Algert Global LLC lowered its position in shares of Badger Meter, Inc. (NYSE:BMI - Free Report) by 32.3% during the 1st quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor owned 58,639 shares of the scientific and technical instruments company's stock after selling 27,921 shares during the quarter. Algert Global LLC owned about 0.20% of Badger Meter worth $11,156,000 at the end of the most recent quarter.

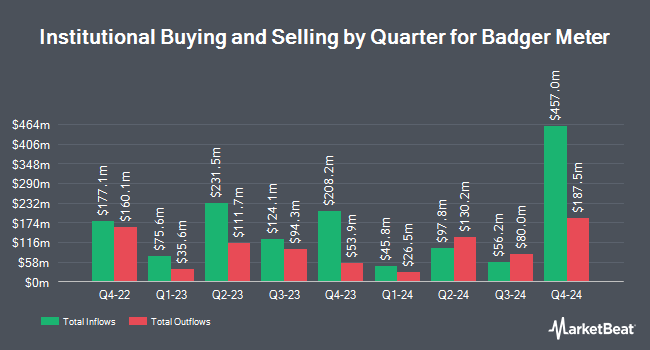

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Bessemer Group Inc. raised its stake in Badger Meter by 162.5% during the fourth quarter. Bessemer Group Inc. now owns 147 shares of the scientific and technical instruments company's stock valued at $31,000 after buying an additional 91 shares in the last quarter. Golden State Wealth Management LLC raised its position in shares of Badger Meter by 100.0% during the 1st quarter. Golden State Wealth Management LLC now owns 184 shares of the scientific and technical instruments company's stock worth $35,000 after purchasing an additional 92 shares during the period. SBI Securities Co. Ltd. raised its position in shares of Badger Meter by 83.0% during the 1st quarter. SBI Securities Co. Ltd. now owns 194 shares of the scientific and technical instruments company's stock worth $37,000 after purchasing an additional 88 shares during the period. Banque Cantonale Vaudoise acquired a new stake in shares of Badger Meter during the 1st quarter worth approximately $37,000. Finally, Heck Capital Advisors LLC acquired a new stake in shares of Badger Meter during the 4th quarter worth approximately $39,000. Institutional investors and hedge funds own 89.01% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently weighed in on BMI shares. Stifel Nicolaus set a $224.00 price target on Badger Meter in a research report on Wednesday, July 23rd. Argus set a $240.00 price target on Badger Meter in a research note on Thursday, April 24th. Royal Bank Of Canada decreased their price target on Badger Meter from $284.00 to $264.00 and set an "outperform" rating for the company in a research note on Wednesday, July 23rd. Raymond James Financial started coverage on Badger Meter in a report on Tuesday, June 3rd. They issued a "market perform" rating for the company. Finally, Robert W. Baird increased their target price on Badger Meter from $216.00 to $219.00 and gave the company a "neutral" rating in a report on Wednesday, July 23rd. Two research analysts have rated the stock with a Buy rating and three have assigned a Hold rating to the stock. According to MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $238.40.

Check Out Our Latest Stock Report on BMI

Badger Meter Stock Performance

Shares of Badger Meter stock traded up $6.8950 during trading on Friday, reaching $189.9450. The company's stock had a trading volume of 129,283 shares, compared to its average volume of 276,024. The business's fifty day moving average price is $218.03 and its 200-day moving average price is $216.12. The firm has a market cap of $5.60 billion, a price-to-earnings ratio of 41.34, a price-to-earnings-growth ratio of 3.30 and a beta of 0.84. Badger Meter, Inc. has a one year low of $162.17 and a one year high of $256.08.

Badger Meter (NYSE:BMI - Get Free Report) last posted its quarterly earnings data on Tuesday, July 22nd. The scientific and technical instruments company reported $1.17 EPS for the quarter, missing analysts' consensus estimates of $1.19 by ($0.02). The business had revenue of $238.10 million during the quarter, compared to the consensus estimate of $235.38 million. Badger Meter had a return on equity of 21.57% and a net margin of 15.53%.The company's revenue for the quarter was up 9.9% on a year-over-year basis. During the same quarter in the previous year, the firm posted $1.12 earnings per share. Sell-side analysts anticipate that Badger Meter, Inc. will post 4.65 EPS for the current year.

Badger Meter Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, September 5th. Investors of record on Friday, August 22nd will be given a dividend of $0.40 per share. This represents a $1.60 dividend on an annualized basis and a yield of 0.8%. This is a boost from Badger Meter's previous quarterly dividend of $0.34. The ex-dividend date of this dividend is Friday, August 22nd. Badger Meter's dividend payout ratio (DPR) is 29.63%.

Badger Meter Profile

(

Free Report)

Badger Meter, Inc manufactures and markets flow measurement, quality, control, and communication solutions worldwide. It offers mechanical or static water meters, and related radio and software technologies and services to municipal water utilities market. The company also provides flow instrumentation products, including meters, valves, and other sensing instruments to measure and control fluids going through a pipe or pipeline, including water, air, steam, and other liquids and gases to original equipment manufacturers as the primary flow measurement device within a product or system, as well as through manufacturers' representatives.

Further Reading

Before you consider Badger Meter, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Badger Meter wasn't on the list.

While Badger Meter currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.