J.P. Marvel Investment Advisors LLC reduced its holdings in shares of Akamai Technologies, Inc. (NASDAQ:AKAM - Free Report) by 4.0% during the first quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 78,481 shares of the technology infrastructure company's stock after selling 3,300 shares during the quarter. Akamai Technologies accounts for 1.1% of J.P. Marvel Investment Advisors LLC's portfolio, making the stock its 26th biggest holding. J.P. Marvel Investment Advisors LLC owned about 0.05% of Akamai Technologies worth $6,318,000 as of its most recent SEC filing.

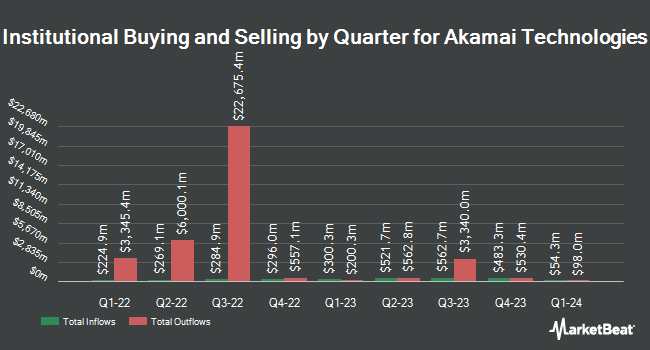

A number of other hedge funds and other institutional investors have also recently modified their holdings of the business. Orion Portfolio Solutions LLC increased its position in Akamai Technologies by 0.6% during the fourth quarter. Orion Portfolio Solutions LLC now owns 19,991 shares of the technology infrastructure company's stock valued at $1,912,000 after acquiring an additional 114 shares during the last quarter. Beverly Hills Private Wealth LLC increased its position in Akamai Technologies by 4.7% during the first quarter. Beverly Hills Private Wealth LLC now owns 2,828 shares of the technology infrastructure company's stock valued at $228,000 after acquiring an additional 126 shares during the last quarter. Opes Wealth Management LLC increased its position in Akamai Technologies by 2.7% in the first quarter. Opes Wealth Management LLC now owns 4,872 shares of the technology infrastructure company's stock worth $392,000 after buying an additional 128 shares in the last quarter. Amalgamated Bank increased its position in Akamai Technologies by 0.5% in the first quarter. Amalgamated Bank now owns 29,080 shares of the technology infrastructure company's stock worth $2,341,000 after buying an additional 139 shares in the last quarter. Finally, MassMutual Private Wealth & Trust FSB increased its position in Akamai Technologies by 54.8% in the first quarter. MassMutual Private Wealth & Trust FSB now owns 438 shares of the technology infrastructure company's stock worth $35,000 after buying an additional 155 shares in the last quarter. 94.28% of the stock is owned by institutional investors.

Insider Activity

In other news, COO Adam Karon sold 3,927 shares of the firm's stock in a transaction that occurred on Thursday, May 8th. The stock was sold at an average price of $85.02, for a total value of $333,873.54. Following the completion of the sale, the chief operating officer directly owned 10,809 shares of the company's stock, valued at $918,981.18. This trade represents a 26.65% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, EVP Paul C. Joseph sold 5,000 shares of the firm's stock in a transaction that occurred on Tuesday, July 15th. The shares were sold at an average price of $77.74, for a total value of $388,700.00. Following the completion of the sale, the executive vice president directly owned 32,349 shares of the company's stock, valued at $2,514,811.26. The trade was a 13.39% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 22,084 shares of company stock valued at $1,726,847 in the last ninety days. Insiders own 2.00% of the company's stock.

Akamai Technologies Price Performance

NASDAQ AKAM traded down $0.09 during trading on Tuesday, hitting $79.62. 488,680 shares of the stock traded hands, compared to its average volume of 2,395,014. The company has a market capitalization of $11.64 billion, a P/E ratio of 26.80, a price-to-earnings-growth ratio of 2.55 and a beta of 0.77. Akamai Technologies, Inc. has a 12-month low of $67.51 and a 12-month high of $106.80. The firm has a 50-day simple moving average of $78.35 and a 200-day simple moving average of $82.45. The company has a quick ratio of 1.18, a current ratio of 1.18 and a debt-to-equity ratio of 0.52.

Akamai Technologies (NASDAQ:AKAM - Get Free Report) last posted its quarterly earnings data on Thursday, May 8th. The technology infrastructure company reported $1.70 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.58 by $0.12. The business had revenue of $1.02 billion during the quarter, compared to analyst estimates of $1.01 billion. Akamai Technologies had a return on equity of 14.09% and a net margin of 11.26%. The company's revenue for the quarter was up 2.9% on a year-over-year basis. During the same period last year, the company earned $1.64 EPS. As a group, analysts predict that Akamai Technologies, Inc. will post 4.6 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of brokerages have commented on AKAM. Piper Sandler restated a "neutral" rating and issued a $88.00 price target (up previously from $80.00) on shares of Akamai Technologies in a research report on Friday, May 9th. Wall Street Zen lowered Akamai Technologies from a "buy" rating to a "hold" rating in a research note on Sunday, July 20th. UBS Group upped their price objective on Akamai Technologies from $85.00 to $90.00 and gave the stock a "neutral" rating in a research note on Friday, May 9th. Morgan Stanley dropped their price objective on Akamai Technologies from $102.00 to $90.00 and set an "equal weight" rating for the company in a research note on Wednesday, April 16th. Finally, KeyCorp started coverage on Akamai Technologies in a research note on Friday, June 6th. They issued an "underweight" rating and a $63.00 price objective for the company. Two equities research analysts have rated the stock with a sell rating, ten have assigned a hold rating, nine have assigned a buy rating and two have given a strong buy rating to the company. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and an average target price of $101.25.

Check Out Our Latest Stock Report on Akamai Technologies

Akamai Technologies Profile

(

Free Report)

Akamai Technologies, Inc provides cloud computing, security, and content delivery services in the United States and internationally. The company offers cloud solutions to keep infrastructure, websites, applications, application programming interfaces, and users safe from various cyberattacks and online threats while enhancing performance.

Featured Articles

Before you consider Akamai Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Akamai Technologies wasn't on the list.

While Akamai Technologies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.