Alpha Family Trust bought a new stake in shares of MicroStrategy Incorporated (NASDAQ:MSTR - Free Report) during the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund bought 1,110 shares of the software maker's stock, valued at approximately $320,000.

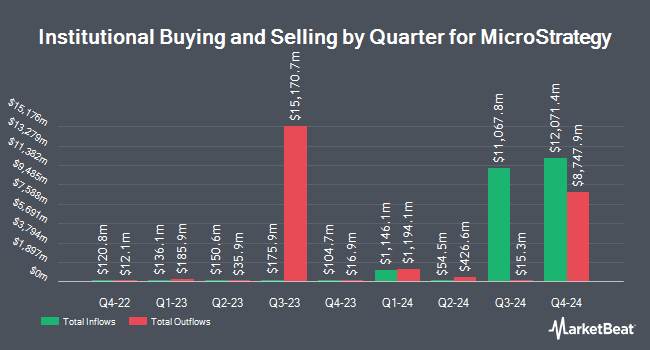

A number of other hedge funds and other institutional investors have also bought and sold shares of MSTR. Dunhill Financial LLC purchased a new position in shares of MicroStrategy during the 4th quarter valued at $26,000. Safe Harbor Fiduciary LLC grew its position in MicroStrategy by 820.0% in the fourth quarter. Safe Harbor Fiduciary LLC now owns 92 shares of the software maker's stock worth $27,000 after acquiring an additional 82 shares in the last quarter. First United Bank & Trust purchased a new position in MicroStrategy in the first quarter worth $29,000. Siemens Fonds Invest GmbH grew its position in MicroStrategy by 6,992.7% in the fourth quarter. Siemens Fonds Invest GmbH now owns 119,654 shares of the software maker's stock worth $33,000 after acquiring an additional 117,967 shares in the last quarter. Finally, Hexagon Capital Partners LLC grew its position in MicroStrategy by 7,750.0% in the first quarter. Hexagon Capital Partners LLC now owns 157 shares of the software maker's stock worth $45,000 after acquiring an additional 155 shares in the last quarter. Institutional investors own 59.84% of the company's stock.

Insiders Place Their Bets

In related news, CAO Jeanine Montgomery acquired 5,000 shares of the stock in a transaction on Tuesday, July 29th. The stock was acquired at an average cost of $90.00 per share, for a total transaction of $450,000.00. Following the completion of the acquisition, the chief accounting officer directly owned 5,000 shares of the company's stock, valued at approximately $450,000. This represents a ∞ increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, Director Jarrod M. Patten bought 5,555 shares of the firm's stock in a transaction on Tuesday, July 29th. The shares were acquired at an average cost of $90.00 per share, with a total value of $499,950.00. Following the purchase, the director directly owned 5,555 shares of the company's stock, valued at approximately $499,950. This represents a ∞ increase in their position. The disclosure for this purchase can be found here. Over the last ninety days, insiders bought 278,132 shares of company stock valued at $25,145,795 and sold 194,571 shares valued at $78,995,024. 8.46% of the stock is currently owned by corporate insiders.

Analysts Set New Price Targets

Several research analysts recently issued reports on MSTR shares. Mizuho upped their target price on shares of MicroStrategy from $563.00 to $586.00 and gave the stock an "outperform" rating in a research report on Monday, August 11th. Benchmark reiterated a "buy" rating on shares of MicroStrategy in a research report on Wednesday. TD Cowen upped their target price on shares of MicroStrategy from $590.00 to $680.00 and gave the stock a "buy" rating in a research report on Tuesday, July 15th. Canaccord Genuity Group reissued a "buy" rating on shares of MicroStrategy in a research note on Monday, May 19th. Finally, Barclays restated a "hold" rating on shares of MicroStrategy in a research report on Monday, May 19th. One analyst has rated the stock with a sell rating, one has assigned a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $552.50.

Read Our Latest Stock Report on MSTR

MicroStrategy Stock Performance

MicroStrategy stock opened at $366.32 on Monday. The company has a current ratio of 0.68, a quick ratio of 0.68 and a debt-to-equity ratio of 0.17. MicroStrategy Incorporated has a 1-year low of $113.69 and a 1-year high of $543.00. The firm has a 50-day moving average of $397.95 and a 200-day moving average of $354.39. The firm has a market cap of $103.87 billion, a P/E ratio of 32.25 and a beta of 3.76.

MicroStrategy (NASDAQ:MSTR - Get Free Report) last issued its quarterly earnings data on Thursday, July 31st. The software maker reported $32.60 EPS for the quarter, topping the consensus estimate of ($0.12) by $32.72. MicroStrategy had a net margin of 1,036.61% and a return on equity of 18.83%. The business had revenue of $114.49 million during the quarter, compared to analyst estimates of $112.68 million. During the same period last year, the business posted ($5.74) earnings per share. MicroStrategy's quarterly revenue was up 2.7% compared to the same quarter last year.

MicroStrategy Company Profile

(

Free Report)

Strategy Incorporated, formerly known as MicroStrategy, provides artificial intelligence-powered enterprise analytics software and services in the United States, Europe, the Middle East, Africa, and internationally. It offers Strategy ONE, a platform that allows non-technical users to access novel and actionable insights for decision-making, and Strategy Cloud for Government, which provides always-on threat monitoring designed to meet the strict technical and regulatory standards of governments and financial institutions.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider MicroStrategy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MicroStrategy wasn't on the list.

While MicroStrategy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.