Allen Investment Management LLC increased its position in Workday, Inc. (NASDAQ:WDAY - Free Report) by 3.4% in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 226,310 shares of the software maker's stock after buying an additional 7,346 shares during the quarter. Workday accounts for 0.6% of Allen Investment Management LLC's portfolio, making the stock its 29th largest position. Allen Investment Management LLC owned about 0.09% of Workday worth $52,850,000 at the end of the most recent quarter.

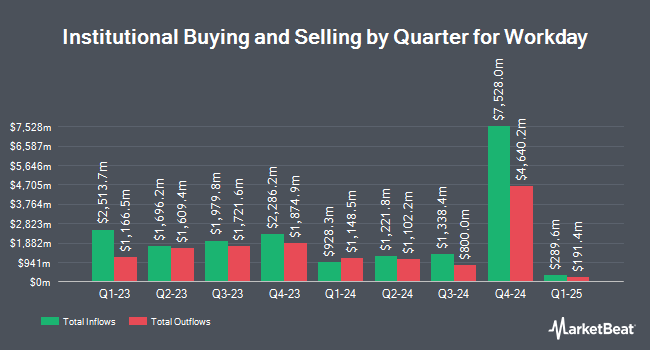

A number of other institutional investors and hedge funds have also bought and sold shares of the business. T. Rowe Price Investment Management Inc. bought a new stake in Workday during the 4th quarter valued at $658,735,000. Norges Bank bought a new stake in Workday in the 4th quarter worth $645,710,000. Geode Capital Management LLC increased its position in shares of Workday by 61.9% in the fourth quarter. Geode Capital Management LLC now owns 4,637,387 shares of the software maker's stock valued at $1,193,105,000 after acquiring an additional 1,772,223 shares during the period. The Manufacturers Life Insurance Company raised its stake in shares of Workday by 60.7% during the fourth quarter. The Manufacturers Life Insurance Company now owns 3,722,255 shares of the software maker's stock valued at $960,454,000 after acquiring an additional 1,406,088 shares during the last quarter. Finally, Invesco Ltd. grew its stake in shares of Workday by 102.6% in the fourth quarter. Invesco Ltd. now owns 1,855,778 shares of the software maker's stock worth $478,846,000 after purchasing an additional 939,955 shares during the last quarter. 89.81% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

WDAY has been the topic of a number of research analyst reports. Loop Capital reduced their price objective on shares of Workday from $285.00 to $250.00 and set a "hold" rating on the stock in a research report on Friday, May 23rd. Guggenheim reissued a "neutral" rating on shares of Workday in a research note on Friday, May 23rd. KeyCorp lowered their price objective on shares of Workday from $335.00 to $325.00 and set an "overweight" rating for the company in a report on Friday, May 23rd. Royal Bank Of Canada reiterated an "outperform" rating and set a $340.00 target price on shares of Workday in a report on Friday, May 23rd. Finally, Wells Fargo & Company reduced their price target on Workday from $360.00 to $325.00 and set an "overweight" rating on the stock in a research note on Tuesday, April 22nd. One equities research analyst has rated the stock with a sell rating, seven have given a hold rating, nineteen have issued a buy rating and two have given a strong buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $296.88.

Read Our Latest Research Report on WDAY

Insider Activity

In other Workday news, CFO Zane Rowe sold 6,000 shares of the company's stock in a transaction dated Tuesday, July 8th. The shares were sold at an average price of $239.59, for a total value of $1,437,540.00. Following the transaction, the chief financial officer directly owned 178,418 shares in the company, valued at approximately $42,747,168.62. This represents a 3.25% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Carl M. Eschenbach sold 6,250 shares of the stock in a transaction dated Tuesday, July 1st. The stock was sold at an average price of $239.43, for a total value of $1,496,437.50. Following the transaction, the chief executive officer owned 1,472 shares in the company, valued at $352,440.96. This trade represents a 80.94% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 329,005 shares of company stock worth $79,203,523 in the last quarter. 20.00% of the stock is currently owned by corporate insiders.

Workday Stock Performance

Shares of NASDAQ:WDAY traded down $3.70 during midday trading on Monday, hitting $238.04. The stock had a trading volume of 1,539,706 shares, compared to its average volume of 2,144,885. The company has a market capitalization of $63.56 billion, a PE ratio of 131.51, a P/E/G ratio of 3.65 and a beta of 1.21. Workday, Inc. has a 1 year low of $199.81 and a 1 year high of $294.00. The stock has a 50 day moving average price of $242.57 and a two-hundred day moving average price of $246.62. The company has a current ratio of 2.07, a quick ratio of 2.07 and a debt-to-equity ratio of 0.33.

Workday (NASDAQ:WDAY - Get Free Report) last announced its quarterly earnings data on Thursday, May 22nd. The software maker reported $2.23 EPS for the quarter, beating the consensus estimate of $2.01 by $0.22. The firm had revenue of $2.24 billion during the quarter, compared to analysts' expectations of $2.22 billion. Workday had a net margin of 5.60% and a return on equity of 8.00%. The business's revenue for the quarter was up 12.6% compared to the same quarter last year. During the same quarter last year, the business earned $1.74 earnings per share. As a group, equities analysts predict that Workday, Inc. will post 2.63 earnings per share for the current fiscal year.

About Workday

(

Free Report)

Workday, Inc provides enterprise cloud applications in the United States and internationally. Its applications help its customers to plan, execute, analyze, and extend to other applications and environments to manage their business and operations. The company offers a suite of financial management applications to maintain accounting information in the general ledger; manage financial processes, such as payables and receivables; identify real-time financial, operational, and management insights; enhance financial consolidation; reduce time-to-close; promote internal control and auditability; and achieve consistency across finance operations.

Featured Articles

Before you consider Workday, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Workday wasn't on the list.

While Workday currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report