Alberta Investment Management Corp purchased a new position in Exponent, Inc. (NASDAQ:EXPO - Free Report) in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor purchased 15,400 shares of the business services provider's stock, valued at approximately $1,248,000.

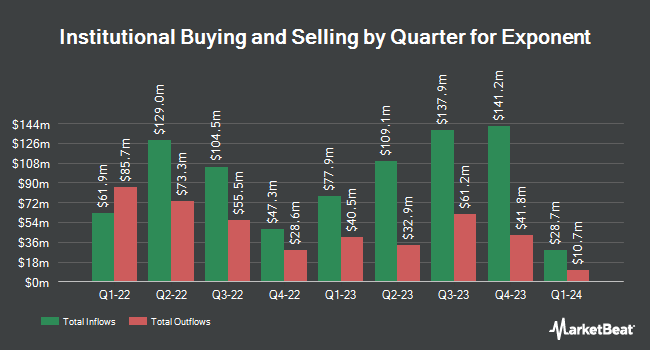

Several other institutional investors have also recently made changes to their positions in EXPO. Nicolet Advisory Services LLC lifted its position in shares of Exponent by 14.8% in the first quarter. Nicolet Advisory Services LLC now owns 8,345 shares of the business services provider's stock worth $659,000 after buying an additional 1,075 shares in the last quarter. Bayforest Capital Ltd purchased a new stake in shares of Exponent during the 1st quarter worth $417,000. XTX Topco Ltd acquired a new position in shares of Exponent during the first quarter worth $247,000. GSA Capital Partners LLP purchased a new stake in shares of Exponent during the 1st quarter valued at $2,171,000. Finally, Cetera Investment Advisers boosted its position in shares of Exponent by 12.5% in the 1st quarter. Cetera Investment Advisers now owns 10,015 shares of the business services provider's stock worth $812,000 after purchasing an additional 1,112 shares in the last quarter. Institutional investors own 92.37% of the company's stock.

Insider Transactions at Exponent

In other news, VP John Pye sold 2,000 shares of the firm's stock in a transaction that occurred on Friday, May 23rd. The shares were sold at an average price of $76.32, for a total transaction of $152,640.00. Following the completion of the sale, the vice president owned 29,204 shares in the company, valued at $2,228,849.28. This trade represents a 6.41% decrease in their position. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at this hyperlink. Also, VP Bradley A. James sold 2,694 shares of the stock in a transaction dated Tuesday, May 20th. The stock was sold at an average price of $79.52, for a total transaction of $214,226.88. The disclosure for this sale can be found here. Insiders sold 6,267 shares of company stock valued at $489,120 over the last 90 days. Corporate insiders own 1.60% of the company's stock.

Exponent Trading Down 0.4%

Shares of NASDAQ:EXPO traded down $0.26 on Thursday, hitting $71.23. 159,537 shares of the company were exchanged, compared to its average volume of 310,731. Exponent, Inc. has a 1-year low of $63.81 and a 1-year high of $115.75. The firm has a market capitalization of $3.61 billion, a P/E ratio of 35.59 and a beta of 0.89. The stock's 50 day moving average price is $74.38 and its 200 day moving average price is $79.88.

Exponent (NASDAQ:EXPO - Get Free Report) last posted its earnings results on Thursday, July 31st. The business services provider reported $0.52 EPS for the quarter, topping the consensus estimate of $0.48 by $0.04. The firm had revenue of $132.87 million for the quarter, compared to analyst estimates of $130.82 million. Exponent had a return on equity of 24.19% and a net margin of 18.35%. Exponent's revenue for the quarter was up 7.3% compared to the same quarter last year. During the same period last year, the company earned $0.57 earnings per share. On average, equities analysts predict that Exponent, Inc. will post 1.98 EPS for the current fiscal year.

Exponent Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Friday, September 19th. Stockholders of record on Friday, September 5th will be paid a dividend of $0.30 per share. The ex-dividend date of this dividend is Friday, September 5th. This represents a $1.20 dividend on an annualized basis and a dividend yield of 1.7%. Exponent's payout ratio is currently 60.00%.

Exponent Company Profile

(

Free Report)

Exponent, Inc, together with its subsidiaries, operates as a science and engineering consulting company in the United States and internationally. The company operates in two segments, Engineering and Other Scientific, and Environmental and Health. The Engineering and Other Scientific segment provides services in the areas of biomechanics, biomedical engineering and sciences, buildings and structures, civil engineering, construction consulting, data sciences, electrical engineering and computer science, human factors, materials and corrosion engineering, mechanical engineering, polymer science and materials chemistry, thermal sciences, and vehicle engineering.

Recommended Stories

Before you consider Exponent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exponent wasn't on the list.

While Exponent currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.