Alight Capital Management LP bought a new stake in shares of Micron Technology, Inc. (NASDAQ:MU - Free Report) during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund bought 60,000 shares of the semiconductor manufacturer's stock, valued at approximately $5,213,000. Micron Technology makes up approximately 2.4% of Alight Capital Management LP's holdings, making the stock its 13th biggest position.

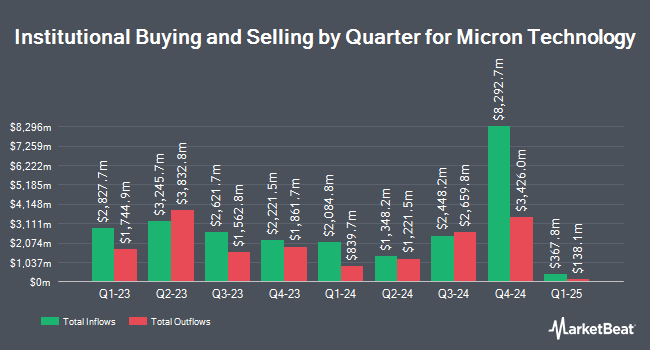

Several other hedge funds have also bought and sold shares of the stock. Vanguard Group Inc. lifted its stake in Micron Technology by 2.1% in the 1st quarter. Vanguard Group Inc. now owns 101,906,368 shares of the semiconductor manufacturer's stock worth $8,854,644,000 after purchasing an additional 2,049,163 shares in the last quarter. Goldman Sachs Group Inc. lifted its stake in Micron Technology by 23.8% in the 1st quarter. Goldman Sachs Group Inc. now owns 10,616,488 shares of the semiconductor manufacturer's stock worth $922,467,000 after purchasing an additional 2,038,641 shares in the last quarter. Charles Schwab Investment Management Inc. lifted its stake in Micron Technology by 0.8% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 6,938,848 shares of the semiconductor manufacturer's stock worth $602,917,000 after purchasing an additional 58,285 shares in the last quarter. Dimensional Fund Advisors LP lifted its stake in Micron Technology by 26.3% in the 1st quarter. Dimensional Fund Advisors LP now owns 6,800,052 shares of the semiconductor manufacturer's stock worth $590,807,000 after purchasing an additional 1,416,174 shares in the last quarter. Finally, Sumitomo Mitsui Trust Group Inc. lifted its stake in Micron Technology by 0.4% in the 1st quarter. Sumitomo Mitsui Trust Group Inc. now owns 4,366,631 shares of the semiconductor manufacturer's stock worth $379,417,000 after purchasing an additional 17,970 shares in the last quarter. Hedge funds and other institutional investors own 80.84% of the company's stock.

Wall Street Analysts Forecast Growth

Several analysts have recently issued reports on MU shares. The Goldman Sachs Group started coverage on shares of Micron Technology in a research report on Thursday, July 10th. They set a "neutral" rating and a $130.00 target price on the stock. KeyCorp upped their target price on shares of Micron Technology from $135.00 to $160.00 and gave the company an "overweight" rating in a research report on Thursday, June 26th. Susquehanna upped their target price on shares of Micron Technology from $150.00 to $160.00 and gave the company a "positive" rating in a research report on Thursday, June 26th. Zacks Research upgraded shares of Micron Technology from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, August 19th. Finally, Piper Sandler upped their target price on shares of Micron Technology from $120.00 to $165.00 and gave the company an "overweight" rating in a research report on Thursday, June 26th. Two equities research analysts have rated the stock with a Strong Buy rating, twenty-one have issued a Buy rating, five have issued a Hold rating and one has issued a Sell rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $147.54.

Check Out Our Latest Stock Analysis on Micron Technology

Insider Transactions at Micron Technology

In other news, EVP Sumit Sadana sold 92,638 shares of the company's stock in a transaction that occurred on Friday, June 27th. The shares were sold at an average price of $125.49, for a total value of $11,625,142.62. Following the completion of the sale, the executive vice president owned 201,326 shares of the company's stock, valued at approximately $25,264,399.74. This represents a 31.51% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Manish H. Bhatia sold 80,000 shares of the firm's stock in a transaction that occurred on Monday, June 30th. The shares were sold at an average price of $123.16, for a total transaction of $9,852,800.00. Following the completion of the sale, the executive vice president owned 275,067 shares of the company's stock, valued at approximately $33,877,251.72. This trade represents a 22.53% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 264,884 shares of company stock worth $32,363,889. Insiders own 0.30% of the company's stock.

Micron Technology Trading Up 5.8%

MU stock traded up $7.16 during mid-day trading on Friday, reaching $131.37. The company had a trading volume of 28,358,729 shares, compared to its average volume of 16,826,394. The company has a debt-to-equity ratio of 0.30, a current ratio of 2.75 and a quick ratio of 1.89. The company has a market capitalization of $147.02 billion, a PE ratio of 23.67 and a beta of 1.47. The firm has a 50 day moving average of $117.85 and a 200 day moving average of $101.70. Micron Technology, Inc. has a 12 month low of $61.54 and a 12 month high of $131.41.

Micron Technology (NASDAQ:MU - Get Free Report) last issued its earnings results on Wednesday, June 25th. The semiconductor manufacturer reported $1.91 EPS for the quarter, topping analysts' consensus estimates of $1.57 by $0.34. The business had revenue of $9.30 billion for the quarter, compared to the consensus estimate of $8.83 billion. Micron Technology had a net margin of 18.41% and a return on equity of 13.60%. During the same period in the prior year, the firm earned $0.62 EPS. Micron Technology has set its Q4 2025 guidance at 2.350-2.650 EPS. On average, equities analysts predict that Micron Technology, Inc. will post 6.08 earnings per share for the current fiscal year.

Micron Technology Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Tuesday, July 22nd. Stockholders of record on Monday, July 7th were given a $0.115 dividend. This represents a $0.46 annualized dividend and a dividend yield of 0.4%. The ex-dividend date of this dividend was Monday, July 7th. Micron Technology's dividend payout ratio is presently 8.29%.

About Micron Technology

(

Free Report)

Micron Technology, Inc designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. It provides memory and storage technologies comprising dynamic random access memory semiconductor devices with low latency that provide high-speed data retrieval; non-volatile and re-writeable semiconductor storage devices; and non-volatile re-writable semiconductor memory devices that provide fast read speeds under the Micron and Crucial brands, as well as through private labels.

Further Reading

Before you consider Micron Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Micron Technology wasn't on the list.

While Micron Technology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report