Algert Global LLC lowered its stake in shares of Grand Canyon Education, Inc. (NASDAQ:LOPE - Free Report) by 22.3% in the first quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 55,546 shares of the company's stock after selling 15,960 shares during the quarter. Algert Global LLC owned about 0.20% of Grand Canyon Education worth $9,611,000 at the end of the most recent quarter.

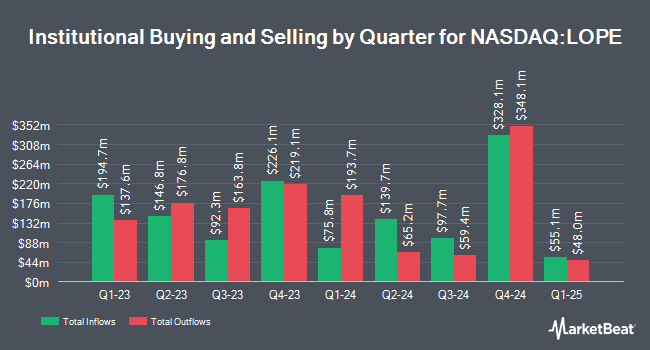

A number of other institutional investors and hedge funds also recently modified their holdings of LOPE. GeoWealth Management LLC acquired a new stake in Grand Canyon Education during the 4th quarter worth approximately $25,000. Caitong International Asset Management Co. Ltd acquired a new stake in Grand Canyon Education during the 1st quarter worth approximately $35,000. Migdal Insurance & Financial Holdings Ltd. increased its position in Grand Canyon Education by 58.2% during the 1st quarter. Migdal Insurance & Financial Holdings Ltd. now owns 261 shares of the company's stock worth $45,000 after purchasing an additional 96 shares in the last quarter. UMB Bank n.a. increased its position in Grand Canyon Education by 107.8% during the 1st quarter. UMB Bank n.a. now owns 318 shares of the company's stock worth $55,000 after purchasing an additional 165 shares in the last quarter. Finally, Cypress Capital Management LLC WY acquired a new stake in Grand Canyon Education during the 1st quarter worth approximately $65,000. Institutional investors and hedge funds own 94.17% of the company's stock.

Analyst Ratings Changes

LOPE has been the subject of a number of research analyst reports. Wall Street Zen raised shares of Grand Canyon Education from a "hold" rating to a "buy" rating in a research report on Saturday, August 9th. BMO Capital Markets dropped their target price on shares of Grand Canyon Education from $222.00 to $210.00 and set an "outperform" rating for the company in a research report on Monday, July 7th. Finally, Barrington Research reissued an "outperform" rating and set a $215.00 target price on shares of Grand Canyon Education in a research report on Thursday, August 7th. Three equities research analysts have rated the stock with a Buy rating, According to data from MarketBeat.com, the stock has an average rating of "Buy" and a consensus price target of $203.67.

Check Out Our Latest Report on Grand Canyon Education

Grand Canyon Education Price Performance

NASDAQ LOPE traded down $0.93 on Friday, reaching $204.30. The company had a trading volume of 113,645 shares, compared to its average volume of 219,124. The firm has a market capitalization of $5.74 billion, a PE ratio of 24.73, a P/E/G ratio of 1.48 and a beta of 0.79. Grand Canyon Education, Inc. has a 1 year low of $130.69 and a 1 year high of $207.12. The firm has a 50-day moving average of $182.37 and a 200-day moving average of $181.47.

Grand Canyon Education (NASDAQ:LOPE - Get Free Report) last released its quarterly earnings results on Wednesday, August 6th. The company reported $1.53 earnings per share for the quarter, topping analysts' consensus estimates of $1.37 by $0.16. The firm had revenue of $247.50 million during the quarter, compared to analysts' expectations of $240.90 million. Grand Canyon Education had a return on equity of 31.50% and a net margin of 22.15%.Grand Canyon Education's quarterly revenue was up 8.8% compared to the same quarter last year. During the same quarter in the prior year, the business earned $1.19 EPS. As a group, sell-side analysts expect that Grand Canyon Education, Inc. will post 8.81 EPS for the current fiscal year.

About Grand Canyon Education

(

Free Report)

Grand Canyon Education, Inc provides education services to colleges and universities in the United States. It offers technology services, including learning management system, internal administration, infrastructure, and support services; academic services, such as program and curriculum, faculty and related training and development, class scheduling, and skills and simulation lab sites; and counseling services and support services comprising admission, financial aid, and field experience and other counseling services.

Further Reading

Before you consider Grand Canyon Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Grand Canyon Education wasn't on the list.

While Grand Canyon Education currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.