Allianz Asset Management GmbH trimmed its holdings in shares of Crane NXT, Co. (NYSE:CXT - Free Report) by 42.6% in the first quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 28,774 shares of the company's stock after selling 21,332 shares during the period. Allianz Asset Management GmbH owned about 0.05% of Crane NXT worth $1,473,000 as of its most recent SEC filing.

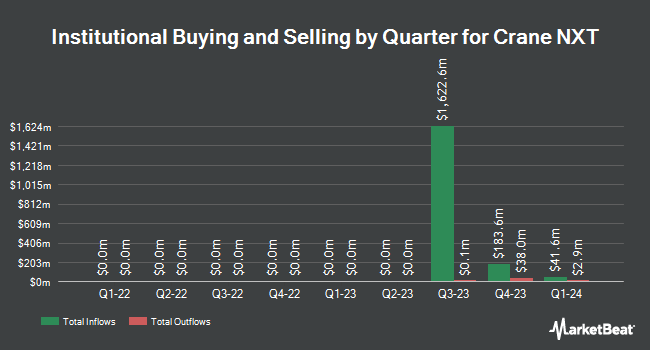

Other large investors have also recently added to or reduced their stakes in the company. Deutsche Bank AG boosted its stake in shares of Crane NXT by 3.0% during the 4th quarter. Deutsche Bank AG now owns 5,831 shares of the company's stock valued at $339,000 after buying an additional 168 shares during the period. Covestor Ltd boosted its stake in shares of Crane NXT by 38.6% during the 4th quarter. Covestor Ltd now owns 739 shares of the company's stock valued at $43,000 after buying an additional 206 shares during the period. Fifth Third Bancorp lifted its holdings in shares of Crane NXT by 46.0% during the 1st quarter. Fifth Third Bancorp now owns 812 shares of the company's stock valued at $42,000 after buying an additional 256 shares during the last quarter. UMB Bank n.a. grew its stake in shares of Crane NXT by 87.2% in the 1st quarter. UMB Bank n.a. now owns 702 shares of the company's stock valued at $36,000 after buying an additional 327 shares in the last quarter. Finally, Park Square Financial Group LLC bought a new position in Crane NXT during the fourth quarter valued at approximately $26,000. 77.49% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

CXT has been the topic of a number of recent research reports. DA Davidson cut their price target on shares of Crane NXT from $100.00 to $85.00 and set a "buy" rating on the stock in a report on Friday, May 9th. UBS Group lowered their target price on shares of Crane NXT from $62.00 to $60.00 and set a "neutral" rating on the stock in a research note on Tuesday, May 13th. Three equities research analysts have rated the stock with a hold rating, two have issued a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, Crane NXT currently has an average rating of "Moderate Buy" and a consensus price target of $73.75.

Read Our Latest Research Report on Crane NXT

Crane NXT Stock Performance

NYSE CXT traded down $0.12 during midday trading on Monday, hitting $56.98. The company had a trading volume of 139,085 shares, compared to its average volume of 421,127. The company has a quick ratio of 0.92, a current ratio of 1.20 and a debt-to-equity ratio of 0.49. The stock has a market cap of $3.27 billion, a price-to-earnings ratio of 19.57 and a beta of 1.33. The firm has a fifty day simple moving average of $56.06 and a two-hundred day simple moving average of $54.63. Crane NXT, Co. has a fifty-two week low of $41.54 and a fifty-two week high of $67.00.

Crane NXT (NYSE:CXT - Get Free Report) last released its quarterly earnings data on Wednesday, May 7th. The company reported $0.54 EPS for the quarter, topping analysts' consensus estimates of $0.51 by $0.03. The company had revenue of $330.30 million during the quarter, compared to the consensus estimate of $318.46 million. Crane NXT had a net margin of 11.17% and a return on equity of 21.58%. The firm's revenue for the quarter was up 5.3% compared to the same quarter last year. During the same period last year, the firm earned $0.85 EPS. Equities analysts forecast that Crane NXT, Co. will post 4.16 earnings per share for the current fiscal year.

Crane NXT Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Wednesday, June 11th. Investors of record on Friday, May 30th were issued a dividend of $0.17 per share. This represents a $0.68 annualized dividend and a yield of 1.2%. The ex-dividend date of this dividend was Friday, May 30th. Crane NXT's dividend payout ratio (DPR) is currently 23.37%.

Crane NXT Profile

(

Free Report)

Crane NXT, Co operates as an industrial technology company that provides technology solutions to secure, detect, and authenticate customers' important assets. The company operates through Crane Payment Innovations and Crane Currency segments. The Crane Payment Innovations segment offers electronic equipment and associated software, as well as advanced automation solutions, processing systems, field service solutions, remote diagnostics, and productivity software solutions.

Featured Articles

Before you consider Crane NXT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Crane NXT wasn't on the list.

While Crane NXT currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.