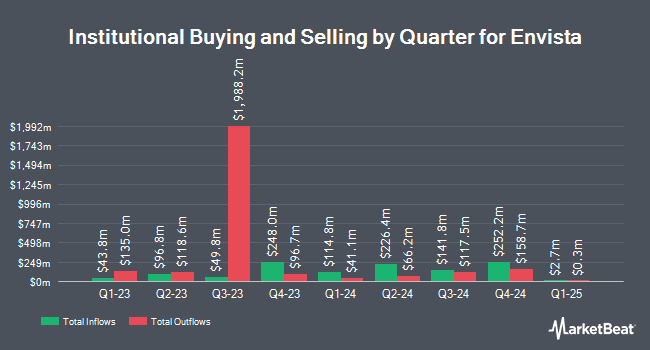

Allianz Asset Management GmbH grew its stake in Envista Holdings Corporation (NYSE:NVST - Free Report) by 103.4% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 425,485 shares of the company's stock after acquiring an additional 216,350 shares during the period. Allianz Asset Management GmbH owned 0.25% of Envista worth $7,344,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other institutional investors and hedge funds have also modified their holdings of the business. Treasurer of the State of North Carolina boosted its position in Envista by 0.6% during the 4th quarter. Treasurer of the State of North Carolina now owns 75,560 shares of the company's stock worth $1,458,000 after buying an additional 480 shares during the period. Palouse Capital Management Inc. grew its position in Envista by 14.4% during the first quarter. Palouse Capital Management Inc. now owns 9,444 shares of the company's stock valued at $163,000 after buying an additional 1,186 shares during the period. California Public Employees Retirement System boosted its position in Envista by 0.4% during the fourth quarter. California Public Employees Retirement System now owns 288,546 shares of the company's stock worth $5,566,000 after purchasing an additional 1,272 shares during the period. UMB Bank n.a. boosted its position in shares of Envista by 214.4% in the first quarter. UMB Bank n.a. now owns 2,094 shares of the company's stock valued at $36,000 after acquiring an additional 1,428 shares during the period. Finally, Principal Financial Group Inc. boosted its position in shares of Envista by 0.5% in the first quarter. Principal Financial Group Inc. now owns 396,548 shares of the company's stock valued at $6,844,000 after acquiring an additional 2,008 shares during the period.

Analyst Upgrades and Downgrades

Several research analysts have recently issued reports on the stock. Baird R W upgraded shares of Envista from a "hold" rating to a "strong-buy" rating in a report on Tuesday, May 27th. Robert W. Baird raised shares of Envista from a "neutral" rating to an "outperform" rating and increased their target price for the stock from $21.00 to $23.00 in a report on Tuesday, May 27th. Evercore ISI upped their price target on Envista from $19.00 to $23.00 and gave the stock an "outperform" rating in a research note on Wednesday, July 9th. UBS Group raised their price target on Envista from $18.00 to $22.00 and gave the stock a "neutral" rating in a research report on Tuesday. Finally, Morgan Stanley set a $16.00 target price on Envista in a research report on Tuesday, April 15th. One analyst has rated the stock with a sell rating, nine have issued a hold rating, four have assigned a buy rating and one has given a strong buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $20.54.

Get Our Latest Analysis on Envista

Envista Trading Down 5.7%

NYSE:NVST traded down $1.14 during trading hours on Thursday, hitting $18.82. 1,318,675 shares of the stock were exchanged, compared to its average volume of 2,554,215. The company's 50 day moving average is $19.29 and its two-hundred day moving average is $18.60. The company has a quick ratio of 1.82, a current ratio of 2.12 and a debt-to-equity ratio of 0.43. The company has a market capitalization of $3.19 billion, a P/E ratio of -2.89, a price-to-earnings-growth ratio of 1.28 and a beta of 1.00. Envista Holdings Corporation has a twelve month low of $14.22 and a twelve month high of $23.00.

Envista (NYSE:NVST - Get Free Report) last announced its quarterly earnings data on Thursday, May 1st. The company reported $0.24 earnings per share for the quarter, beating the consensus estimate of $0.20 by $0.04. The company had revenue of $616.90 million during the quarter, compared to analysts' expectations of $608.17 million. Envista had a positive return on equity of 4.07% and a negative net margin of 44.90%. Envista's revenue for the quarter was down 1.1% compared to the same quarter last year. During the same quarter last year, the company earned $0.26 EPS. On average, sell-side analysts anticipate that Envista Holdings Corporation will post 1 earnings per share for the current fiscal year.

Envista Profile

(

Free Report)

Envista Holdings Corporation, together with its subsidiaries, develops, manufactures, markets, and sells dental products in the United States, China, and internationally. The company operates in two segments, Specialty Products & Technologies, and Equipment & Consumables. The Specialty Products & Technologies segment offers dental implant systems, guided surgery systems, biomaterials, and prefabricated and custom-built prosthetics to oral surgeons, prosthodontists and periodontists, and general dentist; and brackets and wires, tubes and bands, archwires, clear aligners, digital orthodontic treatments, retainers, and other orthodontic laboratory products.

See Also

Before you consider Envista, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Envista wasn't on the list.

While Envista currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.