Alberta Investment Management Corp boosted its stake in OR Royalties Inc. (NYSE:OR - Free Report) by 717.1% during the first quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 790,961 shares of the basic materials company's stock after purchasing an additional 694,161 shares during the period. Alberta Investment Management Corp owned about 0.42% of OR Royalties worth $16,690,000 at the end of the most recent reporting period.

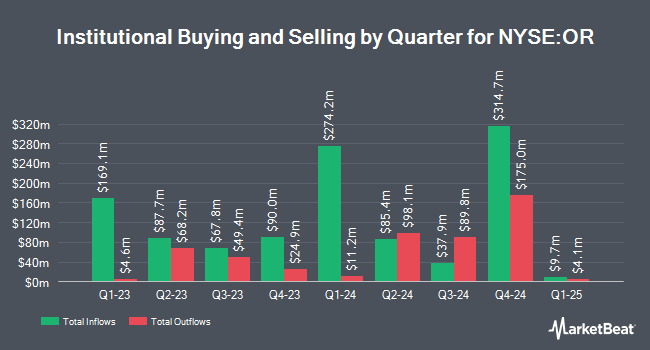

A number of other hedge funds also recently bought and sold shares of OR. Employees Retirement System of Texas purchased a new position in shares of OR Royalties during the 4th quarter worth approximately $131,000. Franklin Resources Inc. grew its holdings in shares of OR Royalties by 4.5% during the 4th quarter. Franklin Resources Inc. now owns 12,282 shares of the basic materials company's stock worth $222,000 after acquiring an additional 534 shares during the period. Autumn Glory Partners LLC purchased a new position in shares of OR Royalties during the 1st quarter worth approximately $232,000. Cetera Investment Advisers purchased a new position in shares of OR Royalties during the 1st quarter worth approximately $268,000. Finally, Mariner LLC grew its holdings in shares of OR Royalties by 36.1% during the 4th quarter. Mariner LLC now owns 15,816 shares of the basic materials company's stock worth $286,000 after acquiring an additional 4,197 shares during the period. Hedge funds and other institutional investors own 68.52% of the company's stock.

OR Royalties Stock Performance

NYSE:OR traded up $0.61 during mid-day trading on Monday, hitting $28.55. The company's stock had a trading volume of 165,533 shares, compared to its average volume of 855,312. The business's fifty day moving average is $26.55 and its two-hundred day moving average is $22.85. The stock has a market cap of $5.37 billion, a price-to-earnings ratio of 167.99 and a beta of 0.71. OR Royalties Inc. has a 1 year low of $15.78 and a 1 year high of $28.87. The company has a debt-to-equity ratio of 0.06, a current ratio of 4.98 and a quick ratio of 4.98.

OR Royalties (NYSE:OR - Get Free Report) last released its quarterly earnings results on Wednesday, May 7th. The basic materials company reported $0.16 earnings per share for the quarter, topping the consensus estimate of $0.13 by $0.03. The firm had revenue of $54.92 million during the quarter, compared to the consensus estimate of $79.63 million. OR Royalties had a net margin of 15.28% and a return on equity of 8.66%. Analysts anticipate that OR Royalties Inc. will post 0.62 EPS for the current fiscal year.

OR Royalties Increases Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Tuesday, July 15th. Shareholders of record on Monday, June 30th were issued a $0.055 dividend. This represents a $0.22 dividend on an annualized basis and a yield of 0.8%. The ex-dividend date was Monday, June 30th. This is a positive change from OR Royalties's previous quarterly dividend of $0.05. OR Royalties's payout ratio is currently 111.76%.

Wall Street Analyst Weigh In

A number of analysts have recently commented on the company. CIBC reissued an "outperform" rating on shares of OR Royalties in a research report on Tuesday, July 15th. National Bankshares reissued an "outperform" rating on shares of OR Royalties in a research report on Tuesday, June 24th. Scotiabank boosted their price target on OR Royalties from $26.00 to $28.00 and gave the stock a "sector outperform" rating in a research report on Monday, July 7th. Finally, Wall Street Zen cut OR Royalties from a "buy" rating to a "hold" rating in a research report on Saturday, July 12th. Three investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and an average target price of $24.33.

View Our Latest Stock Analysis on OR Royalties

OR Royalties Company Profile

(

Free Report)

Osisko Gold Royalties Ltd acquires and manages precious metal and other royalties, streams, and other interests in Canada and internationally. It also owns options on offtake; royalty/stream financings; and exclusive rights to participate in future royalty/stream financings on various projects. The company's primary asset is a 3-5% net smelter return royalty on the Canadian Malartic complex located in Canada.

Featured Articles

Before you consider OR Royalties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and OR Royalties wasn't on the list.

While OR Royalties currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.