AlphaQuest LLC grew its holdings in shares of APA Corporation (NASDAQ:APA - Free Report) by 1,069.0% in the 1st quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 23,006 shares of the company's stock after acquiring an additional 21,038 shares during the period. AlphaQuest LLC's holdings in APA were worth $484,000 as of its most recent SEC filing.

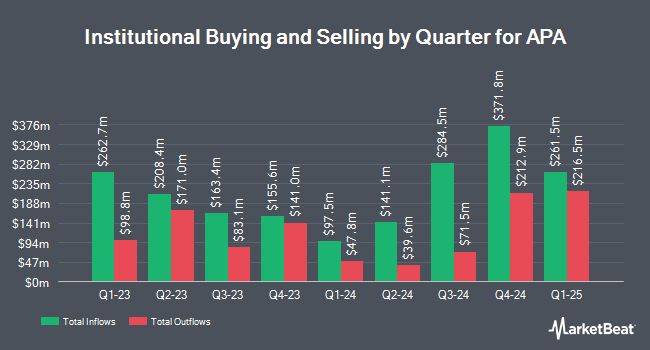

Several other large investors have also modified their holdings of APA. Dimensional Fund Advisors LP lifted its position in shares of APA by 46.8% during the first quarter. Dimensional Fund Advisors LP now owns 9,080,787 shares of the company's stock worth $190,876,000 after purchasing an additional 2,894,543 shares during the last quarter. Freestone Grove Partners LP bought a new position in shares of APA during the fourth quarter worth about $30,767,000. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC lifted its position in shares of APA by 29.1% during the fourth quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 5,297,871 shares of the company's stock worth $122,328,000 after purchasing an additional 1,195,212 shares during the last quarter. Nuveen LLC bought a new position in shares of APA during the first quarter worth about $22,533,000. Finally, Charles Schwab Investment Management Inc. lifted its holdings in APA by 8.1% in the first quarter. Charles Schwab Investment Management Inc. now owns 13,932,980 shares of the company's stock worth $292,871,000 after acquiring an additional 1,046,893 shares during the last quarter. Institutional investors own 83.01% of the company's stock.

APA Price Performance

Shares of NASDAQ APA traded up $0.24 during mid-day trading on Friday, reaching $23.22. 5,660,800 shares of the company traded hands, compared to its average volume of 7,417,131. APA Corporation has a fifty-two week low of $13.58 and a fifty-two week high of $29.47. The company has a debt-to-equity ratio of 0.62, a current ratio of 0.80 and a quick ratio of 0.80. The firm has a market cap of $8.31 billion, a PE ratio of 7.77, a price-to-earnings-growth ratio of 6.84 and a beta of 1.23. The stock has a fifty day simple moving average of $19.72 and a 200-day simple moving average of $18.92.

APA (NASDAQ:APA - Get Free Report) last posted its quarterly earnings data on Wednesday, August 6th. The company reported $0.87 EPS for the quarter, beating analysts' consensus estimates of $0.45 by $0.42. APA had a net margin of 10.53% and a return on equity of 20.98%. The business had revenue of $2.18 billion for the quarter, compared to analyst estimates of $2.03 billion. During the same quarter last year, the business earned $1.17 earnings per share. The business's revenue for the quarter was down 14.4% on a year-over-year basis. Equities research analysts anticipate that APA Corporation will post 4.03 EPS for the current fiscal year.

Analysts Set New Price Targets

APA has been the topic of a number of recent research reports. Scotiabank reissued a "sector perform" rating and issued a $22.00 target price (up previously from $14.00) on shares of APA in a report on Friday, July 11th. Barclays raised their target price on shares of APA from $21.00 to $22.00 and gave the stock an "equal weight" rating in a report on Friday, August 8th. UBS Group raised their target price on shares of APA from $21.00 to $23.00 and gave the stock a "neutral" rating in a report on Wednesday, August 20th. Cfra Research raised shares of APA to a "hold" rating in a report on Friday, August 8th. Finally, Argus raised shares of APA to a "hold" rating in a report on Friday, May 16th. Three equities research analysts have rated the stock with a Buy rating, fourteen have assigned a Hold rating and three have issued a Sell rating to the company. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average target price of $23.72.

Get Our Latest Stock Analysis on APA

APA Company Profile

(

Free Report)

APA Corporation, an independent energy company, explores for, develops, and produces natural gas, crude oil, and natural gas liquids. It has oil and gas operations in the United States, Egypt, and North Sea. The company also has exploration and appraisal activities in Suriname, as well as holds interests in projects located in Uruguay and internationally.

Further Reading

Before you consider APA, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and APA wasn't on the list.

While APA currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.