Alta Advisers Ltd bought a new position in The Travelers Companies, Inc. (NYSE:TRV - Free Report) during the first quarter, according to its most recent 13F filing with the SEC. The institutional investor bought 1,145 shares of the insurance provider's stock, valued at approximately $303,000.

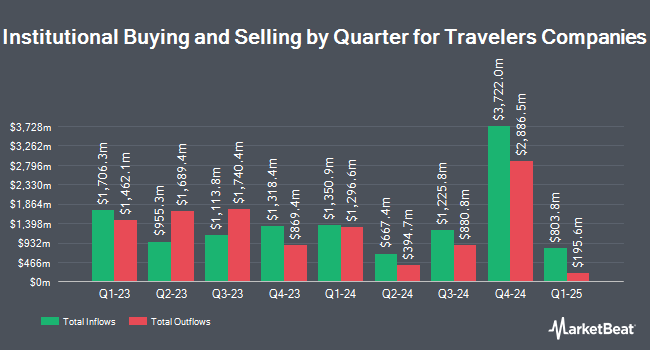

Several other institutional investors and hedge funds have also recently modified their holdings of TRV. Putney Financial Group LLC bought a new stake in Travelers Companies during the fourth quarter valued at approximately $26,000. Ameriflex Group Inc. purchased a new stake in shares of Travelers Companies during the 4th quarter valued at $26,000. Kapitalo Investimentos Ltda bought a new stake in shares of Travelers Companies during the 4th quarter worth $30,000. Wood Tarver Financial Group LLC purchased a new position in Travelers Companies in the fourth quarter worth $33,000. Finally, Generali Investments Management Co LLC purchased a new stake in Travelers Companies during the fourth quarter valued at about $37,000. Hedge funds and other institutional investors own 82.45% of the company's stock.

Travelers Companies Stock Down 3.8%

Shares of NYSE TRV traded down $10.08 during mid-day trading on Wednesday, hitting $256.92. 1,375,345 shares of the stock traded hands, compared to its average volume of 1,284,016. The Travelers Companies, Inc. has a 52 week low of $200.40 and a 52 week high of $277.83. The company has a market cap of $58.03 billion, a price-to-earnings ratio of 13.99, a PEG ratio of 3.91 and a beta of 0.51. The company has a debt-to-equity ratio of 0.28, a quick ratio of 0.33 and a current ratio of 0.33. The stock has a fifty day moving average price of $267.76 and a 200-day moving average price of $254.87.

Travelers Companies (NYSE:TRV - Get Free Report) last issued its quarterly earnings results on Wednesday, April 16th. The insurance provider reported $1.91 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.53 by $1.38. The company had revenue of $10.52 billion during the quarter, compared to analysts' expectations of $10.97 billion. Travelers Companies had a net margin of 9.09% and a return on equity of 16.10%. During the same period last year, the company posted $4.69 EPS. Research analysts anticipate that The Travelers Companies, Inc. will post 17.02 EPS for the current year.

Travelers Companies Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Monday, June 30th. Investors of record on Tuesday, June 10th were paid a $1.10 dividend. The ex-dividend date was Tuesday, June 10th. This represents a $4.40 annualized dividend and a dividend yield of 1.71%. This is an increase from Travelers Companies's previous quarterly dividend of $1.05. Travelers Companies's dividend payout ratio is presently 23.95%.

Insider Activity at Travelers Companies

In other Travelers Companies news, EVP Jeffrey P. Klenk sold 15,180 shares of the stock in a transaction on Thursday, May 29th. The stock was sold at an average price of $272.87, for a total transaction of $4,142,166.60. Following the sale, the executive vice president directly owned 6,075 shares in the company, valued at approximately $1,657,685.25. This trade represents a 71.42% decrease in their position. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, EVP Maria Olivo sold 36,199 shares of the company's stock in a transaction dated Thursday, May 29th. The shares were sold at an average price of $274.20, for a total transaction of $9,925,765.80. Following the transaction, the executive vice president owned 118,116 shares in the company, valued at $32,387,407.20. This represents a 23.46% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 163,869 shares of company stock worth $44,868,201 over the last quarter. 1.46% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

A number of equities analysts have recently issued reports on the company. Evercore ISI upped their price objective on Travelers Companies from $288.00 to $296.00 and gave the stock an "outperform" rating in a report on Thursday, April 17th. HSBC lowered Travelers Companies from a "buy" rating to a "hold" rating and set a $270.00 target price for the company. in a research note on Monday, March 24th. UBS Group lowered their price objective on shares of Travelers Companies from $270.00 to $267.00 and set a "neutral" rating for the company in a report on Wednesday, April 9th. Morgan Stanley set a $269.00 price target on shares of Travelers Companies and gave the company an "equal weight" rating in a research report on Monday, May 19th. Finally, Hsbc Global Res downgraded Travelers Companies from a "strong-buy" rating to a "hold" rating in a report on Monday, March 24th. Three research analysts have rated the stock with a sell rating, ten have assigned a hold rating and eight have assigned a buy rating to the company's stock. Based on data from MarketBeat.com, Travelers Companies presently has an average rating of "Hold" and an average target price of $271.11.

View Our Latest Stock Analysis on TRV

About Travelers Companies

(

Free Report)

The Travelers Companies, Inc, through its subsidiaries, provides a range of commercial and personal property, and casualty insurance products and services to businesses, government units, associations, and individuals in the United States and internationally. The company operates through three segments: Business Insurance, Bond & Specialty Insurance, and Personal Insurance.

See Also

Before you consider Travelers Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Travelers Companies wasn't on the list.

While Travelers Companies currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.