Algert Global LLC increased its holdings in shares of PagerDuty (NYSE:PD - Free Report) by 512.5% during the 1st quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 397,212 shares of the company's stock after buying an additional 332,363 shares during the period. Algert Global LLC owned about 0.44% of PagerDuty worth $7,257,000 at the end of the most recent quarter.

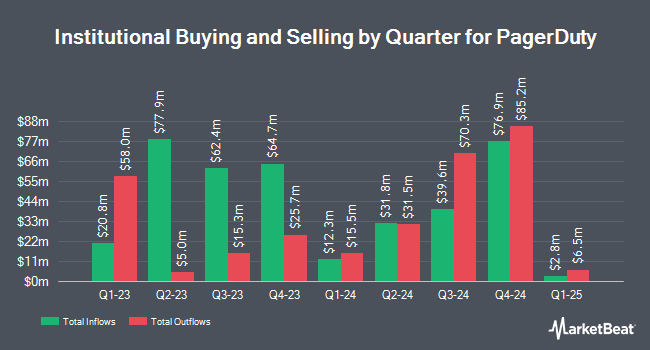

Several other large investors have also recently modified their holdings of PD. Raymond James Financial Inc. bought a new position in shares of PagerDuty during the fourth quarter valued at $6,574,000. Barclays PLC raised its stake in shares of PagerDuty by 2.0% during the fourth quarter. Barclays PLC now owns 918,762 shares of the company's stock valued at $16,777,000 after acquiring an additional 17,642 shares during the last quarter. Marshall Wace LLP raised its stake in shares of PagerDuty by 989.0% during the fourth quarter. Marshall Wace LLP now owns 721,953 shares of the company's stock valued at $13,183,000 after acquiring an additional 655,655 shares during the last quarter. Canada Pension Plan Investment Board boosted its holdings in PagerDuty by 181.1% in the fourth quarter. Canada Pension Plan Investment Board now owns 20,800 shares of the company's stock valued at $380,000 after acquiring an additional 13,400 shares during the last quarter. Finally, MetLife Investment Management LLC boosted its holdings in PagerDuty by 6.4% in the fourth quarter. MetLife Investment Management LLC now owns 55,243 shares of the company's stock valued at $1,009,000 after acquiring an additional 3,340 shares during the last quarter. Institutional investors own 97.26% of the company's stock.

Wall Street Analysts Forecast Growth

PD has been the topic of several analyst reports. TD Securities reduced their target price on PagerDuty from $19.00 to $18.00 and set a "hold" rating on the stock in a report on Wednesday, May 21st. JPMorgan Chase & Co. reduced their target price on PagerDuty from $21.00 to $18.00 and set an "underweight" rating on the stock in a report on Friday, May 30th. TD Cowen upgraded PagerDuty from a "hold" rating to a "buy" rating and set a $22.00 target price on the stock in a report on Monday, July 28th. Cowen upgraded PagerDuty from a "hold" rating to a "buy" rating in a report on Monday, July 28th. Finally, Canaccord Genuity Group cut their target price on PagerDuty from $23.00 to $21.00 and set a "buy" rating on the stock in a report on Monday, June 2nd. Six research analysts have rated the stock with a Buy rating, six have assigned a Hold rating and two have given a Sell rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $19.75.

View Our Latest Report on PagerDuty

PagerDuty Stock Down 0.3%

NYSE PD traded down $0.0450 on Wednesday, reaching $16.0550. The company had a trading volume of 2,461,247 shares, compared to its average volume of 2,725,460. The stock has a market capitalization of $1.46 billion, a P/E ratio of -40.14, a P/E/G ratio of 9.66 and a beta of 0.89. The company's fifty day moving average is $15.31 and its 200 day moving average is $16.32. PagerDuty has a 52-week low of $13.69 and a 52-week high of $21.98. The company has a quick ratio of 2.02, a current ratio of 2.02 and a debt-to-equity ratio of 2.70.

PagerDuty (NYSE:PD - Get Free Report) last released its quarterly earnings results on Thursday, May 29th. The company reported $0.24 EPS for the quarter, beating analysts' consensus estimates of $0.19 by $0.05. PagerDuty had a negative return on equity of 8.73% and a negative net margin of 7.75%.The business had revenue of $119.81 million during the quarter, compared to analyst estimates of $118.98 million. During the same period in the prior year, the firm posted $0.17 EPS. PagerDuty's quarterly revenue was up 7.8% compared to the same quarter last year. PagerDuty has set its FY 2026 guidance at 0.950-1.00 EPS. Q2 2026 guidance at 0.190-0.200 EPS. Sell-side analysts anticipate that PagerDuty will post -0.27 earnings per share for the current fiscal year.

PagerDuty Profile

(

Free Report)

PagerDuty, Inc engages in the operation of a digital operations management platform in the United States and internationally. The company's digital operations management platform collects data and digital signals from virtually any software-enabled system or device and leverage machine learning to correlate, process, and predict opportunities and issues.

See Also

Before you consider PagerDuty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PagerDuty wasn't on the list.

While PagerDuty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.