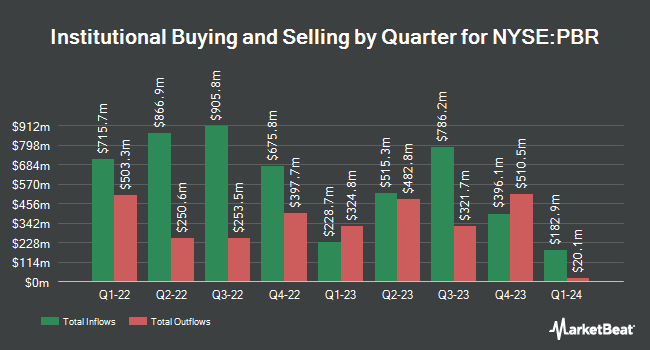

Altfest L J & Co. Inc. bought a new stake in shares of Petroleo Brasileiro S.A.- Petrobras (NYSE:PBR - Free Report) during the 1st quarter, according to its most recent Form 13F filing with the SEC. The fund bought 68,185 shares of the oil and gas exploration company's stock, valued at approximately $978,000.

Other large investors also recently added to or reduced their stakes in the company. R Squared Ltd grew its holdings in shares of Petroleo Brasileiro S.A.- Petrobras by 216.7% during the 1st quarter. R Squared Ltd now owns 14,600 shares of the oil and gas exploration company's stock valued at $209,000 after acquiring an additional 9,990 shares in the last quarter. Banco Santander S.A. grew its holdings in shares of Petroleo Brasileiro S.A.- Petrobras by 15.2% during the 1st quarter. Banco Santander S.A. now owns 155,244 shares of the oil and gas exploration company's stock valued at $2,226,000 after acquiring an additional 20,462 shares in the last quarter. JBF Capital Inc. boosted its holdings in Petroleo Brasileiro S.A.- Petrobras by 8.1% in the first quarter. JBF Capital Inc. now owns 46,500 shares of the oil and gas exploration company's stock worth $606,000 after purchasing an additional 3,500 shares in the last quarter. N.E.W. Advisory Services LLC bought a new stake in Petroleo Brasileiro S.A.- Petrobras in the first quarter worth $115,000. Finally, Morningstar Investment Management LLC boosted its holdings in Petroleo Brasileiro S.A.- Petrobras by 0.5% in the first quarter. Morningstar Investment Management LLC now owns 241,071 shares of the oil and gas exploration company's stock worth $3,457,000 after purchasing an additional 1,169 shares in the last quarter.

Petroleo Brasileiro S.A.- Petrobras Stock Up 0.2%

PBR stock traded up $0.03 during midday trading on Monday, hitting $12.15. The company's stock had a trading volume of 12,673,850 shares, compared to its average volume of 21,241,012. The company has a debt-to-equity ratio of 0.76, a current ratio of 0.72 and a quick ratio of 0.47. Petroleo Brasileiro S.A.- Petrobras has a twelve month low of $11.03 and a twelve month high of $15.73. The company's fifty day moving average price is $12.49 and its 200 day moving average price is $12.74. The stock has a market capitalization of $78.28 billion, a P/E ratio of 5.68 and a beta of 0.85.

Petroleo Brasileiro S.A.- Petrobras (NYSE:PBR - Get Free Report) last released its quarterly earnings data on Friday, August 8th. The oil and gas exploration company reported $0.64 earnings per share for the quarter, missing the consensus estimate of $0.70 by ($0.06). The firm had revenue of $21.04 billion for the quarter, compared to analyst estimates of $20.78 billion. Petroleo Brasileiro S.A.- Petrobras had a return on equity of 25.58% and a net margin of 15.99%. As a group, equities research analysts predict that Petroleo Brasileiro S.A.- Petrobras will post 2.14 EPS for the current year.

Petroleo Brasileiro S.A.- Petrobras Increases Dividend

The firm also recently disclosed a -- dividend, which will be paid on Wednesday, August 27th. Shareholders of record on Wednesday, June 4th will be issued a $0.2806 dividend. The ex-dividend date of this dividend is Wednesday, June 4th. This represents a yield of 1,760.0%. This is an increase from Petroleo Brasileiro S.A.- Petrobras's previous -- dividend of $0.24. Petroleo Brasileiro S.A.- Petrobras's payout ratio is presently 46.26%.

Wall Street Analysts Forecast Growth

A number of brokerages recently issued reports on PBR. Bank of America cut shares of Petroleo Brasileiro S.A.- Petrobras from a "buy" rating to a "neutral" rating in a report on Monday, June 9th. Wall Street Zen upgraded shares of Petroleo Brasileiro S.A.- Petrobras from a "hold" rating to a "buy" rating in a report on Wednesday, May 14th. Finally, Jefferies Financial Group upgraded shares of Petroleo Brasileiro S.A.- Petrobras from a "hold" rating to a "buy" rating and set a $15.30 price target for the company in a report on Thursday, May 15th. One equities research analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, Petroleo Brasileiro S.A.- Petrobras presently has an average rating of "Buy" and an average price target of $17.40.

View Our Latest Research Report on Petroleo Brasileiro S.A.- Petrobras

Petroleo Brasileiro S.A.- Petrobras Company Profile

(

Free Report)

Petróleo Brasileiro SA - Petrobras explores, produces, and sells oil and gas in Brazil and internationally. The company operates through three segments: Exploration and Production; Refining, Transportation and Marketing; and Gas and Power. The Exploration and Production segment explores, develops, and produces crude oil, natural gas liquids, and natural gas primarily for supplies to the domestic refineries.

Featured Articles

Before you consider Petroleo Brasileiro S.A.- Petrobras, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Petroleo Brasileiro S.A.- Petrobras wasn't on the list.

While Petroleo Brasileiro S.A.- Petrobras currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.