Kavar Capital Partners Group LLC decreased its holdings in Alphabet Inc. (NASDAQ:GOOGL - Free Report) by 1.8% in the 2nd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 101,431 shares of the information services provider's stock after selling 1,851 shares during the quarter. Alphabet accounts for about 2.6% of Kavar Capital Partners Group LLC's portfolio, making the stock its 9th largest holding. Kavar Capital Partners Group LLC's holdings in Alphabet were worth $17,875,000 at the end of the most recent quarter.

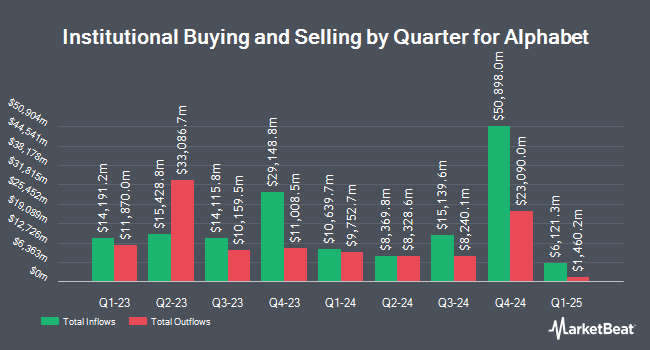

A number of other institutional investors have also added to or reduced their stakes in the stock. Brighton Jones LLC grew its holdings in Alphabet by 3.9% during the 4th quarter. Brighton Jones LLC now owns 110,330 shares of the information services provider's stock worth $20,886,000 after acquiring an additional 4,110 shares during the last quarter. Revolve Wealth Partners LLC lifted its position in shares of Alphabet by 3.5% during the 4th quarter. Revolve Wealth Partners LLC now owns 14,930 shares of the information services provider's stock valued at $2,826,000 after acquiring an additional 506 shares during the period. Rhumbline Advisers lifted its position in shares of Alphabet by 0.8% during the 1st quarter. Rhumbline Advisers now owns 11,267,743 shares of the information services provider's stock valued at $1,742,444,000 after acquiring an additional 86,670 shares during the period. MKT Advisors LLC increased its stake in Alphabet by 2.6% during the 1st quarter. MKT Advisors LLC now owns 7,589 shares of the information services provider's stock valued at $1,114,000 after purchasing an additional 195 shares in the last quarter. Finally, Sandbox Financial Partners LLC increased its stake in Alphabet by 0.5% during the 1st quarter. Sandbox Financial Partners LLC now owns 16,160 shares of the information services provider's stock valued at $2,499,000 after purchasing an additional 73 shares in the last quarter. 40.03% of the stock is currently owned by institutional investors and hedge funds.

Alphabet Stock Down 0.1%

NASDAQ GOOGL opened at $245.35 on Friday. The company has a debt-to-equity ratio of 0.07, a quick ratio of 1.90 and a current ratio of 1.90. The company has a market capitalization of $2.97 trillion, a P/E ratio of 26.13, a P/E/G ratio of 1.66 and a beta of 1.00. Alphabet Inc. has a one year low of $140.53 and a one year high of $256.00. The stock has a 50 day moving average price of $221.25 and a 200-day moving average price of $185.96.

Alphabet (NASDAQ:GOOGL - Get Free Report) last posted its earnings results on Wednesday, July 23rd. The information services provider reported $2.31 EPS for the quarter, beating analysts' consensus estimates of $2.15 by $0.16. Alphabet had a return on equity of 34.31% and a net margin of 31.12%.The firm had revenue of $96.43 billion during the quarter, compared to the consensus estimate of $93.60 billion. As a group, equities analysts predict that Alphabet Inc. will post 8.9 EPS for the current fiscal year.

Alphabet Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Monday, September 15th. Shareholders of record on Monday, September 8th were paid a $0.21 dividend. The ex-dividend date was Monday, September 8th. This represents a $0.84 dividend on an annualized basis and a yield of 0.3%. Alphabet's dividend payout ratio (DPR) is presently 8.95%.

Wall Street Analysts Forecast Growth

Several analysts have recently issued reports on GOOGL shares. Truist Financial upped their target price on shares of Alphabet from $225.00 to $285.00 and gave the stock a "buy" rating in a research note on Monday, September 22nd. KeyCorp lifted their price target on shares of Alphabet from $230.00 to $265.00 and gave the stock an "overweight" rating in a research note on Wednesday, September 3rd. Moffett Nathanson lifted their target price on shares of Alphabet from $230.00 to $295.00 and gave the stock a "buy" rating in a research note on Thursday, September 25th. Deutsche Bank Aktiengesellschaft restated a "buy" rating on shares of Alphabet in a report on Wednesday, September 3rd. Finally, Tigress Financial upped their price target on shares of Alphabet from $240.00 to $280.00 and gave the stock a "strong-buy" rating in a research note on Friday, September 5th. Four analysts have rated the stock with a Strong Buy rating, thirty-three have assigned a Buy rating and ten have given a Hold rating to the company's stock. Based on data from MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $240.76.

Get Our Latest Research Report on GOOGL

Insiders Place Their Bets

In related news, CEO Sundar Pichai sold 32,500 shares of the firm's stock in a transaction dated Wednesday, October 1st. The stock was sold at an average price of $243.41, for a total transaction of $7,910,825.00. Following the sale, the chief executive officer owned 2,402,119 shares of the company's stock, valued at $584,699,785.79. This trade represents a 1.33% decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director John L. Hennessy sold 600 shares of the firm's stock in a transaction dated Monday, September 15th. The shares were sold at an average price of $249.44, for a total value of $149,664.00. Following the sale, the director directly owned 5,716 shares in the company, valued at approximately $1,425,799.04. The trade was a 9.50% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 276,738 shares of company stock valued at $59,135,475. Insiders own 11.64% of the company's stock.

Alphabet Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report