AlphaQ Advisors LLC raised its holdings in Alphabet Inc. (NASDAQ:GOOGL - Free Report) by 38.6% in the 4th quarter, according to the company in its most recent 13F filing with the SEC. The fund owned 9,260 shares of the information services provider's stock after purchasing an additional 2,580 shares during the quarter. Alphabet makes up about 4.8% of AlphaQ Advisors LLC's investment portfolio, making the stock its 7th largest position. AlphaQ Advisors LLC's holdings in Alphabet were worth $1,753,000 at the end of the most recent quarter.

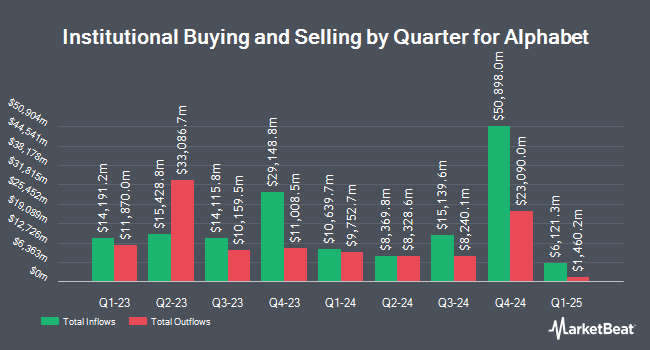

Other institutional investors and hedge funds also recently bought and sold shares of the company. McIlrath & Eck LLC lifted its holdings in Alphabet by 2.1% during the 4th quarter. McIlrath & Eck LLC now owns 10,070 shares of the information services provider's stock worth $1,906,000 after buying an additional 203 shares in the last quarter. 10Elms LLP acquired a new position in shares of Alphabet during the fourth quarter valued at $401,000. Taylor Hoffman Capital Management LLC boosted its holdings in Alphabet by 1.5% in the fourth quarter. Taylor Hoffman Capital Management LLC now owns 39,664 shares of the information services provider's stock valued at $7,508,000 after acquiring an additional 580 shares during the last quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp boosted its holdings in Alphabet by 6.5% in the fourth quarter. BRITISH COLUMBIA INVESTMENT MANAGEMENT Corp now owns 1,855,221 shares of the information services provider's stock valued at $351,193,000 after acquiring an additional 113,147 shares during the last quarter. Finally, Focus Partners Advisor Solutions LLC increased its position in Alphabet by 39.8% in the fourth quarter. Focus Partners Advisor Solutions LLC now owns 63,888 shares of the information services provider's stock worth $12,094,000 after purchasing an additional 18,200 shares during the period. Institutional investors and hedge funds own 40.03% of the company's stock.

Alphabet Stock Down 1.5%

Shares of GOOGL opened at $163.98 on Wednesday. The firm's 50-day simple moving average is $158.23 and its 200 day simple moving average is $174.93. The company has a debt-to-equity ratio of 0.03, a quick ratio of 1.84 and a current ratio of 1.84. The firm has a market cap of $1.99 trillion, a P/E ratio of 20.37, a price-to-earnings-growth ratio of 1.34 and a beta of 1.01. Alphabet Inc. has a 52 week low of $140.53 and a 52 week high of $207.05.

Alphabet (NASDAQ:GOOGL - Get Free Report) last posted its earnings results on Thursday, April 24th. The information services provider reported $2.81 EPS for the quarter, beating the consensus estimate of $2.02 by $0.79. The company had revenue of $76.49 billion for the quarter, compared to the consensus estimate of $89.30 billion. Alphabet had a return on equity of 32.49% and a net margin of 28.60%. During the same quarter in the prior year, the business earned $1.89 earnings per share. On average, analysts forecast that Alphabet Inc. will post 8.9 earnings per share for the current year.

Alphabet Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, June 16th. Shareholders of record on Monday, June 9th will be issued a $0.21 dividend. This represents a $0.84 dividend on an annualized basis and a yield of 0.51%. This is a positive change from Alphabet's previous quarterly dividend of $0.20. The ex-dividend date is Monday, June 9th. Alphabet's dividend payout ratio is currently 9.36%.

Insider Buying and Selling at Alphabet

In related news, CAO Amie Thuener O'toole sold 1,374 shares of the stock in a transaction that occurred on Monday, March 3rd. The stock was sold at an average price of $173.47, for a total transaction of $238,347.78. Following the sale, the chief accounting officer now owns 15,024 shares of the company's stock, valued at $2,606,213.28. This represents a 8.38% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through the SEC website. Also, insider Ruth Porat sold 17,690 shares of the firm's stock in a transaction on Friday, February 21st. The stock was sold at an average price of $183.48, for a total value of $3,245,761.20. Following the transaction, the insider now owns 1,449,286 shares in the company, valued at approximately $265,914,995.28. This trade represents a 1.21% decrease in their position. The disclosure for this sale can be found here. Insiders have sold a total of 129,744 shares of company stock valued at $20,968,366 in the last ninety days. 11.64% of the stock is currently owned by corporate insiders.

Wall Street Analysts Forecast Growth

A number of research firms recently weighed in on GOOGL. Morgan Stanley dropped their price target on shares of Alphabet from $210.00 to $185.00 and set an "overweight" rating for the company in a research note on Thursday, April 17th. Bank of America raised their price target on Alphabet from $185.00 to $200.00 and gave the stock a "buy" rating in a research report on Friday, April 25th. Truist Financial decreased their price objective on Alphabet from $220.00 to $200.00 and set a "buy" rating for the company in a research note on Thursday, April 17th. Roth Mkm reissued a "buy" rating and issued a $220.00 target price on shares of Alphabet in a research note on Wednesday, March 19th. Finally, Needham & Company LLC restated a "buy" rating and set a $178.00 target price on shares of Alphabet in a report on Friday, April 25th. Ten analysts have rated the stock with a hold rating, twenty-six have given a buy rating and four have issued a strong buy rating to the stock. Based on data from MarketBeat.com, Alphabet has a consensus rating of "Moderate Buy" and an average target price of $199.75.

Get Our Latest Report on Alphabet

Alphabet Company Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Today, we are inviting you to take a free peek at our proprietary, exclusive, and up-to-the-minute list of 20 stocks that Wall Street's top analysts hate.

Many of these appear to have good fundamentals and might seem like okay investments, but something is wrong. Analysts smell something seriously rotten about these companies. These are true "Strong Sell" stocks.

Get This Free Report