AlphaQuest LLC grew its stake in CTS Corporation (NYSE:CTS - Free Report) by 5,999.3% in the first quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 8,417 shares of the electronics maker's stock after acquiring an additional 8,279 shares during the period. AlphaQuest LLC's holdings in CTS were worth $350,000 as of its most recent filing with the Securities and Exchange Commission.

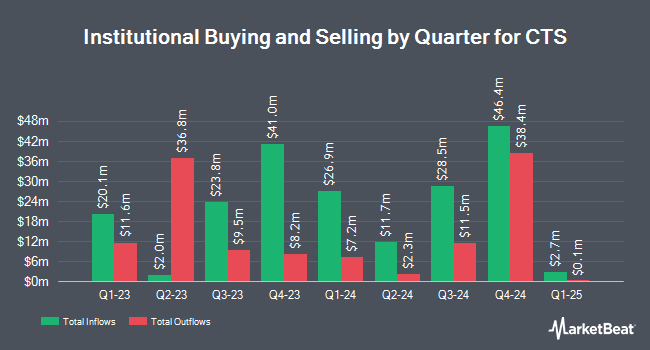

A number of other large investors also recently modified their holdings of the stock. Martingale Asset Management L P increased its holdings in shares of CTS by 6.0% in the first quarter. Martingale Asset Management L P now owns 37,184 shares of the electronics maker's stock valued at $1,545,000 after purchasing an additional 2,100 shares in the last quarter. American Century Companies Inc. boosted its position in CTS by 8.7% in the 1st quarter. American Century Companies Inc. now owns 73,299 shares of the electronics maker's stock valued at $3,046,000 after buying an additional 5,881 shares during the last quarter. Russell Investments Group Ltd. boosted its position in CTS by 2.6% in the 1st quarter. Russell Investments Group Ltd. now owns 21,199 shares of the electronics maker's stock valued at $881,000 after buying an additional 544 shares during the last quarter. Public Sector Pension Investment Board increased its stake in shares of CTS by 27.3% in the 1st quarter. Public Sector Pension Investment Board now owns 95,549 shares of the electronics maker's stock valued at $3,970,000 after buying an additional 20,468 shares during the period. Finally, Nuveen LLC bought a new stake in shares of CTS during the first quarter worth $3,655,000. 96.87% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Separately, Wall Street Zen upgraded CTS from a "hold" rating to a "buy" rating in a report on Saturday, July 12th. One equities research analyst has rated the stock with a Hold rating, According to MarketBeat, CTS has an average rating of "Hold".

Read Our Latest Report on CTS

CTS Trading Down 1.1%

Shares of CTS stock traded down $0.46 on Tuesday, reaching $42.03. The company had a trading volume of 140,308 shares, compared to its average volume of 150,819. The stock has a market cap of $1.24 billion, a PE ratio of 19.83, a PEG ratio of 1.19 and a beta of 0.83. The company has a 50-day moving average of $41.68 and a 200-day moving average of $41.40. The company has a current ratio of 2.61, a quick ratio of 2.04 and a debt-to-equity ratio of 0.16. CTS Corporation has a 12 month low of $34.02 and a 12 month high of $59.68.

CTS (NYSE:CTS - Get Free Report) last posted its earnings results on Thursday, July 24th. The electronics maker reported $0.57 earnings per share for the quarter, topping the consensus estimate of $0.55 by $0.02. CTS had a net margin of 12.32% and a return on equity of 12.31%. The company had revenue of $135.30 million for the quarter, compared to analyst estimates of $132.65 million. During the same period last year, the business posted $0.54 earnings per share. CTS has set its FY 2025 guidance at 2.200-2.350 EPS. On average, equities analysts forecast that CTS Corporation will post 2.28 earnings per share for the current year.

CTS Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, October 24th. Shareholders of record on Friday, September 26th will be paid a $0.04 dividend. This represents a $0.16 dividend on an annualized basis and a yield of 0.4%. The ex-dividend date of this dividend is Friday, September 26th. CTS's payout ratio is presently 7.55%.

CTS Company Profile

(

Free Report)

CTS Corporation manufactures and sells sensors, actuators, and connectivity components in North America, Europe, and Asia. The company provides encoders, rotary position sensors, slide potentiometers, industrial and commercial rotary potentiometers. It also provides non-contacting, and contacting pedals; and eBrake pedals.

Featured Stories

Before you consider CTS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CTS wasn't on the list.

While CTS currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.