Alpha Family Trust boosted its stake in shares of T-Mobile US, Inc. (NASDAQ:TMUS - Free Report) by 34.3% in the 1st quarter, according to its most recent Form 13F filing with the SEC. The fund owned 5,340 shares of the Wireless communications provider's stock after purchasing an additional 1,365 shares during the period. T-Mobile US accounts for about 0.8% of Alpha Family Trust's investment portfolio, making the stock its 19th biggest holding. Alpha Family Trust's holdings in T-Mobile US were worth $1,424,000 as of its most recent filing with the SEC.

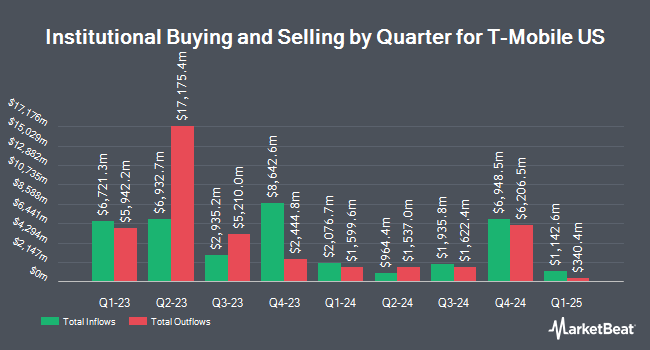

Several other institutional investors and hedge funds have also recently bought and sold shares of the business. Godsey & Gibb Inc. increased its stake in shares of T-Mobile US by 139.5% during the first quarter. Godsey & Gibb Inc. now owns 103 shares of the Wireless communications provider's stock worth $27,000 after purchasing an additional 60 shares during the period. Stone House Investment Management LLC acquired a new stake in shares of T-Mobile US in the 1st quarter valued at $29,000. TCTC Holdings LLC boosted its holdings in shares of T-Mobile US by 208.1% in the 1st quarter. TCTC Holdings LLC now owns 114 shares of the Wireless communications provider's stock valued at $30,000 after purchasing an additional 77 shares in the last quarter. Adirondack Trust Co. boosted its holdings in shares of T-Mobile US by 366.7% in the 1st quarter. Adirondack Trust Co. now owns 140 shares of the Wireless communications provider's stock valued at $37,000 after purchasing an additional 110 shares in the last quarter. Finally, City Holding Co. boosted its holdings in shares of T-Mobile US by 45.3% during the 1st quarter. City Holding Co. now owns 138 shares of the Wireless communications provider's stock valued at $37,000 after acquiring an additional 43 shares in the last quarter. Institutional investors own 42.49% of the company's stock.

Analyst Ratings Changes

Several equities research analysts recently weighed in on the company. Wall Street Zen downgraded T-Mobile US from a "buy" rating to a "hold" rating in a report on Saturday, May 24th. Royal Bank Of Canada raised their target price on T-Mobile US from $265.00 to $270.00 and gave the stock a "sector perform" rating in a research report on Friday, July 25th. Redburn Atlantic raised T-Mobile US from a "strong sell" rating to a "hold" rating and set a $228.00 target price for the company in a research report on Monday, July 7th. Scotiabank raised T-Mobile US from a "sector perform" rating to a "sector outperform" rating and raised their target price for the stock from $275.00 to $277.50 in a research report on Wednesday, April 30th. Finally, KeyCorp reaffirmed an "underweight" rating and set a $200.00 target price on shares of T-Mobile US in a research report on Wednesday, July 9th. One research analyst has rated the stock with a sell rating, thirteen have issued a hold rating, nine have given a buy rating and three have assigned a strong buy rating to the company. Based on data from MarketBeat.com, T-Mobile US presently has an average rating of "Moderate Buy" and a consensus target price of $256.31.

Read Our Latest Research Report on T-Mobile US

Insider Buying and Selling

In other T-Mobile US news, Director Telekom Ag Deutsche sold 69,840 shares of the stock in a transaction on Monday, July 7th. The stock was sold at an average price of $238.08, for a total transaction of $16,627,507.20. Following the sale, the director owned 647,660,844 shares in the company, valued at $154,195,093,739.52. This represents a 0.01% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Insiders sold a total of 1,974,370 shares of company stock valued at $462,526,830 in the last quarter. 0.37% of the stock is currently owned by corporate insiders.

T-Mobile US Stock Performance

Shares of TMUS opened at $254.63 on Monday. The company has a debt-to-equity ratio of 1.33, a quick ratio of 1.13 and a current ratio of 1.21. The stock has a 50 day moving average price of $235.58 and a two-hundred day moving average price of $247.42. The firm has a market capitalization of $286.57 billion, a P/E ratio of 24.02, a P/E/G ratio of 1.39 and a beta of 0.62. T-Mobile US, Inc. has a 52 week low of $192.61 and a 52 week high of $276.49.

T-Mobile US (NASDAQ:TMUS - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The Wireless communications provider reported $2.84 earnings per share for the quarter, topping analysts' consensus estimates of $2.69 by $0.15. T-Mobile US had a return on equity of 19.68% and a net margin of 14.53%. The firm had revenue of $21.13 billion for the quarter, compared to the consensus estimate of $20.99 billion. During the same quarter in the previous year, the business earned $2.49 EPS. The company's revenue was up 6.9% compared to the same quarter last year. Equities analysts forecast that T-Mobile US, Inc. will post 10.37 earnings per share for the current fiscal year.

T-Mobile US Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Thursday, September 11th. Investors of record on Friday, August 29th will be paid a $0.88 dividend. The ex-dividend date is Friday, August 29th. This represents a $3.52 annualized dividend and a yield of 1.4%. T-Mobile US's dividend payout ratio is presently 33.21%.

T-Mobile US Company Profile

(

Free Report)

T-Mobile US, Inc, together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the United States Virgin Islands. The company offers voice, messaging, and data services to customers in the postpaid, prepaid, and wholesale and other services. It also provides wireless devices, including smartphones, wearables, tablets, home broadband routers, and other mobile communication devices, as well as wireless devices and accessories; financing through equipment installment plans; reinsurance for device insurance policies and extended warranty contracts; leasing through JUMP! On Demand; and High Speed Internet services.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider T-Mobile US, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and T-Mobile US wasn't on the list.

While T-Mobile US currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.