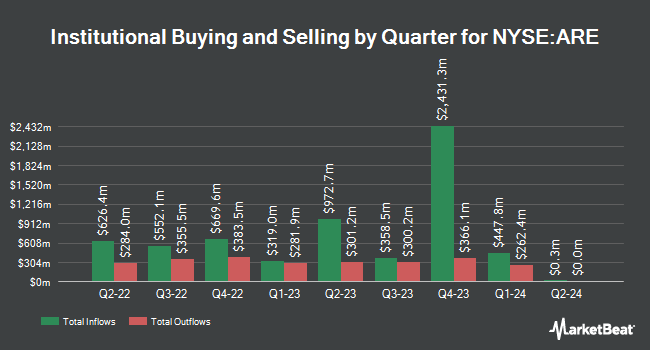

National Bank of Canada FI raised its holdings in shares of Alexandria Real Estate Equities, Inc. (NYSE:ARE - Free Report) by 59.6% in the 1st quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 116,242 shares of the real estate investment trust's stock after purchasing an additional 43,404 shares during the period. National Bank of Canada FI owned about 0.07% of Alexandria Real Estate Equities worth $10,754,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds also recently modified their holdings of ARE. Colonial Trust Co SC raised its holdings in shares of Alexandria Real Estate Equities by 514.3% during the fourth quarter. Colonial Trust Co SC now owns 301 shares of the real estate investment trust's stock worth $29,000 after purchasing an additional 252 shares during the period. Tsfg LLC acquired a new stake in shares of Alexandria Real Estate Equities during the first quarter worth $30,000. Avalon Trust Co acquired a new stake in shares of Alexandria Real Estate Equities during the first quarter worth $32,000. TruNorth Capital Management LLC acquired a new stake in shares of Alexandria Real Estate Equities during the first quarter worth $34,000. Finally, Cromwell Holdings LLC acquired a new stake in shares of Alexandria Real Estate Equities during the first quarter worth $36,000. 96.54% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of brokerages have weighed in on ARE. JMP Securities reissued a "market outperform" rating and set a $130.00 target price on shares of Alexandria Real Estate Equities in a report on Wednesday, April 30th. Royal Bank Of Canada lowered their price target on shares of Alexandria Real Estate Equities from $100.00 to $98.00 and set a "sector perform" rating for the company in a research report on Tuesday, July 29th. Baird R W lowered their price target on shares of Alexandria Real Estate Equities from $129.00 to $102.00 in a research report on Thursday, June 12th. Wedbush lowered their price target on shares of Alexandria Real Estate Equities from $104.00 to $76.00 and set a "neutral" rating for the company in a research report on Wednesday, April 30th. Finally, JPMorgan Chase & Co. lowered their price target on shares of Alexandria Real Estate Equities from $117.00 to $95.00 and set a "neutral" rating for the company in a research report on Tuesday, May 20th. Ten equities research analysts have rated the stock with a hold rating and two have given a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of "Hold" and an average price target of $97.17.

Read Our Latest Stock Analysis on ARE

Alexandria Real Estate Equities Stock Up 2.2%

Shares of NYSE ARE traded up $1.61 during mid-day trading on Friday, reaching $76.12. The company had a trading volume of 1,891,556 shares, compared to its average volume of 1,726,794. The stock has a fifty day moving average of $75.83 and a two-hundred day moving average of $81.94. The company has a debt-to-equity ratio of 0.61, a quick ratio of 0.23 and a current ratio of 0.23. The company has a market capitalization of $13.17 billion, a price-to-earnings ratio of -585.54, a PEG ratio of 6.40 and a beta of 1.24. Alexandria Real Estate Equities, Inc. has a 12-month low of $67.37 and a 12-month high of $125.63.

Alexandria Real Estate Equities (NYSE:ARE - Get Free Report) last posted its quarterly earnings results on Monday, July 21st. The real estate investment trust reported $2.33 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $2.29 by $0.04. The business had revenue of $737.28 million during the quarter, compared to analyst estimates of $748.02 million. Alexandria Real Estate Equities had a negative net margin of 0.33% and a negative return on equity of 0.05%. The firm's revenue was down .6% compared to the same quarter last year. During the same period in the prior year, the firm earned $2.36 earnings per share. As a group, equities research analysts expect that Alexandria Real Estate Equities, Inc. will post 9.32 EPS for the current year.

Alexandria Real Estate Equities Dividend Announcement

The company also recently disclosed a quarterly dividend, which was paid on Tuesday, July 15th. Investors of record on Monday, June 30th were issued a $1.32 dividend. The ex-dividend date was Monday, June 30th. This represents a $5.28 dividend on an annualized basis and a yield of 6.9%. Alexandria Real Estate Equities's dividend payout ratio is currently -4,061.54%.

About Alexandria Real Estate Equities

(

Free Report)

Alexandria Real Estate Equities, Inc NYSE: ARE, an S&P 500 company, is a best-in-class, mission-driven life science REIT making a positive and lasting impact on the world. As the pioneer of the life science real estate niche since our founding in 1994, Alexandria is the preeminent and longest-tenured owner, operator, and developer of collaborative life science, agtech, and advanced technology mega campuses in AAA innovation cluster locations, including Greater Boston, the San Francisco Bay Area, New York City, San Diego, Seattle, Maryland, and Research Triangle.

See Also

Before you consider Alexandria Real Estate Equities, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alexandria Real Estate Equities wasn't on the list.

While Alexandria Real Estate Equities currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.