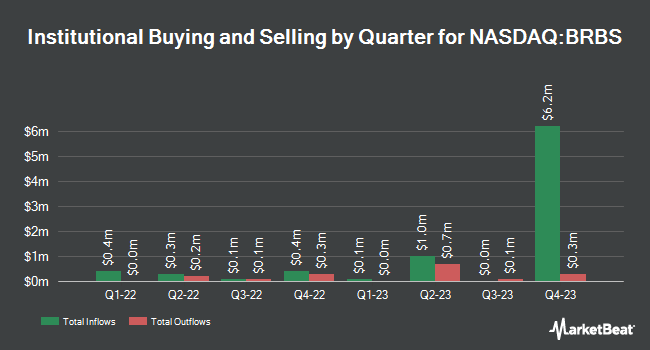

Alliancebernstein L.P. lifted its stake in shares of Blue Ridge Bankshares, Inc. (NASDAQ:BRBS - Free Report) by 1,018.9% during the 1st quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 4,414,787 shares of the company's stock after buying an additional 4,020,231 shares during the quarter. Alliancebernstein L.P. owned 4.84% of Blue Ridge Bankshares worth $14,392,000 as of its most recent filing with the SEC.

Several other hedge funds have also modified their holdings of BRBS. Alpine Global Management LLC purchased a new stake in shares of Blue Ridge Bankshares during the 4th quarter valued at about $34,000. Cannon Wealth Management Services LLC purchased a new stake in shares of Blue Ridge Bankshares during the 1st quarter valued at about $35,000. Wells Fargo & Company MN acquired a new stake in Blue Ridge Bankshares during the 4th quarter valued at approximately $42,000. Arcus Capital Partners LLC acquired a new stake in Blue Ridge Bankshares during the 1st quarter valued at approximately $47,000. Finally, Two Sigma Advisers LP acquired a new stake in Blue Ridge Bankshares during the 4th quarter valued at approximately $51,000. 50.48% of the stock is currently owned by hedge funds and other institutional investors.

Blue Ridge Bankshares Stock Down 0.7%

NASDAQ BRBS traded down $0.03 during mid-day trading on Wednesday, reaching $4.15. 508,060 shares of the company's stock traded hands, compared to its average volume of 375,826. Blue Ridge Bankshares, Inc. has a 1-year low of $2.66 and a 1-year high of $4.26. The company has a fifty day simple moving average of $3.83 and a 200-day simple moving average of $3.53. The company has a current ratio of 1.06, a quick ratio of 1.05 and a debt-to-equity ratio of 0.68. The company has a market cap of $382.32 million, a price-to-earnings ratio of -6.48 and a beta of 0.83.

Blue Ridge Bankshares Company Profile

(

Free Report)

Blue Ridge Bankshares, Inc operates as a bank holding company for the Blue Ridge Bank, National Association that provides commercial and consumer banking, and financial services. It operates through: Commercial Banking and Mortgage Banking segments. The company accepts checking, savings, money market, cash management, and individual retirement accounts, as well as certificates of deposit.

Featured Stories

Before you consider Blue Ridge Bankshares, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Blue Ridge Bankshares wasn't on the list.

While Blue Ridge Bankshares currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.