Alberta Investment Management Corp bought a new position in shares of Veralto Corporation (NYSE:VLTO - Free Report) in the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm bought 55,552 shares of the company's stock, valued at approximately $5,414,000.

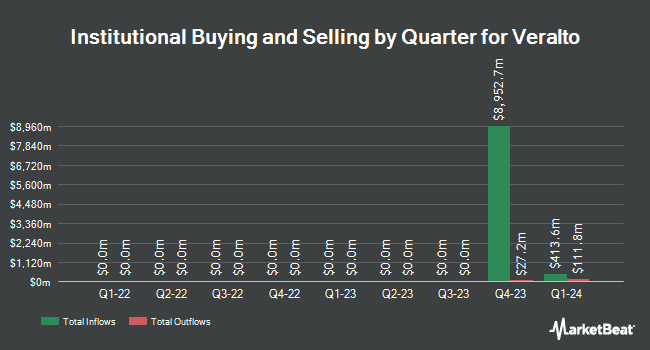

A number of other institutional investors also recently modified their holdings of the company. NorthRock Partners LLC raised its stake in shares of Veralto by 15.0% in the 1st quarter. NorthRock Partners LLC now owns 2,398 shares of the company's stock valued at $234,000 after purchasing an additional 312 shares during the period. Eastern Bank grew its position in shares of Veralto by 91.3% during the 1st quarter. Eastern Bank now owns 152,718 shares of the company's stock worth $14,882,000 after purchasing an additional 72,902 shares in the last quarter. Banque Cantonale Vaudoise bought a new stake in shares of Veralto during the 1st quarter valued at $1,631,000. Federated Hermes Inc. increased its stake in shares of Veralto by 1.0% in the 1st quarter. Federated Hermes Inc. now owns 3,066,510 shares of the company's stock valued at $298,831,000 after purchasing an additional 29,802 shares during the last quarter. Finally, Essex Investment Management Co. LLC bought a new position in shares of Veralto in the 1st quarter valued at $1,314,000. Institutional investors own 91.28% of the company's stock.

Insider Buying and Selling

In other news, SVP Surekha Trivedi sold 848 shares of the stock in a transaction that occurred on Monday, June 2nd. The stock was sold at an average price of $100.55, for a total value of $85,266.40. Following the sale, the senior vice president directly owned 8,433 shares in the company, valued at approximately $847,938.15. This represents a 9.14% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, SVP Lesley Beneteau sold 458 shares of the stock in a transaction on Thursday, May 15th. The stock was sold at an average price of $100.84, for a total value of $46,184.72. Following the completion of the sale, the senior vice president owned 13,571 shares in the company, valued at approximately $1,368,499.64. The trade was a 3.26% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 3,806 shares of company stock valued at $381,351. Corporate insiders own 0.36% of the company's stock.

Analyst Ratings Changes

A number of equities research analysts have weighed in on VLTO shares. Royal Bank Of Canada boosted their target price on shares of Veralto from $104.00 to $108.00 and gave the stock a "sector perform" rating in a report on Wednesday, July 30th. Stifel Nicolaus set a $120.00 price target on shares of Veralto and gave the company a "buy" rating in a research report on Wednesday, July 30th. Northcoast Research started coverage on shares of Veralto in a report on Tuesday, May 6th. They set a "buy" rating and a $110.00 price objective on the stock. Robert W. Baird increased their price objective on shares of Veralto from $106.00 to $112.00 and gave the company a "neutral" rating in a research note on Wednesday, July 30th. Finally, Citigroup reduced their price objective on Veralto from $116.00 to $100.00 and set a "neutral" rating for the company in a research note on Monday, April 14th. Four research analysts have rated the stock with a hold rating and five have issued a buy rating to the company. According to data from MarketBeat.com, Veralto presently has an average rating of "Moderate Buy" and an average target price of $114.00.

Read Our Latest Report on VLTO

Veralto Price Performance

Shares of Veralto stock traded up $0.87 on Wednesday, hitting $107.43. 1,081,747 shares of the company traded hands, compared to its average volume of 1,401,703. The company has a current ratio of 2.32, a quick ratio of 2.06 and a debt-to-equity ratio of 1.00. The firm's 50-day simple moving average is $101.39 and its 200 day simple moving average is $98.63. Veralto Corporation has a 12-month low of $83.86 and a 12-month high of $115.00. The company has a market cap of $26.66 billion, a P/E ratio of 30.01, a P/E/G ratio of 3.52 and a beta of 0.91.

Veralto (NYSE:VLTO - Get Free Report) last issued its quarterly earnings results on Monday, July 28th. The company reported $0.93 earnings per share for the quarter, topping the consensus estimate of $0.89 by $0.04. The company had revenue of $1.37 billion for the quarter, compared to analysts' expectations of $1.34 billion. Veralto had a return on equity of 41.45% and a net margin of 16.65%. The firm's revenue for the quarter was up 6.4% on a year-over-year basis. During the same period in the prior year, the firm earned $0.85 earnings per share. Analysts expect that Veralto Corporation will post 3.66 earnings per share for the current fiscal year.

Veralto Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Thursday, July 31st. Investors of record on Monday, June 30th were issued a $0.11 dividend. The ex-dividend date of this dividend was Monday, June 30th. This represents a $0.44 dividend on an annualized basis and a yield of 0.4%. Veralto's payout ratio is currently 12.29%.

Veralto Company Profile

(

Free Report)

Veralto Corporation provides water analytics, water treatment, marking and coding, and packaging and color services worldwide. It operates through two segments, Water Quality (WQ) and Product Quality & Innovation (PQI). The WQ segment offers precision instrumentation and water treatment technologies to measure, analyze, and treat water in residential, commercial, municipal, industrial, research, and natural resource applications through the Hach, Trojan Technologies, and ChemTreat brands.

Further Reading

Before you consider Veralto, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Veralto wasn't on the list.

While Veralto currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report