Allianz Asset Management GmbH reduced its position in Herc Holdings Inc. (NYSE:HRI - Free Report) by 49.2% during the 1st quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 117,318 shares of the transportation company's stock after selling 113,812 shares during the quarter. Allianz Asset Management GmbH owned about 0.41% of Herc worth $15,752,000 at the end of the most recent reporting period.

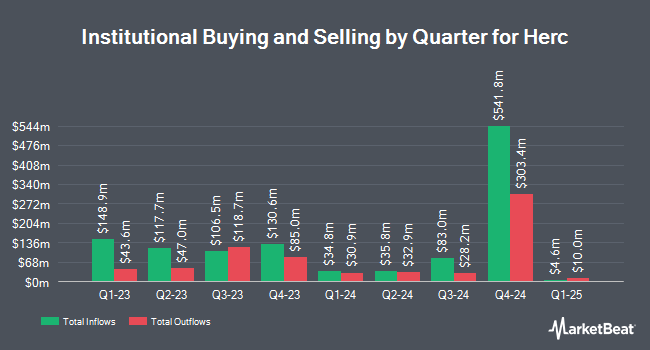

Several other institutional investors and hedge funds have also bought and sold shares of the company. Larson Financial Group LLC raised its stake in Herc by 1,831.3% in the 1st quarter. Larson Financial Group LLC now owns 309 shares of the transportation company's stock worth $41,000 after acquiring an additional 293 shares during the last quarter. Quarry LP lifted its position in Herc by 646.7% during the 4th quarter. Quarry LP now owns 224 shares of the transportation company's stock worth $42,000 after acquiring an additional 194 shares during the period. Nomura Asset Management Co. Ltd. lifted its position in Herc by 53.3% during the 4th quarter. Nomura Asset Management Co. Ltd. now owns 230 shares of the transportation company's stock worth $44,000 after acquiring an additional 80 shares during the period. Point72 Asia Singapore Pte. Ltd. acquired a new stake in Herc during the 4th quarter worth about $59,000. Finally, CWM LLC lifted its position in Herc by 114.4% during the 1st quarter. CWM LLC now owns 1,042 shares of the transportation company's stock worth $140,000 after acquiring an additional 556 shares during the period. 93.11% of the stock is owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of analysts have commented on HRI shares. Citigroup reaffirmed a "buy" rating and set a $140.00 price target (up previously from $130.00) on shares of Herc in a research report on Tuesday, June 24th. Robert W. Baird lowered their price target on Herc from $129.00 to $110.00 and set a "neutral" rating for the company in a research report on Wednesday, April 23rd. JPMorgan Chase & Co. lowered their price target on Herc from $225.00 to $140.00 and set a "neutral" rating for the company in a research report on Monday, April 14th. Barclays lowered their price target on shares of Herc from $250.00 to $160.00 and set an "overweight" rating on the stock in a report on Thursday, April 24th. Finally, The Goldman Sachs Group reaffirmed a "buy" rating and issued a $146.00 price target (down from $171.00) on shares of Herc in a report on Tuesday, April 22nd. Two research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus price target of $139.20.

View Our Latest Stock Analysis on Herc

Herc Stock Performance

NYSE:HRI traded down $23.49 during mid-day trading on Tuesday, hitting $126.40. The company's stock had a trading volume of 596,874 shares, compared to its average volume of 512,939. Herc Holdings Inc. has a 1 year low of $96.18 and a 1 year high of $246.88. The company has a debt-to-equity ratio of 3.04, a current ratio of 1.50 and a quick ratio of 1.50. The stock has a market cap of $3.60 billion, a price-to-earnings ratio of 28.16, a PEG ratio of 3.74 and a beta of 1.86. The business's fifty day moving average is $129.81 and its two-hundred day moving average is $143.08.

Herc (NYSE:HRI - Get Free Report) last posted its quarterly earnings results on Tuesday, July 29th. The transportation company reported $1.87 EPS for the quarter, beating the consensus estimate of $1.29 by $0.58. The company had revenue of $1 billion for the quarter, compared to analyst estimates of $868.23 million. Herc had a net margin of 3.53% and a return on equity of 24.10%. Analysts anticipate that Herc Holdings Inc. will post 12.84 EPS for the current fiscal year.

Herc Announces Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, June 13th. Shareholders of record on Friday, May 30th were given a $0.70 dividend. The ex-dividend date of this dividend was Friday, May 30th. This represents a $2.80 dividend on an annualized basis and a dividend yield of 2.22%. Herc's dividend payout ratio (DPR) is currently 62.36%.

About Herc

(

Free Report)

Herc Holdings Inc, together with its subsidiaries, operates as an equipment rental supplier. It rents aerial, earthmoving, material handling, trucks and trailers, air compressors, compaction, and lighting equipment, as well as generators, and safety supplies and expendables; and provides ProSolutions, an industry specific solution based services, such as pumping solutions, power generation, climate control, remediation and restoration, and studio and production equipment.

Featured Stories

Before you consider Herc, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Herc wasn't on the list.

While Herc currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.