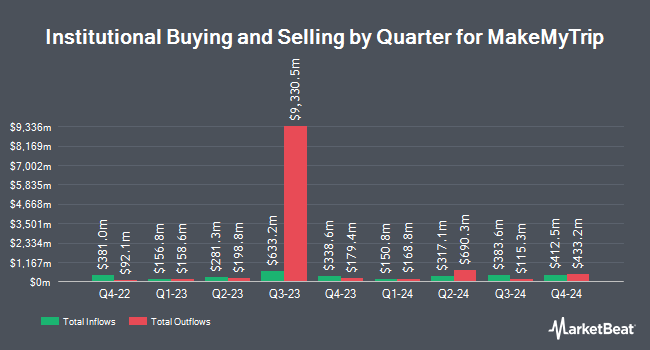

Allspring Global Investments Holdings LLC lifted its position in MakeMyTrip Limited (NASDAQ:MMYT - Free Report) by 642.4% in the second quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 164,953 shares of the technology company's stock after purchasing an additional 142,735 shares during the quarter. Allspring Global Investments Holdings LLC owned about 0.15% of MakeMyTrip worth $15,626,000 at the end of the most recent reporting period.

Other hedge funds have also recently modified their holdings of the company. WPG Advisers LLC purchased a new stake in shares of MakeMyTrip in the first quarter valued at about $28,000. Twin Tree Management LP purchased a new stake in shares of MakeMyTrip in the first quarter valued at about $29,000. Stone House Investment Management LLC purchased a new stake in shares of MakeMyTrip in the first quarter valued at about $49,000. Farther Finance Advisors LLC purchased a new stake in shares of MakeMyTrip in the second quarter valued at about $50,000. Finally, Signaturefd LLC grew its holdings in shares of MakeMyTrip by 40.9% in the first quarter. Signaturefd LLC now owns 930 shares of the technology company's stock valued at $91,000 after purchasing an additional 270 shares during the period. Hedge funds and other institutional investors own 51.89% of the company's stock.

Wall Street Analyst Weigh In

A number of research analysts have commented on the stock. Wall Street Zen cut shares of MakeMyTrip from a "hold" rating to a "sell" rating in a research report on Friday, October 3rd. Macquarie raised shares of MakeMyTrip from a "neutral" rating to an "outperform" rating and set a $110.00 target price on the stock in a research report on Tuesday, June 24th. Finally, Citigroup decreased their target price on shares of MakeMyTrip from $125.00 to $120.00 and set a "buy" rating on the stock in a research report on Wednesday, July 23rd. Three investment analysts have rated the stock with a Buy rating, According to MarketBeat, MakeMyTrip currently has an average rating of "Buy" and a consensus target price of $120.00.

Read Our Latest Stock Analysis on MMYT

MakeMyTrip Stock Up 0.9%

Shares of MMYT opened at $89.02 on Friday. The stock has a market capitalization of $9.90 billion, a PE ratio of 103.51 and a beta of 0.81. MakeMyTrip Limited has a 1 year low of $81.84 and a 1 year high of $123.00. The company has a debt-to-equity ratio of 18.35, a quick ratio of 1.15 and a current ratio of 1.15. The company's 50-day simple moving average is $96.94 and its 200-day simple moving average is $98.33.

MakeMyTrip Profile

(

Free Report)

MakeMyTrip Limited, an online travel company, sells travel products and solutions in India, the United States, Singapore, Malaysia, Thailand, the United Arab Emirates, Peru, Colombia, Vietnam, and Indonesia. The company operates through three segments: Air Ticketing, Hotels and Packages, and Bus Ticketing.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MakeMyTrip, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MakeMyTrip wasn't on the list.

While MakeMyTrip currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.