Royal Bank of Canada decreased its position in Alamo Group, Inc. (NYSE:ALG - Free Report) by 5.0% in the 1st quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 109,639 shares of the industrial products company's stock after selling 5,826 shares during the period. Royal Bank of Canada owned about 0.91% of Alamo Group worth $19,539,000 as of its most recent SEC filing.

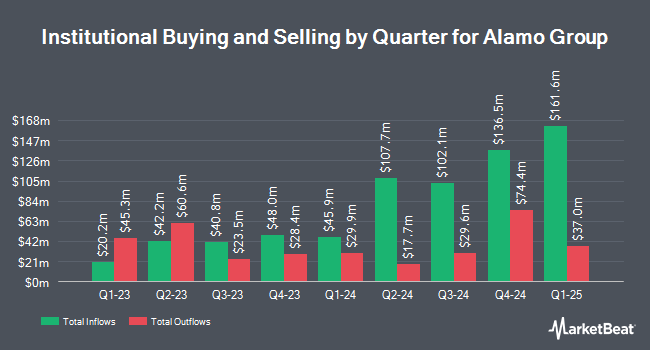

Several other large investors have also recently added to or reduced their stakes in the company. Parallel Advisors LLC raised its holdings in shares of Alamo Group by 80.0% in the 1st quarter. Parallel Advisors LLC now owns 162 shares of the industrial products company's stock worth $29,000 after buying an additional 72 shares in the last quarter. GAMMA Investing LLC raised its holdings in shares of Alamo Group by 110.6% in the 1st quarter. GAMMA Investing LLC now owns 238 shares of the industrial products company's stock worth $42,000 after buying an additional 125 shares in the last quarter. Nisa Investment Advisors LLC raised its holdings in shares of Alamo Group by 30.0% in the 1st quarter. Nisa Investment Advisors LLC now owns 264 shares of the industrial products company's stock worth $47,000 after buying an additional 61 shares in the last quarter. Smartleaf Asset Management LLC raised its holdings in shares of Alamo Group by 31.6% in the 1st quarter. Smartleaf Asset Management LLC now owns 271 shares of the industrial products company's stock worth $49,000 after buying an additional 65 shares in the last quarter. Finally, Lazard Asset Management LLC acquired a new position in shares of Alamo Group in the 4th quarter worth approximately $79,000. Institutional investors and hedge funds own 92.36% of the company's stock.

Insider Buying and Selling

In other Alamo Group news, CEO Jeffery Allen Leonard sold 2,500 shares of the stock in a transaction on Friday, August 22nd. The stock was sold at an average price of $222.19, for a total value of $555,475.00. Following the transaction, the chief executive officer directly owned 38,413 shares in the company, valued at approximately $8,534,984.47. This trade represents a 6.11% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 1.18% of the company's stock.

Alamo Group Trading Down 0.6%

ALG traded down $1.22 during mid-day trading on Monday, reaching $204.42. The stock had a trading volume of 84,941 shares, compared to its average volume of 67,703. The stock has a market capitalization of $2.48 billion, a P/E ratio of 20.82, a P/E/G ratio of 1.07 and a beta of 1.10. The company has a debt-to-equity ratio of 0.18, a quick ratio of 2.76 and a current ratio of 4.56. The firm's fifty day simple moving average is $217.89 and its two-hundred day simple moving average is $200.18. Alamo Group, Inc. has a 52 week low of $157.07 and a 52 week high of $233.29.

Alamo Group (NYSE:ALG - Get Free Report) last announced its quarterly earnings data on Wednesday, August 6th. The industrial products company reported $2.57 EPS for the quarter, missing analysts' consensus estimates of $2.69 by ($0.12). The firm had revenue of $419.07 million during the quarter, compared to the consensus estimate of $406.75 million. Alamo Group had a net margin of 7.41% and a return on equity of 11.45%. On average, equities analysts predict that Alamo Group, Inc. will post 9.53 EPS for the current year.

Alamo Group Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, July 29th. Shareholders of record on Wednesday, July 16th were given a $0.30 dividend. This represents a $1.20 dividend on an annualized basis and a yield of 0.6%. The ex-dividend date was Wednesday, July 16th. Alamo Group's dividend payout ratio (DPR) is presently 12.22%.

Wall Street Analysts Forecast Growth

A number of brokerages have recently issued reports on ALG. Robert W. Baird raised Alamo Group from a "neutral" rating to an "outperform" rating and increased their target price for the stock from $209.00 to $260.00 in a report on Monday, August 4th. DA Davidson restated a "neutral" rating and set a $225.00 price target on shares of Alamo Group in a research report on Tuesday, July 22nd. Baird R W upgraded Alamo Group from a "hold" rating to a "strong-buy" rating in a research report on Monday, August 4th. Finally, Wall Street Zen upgraded Alamo Group from a "hold" rating to a "buy" rating in a research report on Friday, September 5th. One investment analyst has rated the stock with a Strong Buy rating, one has issued a Buy rating and one has assigned a Hold rating to the company's stock. Based on data from MarketBeat.com, the company presently has an average rating of "Buy" and an average target price of $234.00.

Get Our Latest Stock Analysis on Alamo Group

About Alamo Group

(

Free Report)

Alamo Group Inc designs, manufactures, distributes, and services vegetation management and infrastructure maintenance equipment for governmental, industrial, and agricultural uses worldwide. It operates through two segments, Vegetation Management and Industrial Equipment. Its Vegetation Management Division segment offers hydraulically-powered and tractor - and off-road chassis mounted mowers, other cutters and replacement parts for heavy-duty and intensive uses and heavy duty, tractor- and truck-mounted mowing and vegetation maintenance equipment, and replacement parts.

Featured Articles

Before you consider Alamo Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alamo Group wasn't on the list.

While Alamo Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.