stock worth $452,000 after buying an additional 497 shares during the period. Finally, Parallel Advisors LLC boosted its stake in Viking Therapeutics by 64.8% during the first quarter. Parallel Advisors LLC now owns 1,363 shares of the biotechnology company's stock worth $33,000 after buying an additional 536 shares during the period. Institutional investors and hedge funds own 76.03% of the company's stock.

Wall Street Analyst Weigh In

Several analysts have recently issued reports on the stock. Cantor Fitzgerald raised shares of Viking Therapeutics to a "strong-buy" rating in a research report on Tuesday, April 29th. Morgan Stanley reduced their price target on shares of Viking Therapeutics from $105.00 to $102.00 and set an "overweight" rating on the stock in a research report on Thursday, April 24th. Raymond James Financial reduced their price target on shares of Viking Therapeutics from $125.00 to $122.00 and set a "strong-buy" rating on the stock in a research report on Thursday, July 24th. Citigroup increased their price target on shares of Viking Therapeutics from $31.00 to $38.00 and gave the stock a "neutral" rating in a research report on Thursday, July 24th. Finally, HC Wainwright reissued a "buy" rating and set a $102.00 price target on shares of Viking Therapeutics in a research report on Wednesday, June 25th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating, ten have given a buy rating and two have given a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus target price of $86.92.

Read Our Latest Analysis on VKTX

Insider Buying and Selling at Viking Therapeutics

In other Viking Therapeutics news, CEO Brian Lian sold 26,889 shares of the stock in a transaction that occurred on Thursday, July 3rd. The shares were sold at an average price of $27.80, for a total value of $747,514.20. Following the transaction, the chief executive officer directly owned 2,388,014 shares in the company, valued at $66,386,789.20. This represents a 1.11% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, COO Marianna Mancini sold 4,266 shares of the stock in a transaction that occurred on Thursday, July 3rd. The shares were sold at an average price of $27.77, for a total value of $118,466.82. Following the completion of the sale, the chief operating officer directly owned 377,535 shares of the company's stock, valued at $10,484,146.95. The trade was a 1.12% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 35,421 shares of company stock worth $984,405 over the last three months. Insiders own 4.10% of the company's stock.

Viking Therapeutics Price Performance

Shares of VKTX stock traded down $0.21 during trading hours on Friday, reaching $40.03. 3,285,826 shares of the stock were exchanged, compared to its average volume of 4,644,733. The business's fifty day moving average is $31.10 and its two-hundred day moving average is $28.81. Viking Therapeutics, Inc. has a 12-month low of $18.92 and a 12-month high of $81.73. The firm has a market capitalization of $4.50 billion, a P/E ratio of -26.16 and a beta of 0.67.

Viking Therapeutics (NASDAQ:VKTX - Get Free Report) last announced its quarterly earnings results on Wednesday, July 23rd. The biotechnology company reported ($0.58) EPS for the quarter, missing the consensus estimate of ($0.44) by ($0.14). Viking Therapeutics's quarterly revenue was up NaN% compared to the same quarter last year. During the same quarter in the prior year, the firm posted ($0.20) EPS. As a group, equities research analysts predict that Viking Therapeutics, Inc. will post -1.56 earnings per share for the current fiscal year.

Viking Therapeutics Company Profile

(

Free Report)

Viking Therapeutics, Inc, a clinical-stage biopharmaceutical company, focuses on the development of novel therapies for metabolic and endocrine disorders. The company's lead drug candidate is VK2809, an orally available tissue and receptor-subtype selective agonist of the thyroid hormone receptor beta (TRß), which is in Phase IIb clinical trials to treat patients with biopsy-confirmed non-alcoholic steatohepatitis, as well as NAFLD.

Read More

Before you consider Viking Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viking Therapeutics wasn't on the list.

While Viking Therapeutics currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.