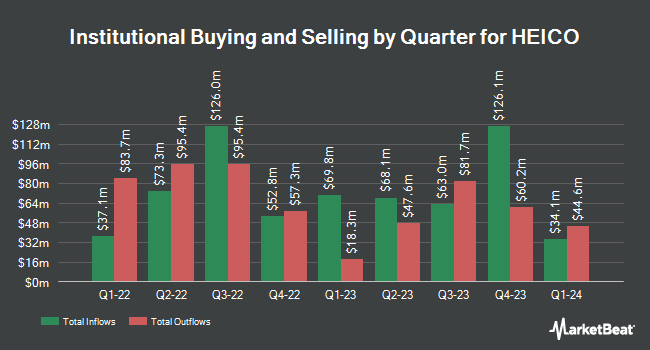

Allianz Asset Management GmbH cut its holdings in Heico Corporation (NYSE:HEI - Free Report) by 56.7% during the first quarter, according to the company in its most recent Form 13F filing with the SEC. The firm owned 899 shares of the aerospace company's stock after selling 1,176 shares during the quarter. Allianz Asset Management GmbH's holdings in Heico were worth $240,000 as of its most recent filing with the SEC.

A number of other institutional investors also recently bought and sold shares of the business. NBC Securities Inc. purchased a new stake in shares of Heico in the first quarter valued at about $27,000. Banque Transatlantique SA purchased a new stake in shares of Heico in the fourth quarter valued at about $44,000. Atwood & Palmer Inc. purchased a new position in shares of Heico during the first quarter valued at approximately $80,000. TD Private Client Wealth LLC lifted its stake in shares of Heico by 37.5% during the first quarter. TD Private Client Wealth LLC now owns 458 shares of the aerospace company's stock valued at $122,000 after buying an additional 125 shares during the period. Finally, SBI Securities Co. Ltd. increased its position in Heico by 14.9% during the first quarter. SBI Securities Co. Ltd. now owns 654 shares of the aerospace company's stock worth $175,000 after purchasing an additional 85 shares during the last quarter. 27.12% of the stock is currently owned by institutional investors and hedge funds.

Heico Stock Down 0.6%

Shares of HEI stock traded down $1.80 during trading on Friday, hitting $314.93. 235,764 shares of the company were exchanged, compared to its average volume of 520,014. The company has a debt-to-equity ratio of 0.56, a quick ratio of 1.56 and a current ratio of 3.43. The firm has a market capitalization of $43.81 billion, a price-to-earnings ratio of 73.54, a P/E/G ratio of 3.94 and a beta of 1.11. The business's 50-day simple moving average is $315.77 and its 200 day simple moving average is $274.13. Heico Corporation has a twelve month low of $216.68 and a twelve month high of $338.92.

Heico (NYSE:HEI - Get Free Report) last posted its earnings results on Tuesday, May 27th. The aerospace company reported $1.12 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.03 by $0.09. Heico had a net margin of 14.54% and a return on equity of 15.88%. The firm had revenue of $1.10 billion during the quarter, compared to analysts' expectations of $1.06 billion. During the same period in the previous year, the company earned $0.88 earnings per share. The company's revenue was up 14.9% compared to the same quarter last year. As a group, analysts forecast that Heico Corporation will post 4.2 EPS for the current fiscal year.

Heico Increases Dividend

The business also recently announced a semi-annual dividend, which was paid on Tuesday, July 15th. Investors of record on Tuesday, July 1st were given a dividend of $0.12 per share. This represents a yield of 10.0%. This is an increase from Heico's previous semi-annual dividend of $0.11. The ex-dividend date of this dividend was Tuesday, July 1st. Heico's payout ratio is presently 5.61%.

Insider Buying and Selling

In other Heico news, Director Frank J. Schwitter sold 356 shares of the business's stock in a transaction on Tuesday, June 3rd. The shares were sold at an average price of $299.10, for a total value of $106,479.60. Following the sale, the director owned 1,500 shares of the company's stock, valued at $448,650. The trade was a 19.18% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Also, Chairman Laurans A. Mendelson sold 56,300 shares of the business's stock in a transaction on Tuesday, July 15th. The shares were sold at an average price of $319.45, for a total transaction of $17,985,035.00. Following the completion of the sale, the chairman directly owned 1,253,127 shares in the company, valued at $400,311,420.15. This trade represents a 4.30% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 91,656 shares of company stock valued at $28,534,115. 9.55% of the stock is owned by company insiders.

Analyst Ratings Changes

HEI has been the subject of several research analyst reports. Wall Street Zen lowered shares of Heico from a "buy" rating to a "hold" rating in a research report on Friday, July 18th. Bank of America raised their price target on shares of Heico from $320.00 to $355.00 and gave the stock a "buy" rating in a research report on Thursday, July 3rd. Barclays set a $280.00 price target on shares of Heico and gave the stock an "equal weight" rating in a research report on Monday, June 2nd. Stifel Nicolaus set a $352.00 price objective on shares of Heico and gave the company a "buy" rating in a research report on Tuesday, June 24th. Finally, UBS Group raised their target price on shares of Heico from $264.00 to $306.00 and gave the company a "neutral" rating in a research note on Thursday, May 29th. Six analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average target price of $301.45.

Read Our Latest Stock Report on HEI

About Heico

(

Free Report)

HEICO Corporation, through its subsidiaries, designs, manufactures, and sells aerospace, defense, and electronic related products and services in the United States and internationally. Its Flight Support Group segment provides jet engine and aircraft component replacement parts; thermal insulation blankets and parts; renewable/reusable insulation systems; and specialty components.

Featured Articles

Before you consider Heico, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Heico wasn't on the list.

While Heico currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.